Economic pressure deepens as export, remittance dip

Exports and remittances, two major sources of foreign currencies for Bangladesh, plunged in April, a bad omen for the economy as it deals with multiple challenges, including a dollar crisis, an elevated level of import costs and falling reserves.

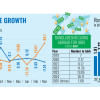

Export earnings slumped 16.5 per cent year-on-year to $3.95 billion last month, according to the Export Promotion Bureau.

And despite a surge in the outflow of migrant workers in 2022, remittances sent by migrant workers and non-resident Bangladeshis living abroad dropped 16.2 per cent to $1.68 billion, the sharpest fall in 14 months, data from the Bangladesh Bank showed.

Exporters blame the falling flow of orders from the western markets amid higher inflation while bankers say migrant workers preferred to send money through informal channels, popularly known as hundi, as the official rate for the greenback is lower than the kerb market.

"The decrease in export and remittances is bad for the economy. This is also bad for employment and investments. It is a signal that the risk in the economy continues," said Prof Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue (CPD).

The latest data comes at a time when Bangladesh's foreign exchange reserves are falling as export and remittances earnings can't cover the cost of imports despite its slowdown.

The taka lost about 25 per cent in value against the greenback in the past one year, raising the import costs and the prices of imported goods to a large extent.

One reason behind the export dip could be the decline in the prices of raw materials, according to Rahman.

"Another factor may be the effect on demand following measures taken by the western countries to contain inflation. Under the current circumstances, prudent macroeconomic management has become important to stabilise the economy and contain the risks."

The shipment of garments, which account for about 85 per cent of the national export basket, declined 15.4 per cent year-on-year in April.

Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association, said the export of apparel items had been declining for the last few months, albeit slowly.

Recently, the export fall was tackled by the higher prices of value-added garment items. But now both quality and quantity can't tackle the export slide.

Bangladesh's overall receipts from the shipment of goods, however, grew 5.38 per cent to $45.67 billion between July and April. The export growth was 8 per cent in the first nine months of 2022-23, EPB data showed.

Most of the major sectors could not perform well in July-April as well.

For instance, the shipment of frozen and live fish, agricultural products, leather and leather goods, jute and jute goods and home textiles declined.

Hassan says if the bank interest rate in the western countries is not hiked further and the old stock of the unsold garment items finishes, there is a possibility that sales of garment items will go up from July.

REMITTANCE

BB data showed that remittances flow in April was lower than the overall inflow in March when migrants sent home $2 billion, the third-highest in FY23, to enable their families and relatives to celebrate the Eid-ul-Fitr, the biggest religious festival in Muslim-majority Bangladesh.

Overall remittances flow grew 2 per cent year-on-year to $17.7 billion between July and April.

CPD's Rahman said the flow of remittances through hundi cartels might have increased as the rate of the dollar is higher in the kerb market.

Hundi cartels, which operate illegal cross-boundary operations, accounted for half of the remittances that flowed to Bangladesh even before the coronavirus pandemic.

A central banker says the hundi carte is mainly responsible for the slide in remittance as the number of migrant workers going abroad for jobs grew substantially.

Bangladesh sent 8.4 lakh workers abroad in July-March, an increase of 21 per cent from 6.96 lakh who went overseas during the same period a year ago, according to the Bureau of Manpower, Employment & Training.

As high as 9.88 lakh migrant workers left the country in search of jobs in other countries in 2021-22, nearly four times 2.80 lakh who went abroad a year ago.

Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development, said the downward trend of both remittances and exports in April had given a bad signal.

"The government may not be able to meet the International Monetary Fund's target on the net reserves if the ongoing erosion of the reserves continues."

As per IMF suggestions, the government will have to maintain a net reserve of $24.46 billion by June.

If the IMF's calculation is taken into account, the net reserves are now less than $22 billion, said Mujeri, a former chief economist of the central bank.

While calculating the reserve level, the IMF excludes the central bank's USD investments through the Export Development Fund (EDF) and other windows. For example, the BB has lent more than $5 billion to exporters through banks under the EDF.

"The entire macroeconomy may face problems if remittances and export earnings continue to decrease," Mujeri said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments