Economic woes far from over

Just a year ago, this newspaper ran a story leaving a question for our readers as to whether Bangladesh would be able to put its economy back on track in 2024.

As we look back, the nation is set to bid farewell to one of the most significant years -- both politically and economically -- since its journey began more than five decades ago.

The country saw a political changeover in early August following a mass uprising just seven months after the national election.

Besides, the economic challenges that persisted in 2023 continued in the outgoing year, with the situation getting worse in many cases.

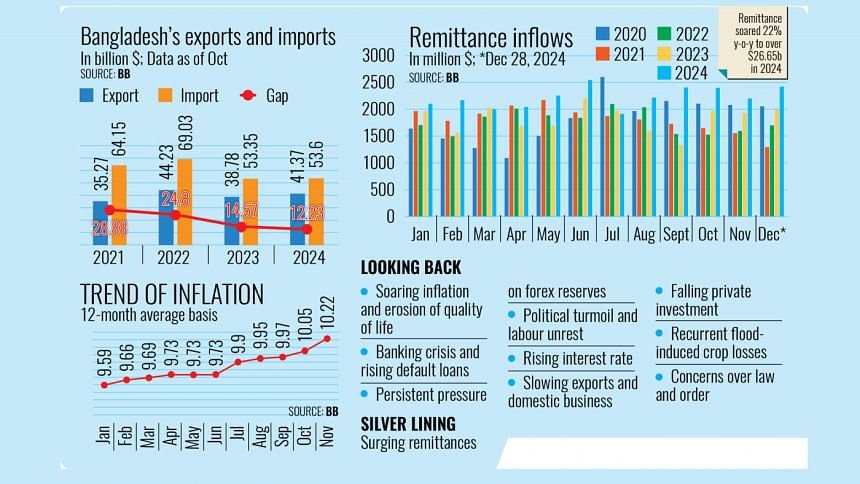

Despite policy tightening by the authorities, inflation, which has hovered above 9 percent since March 2023, stayed elevated as the prices of various locally produced and imported items continued to soar, leading to a gradual erosion of living standards for middle and low-income groups.

The strain on the foreign exchange reserves and pressure on external accounts also persisted as exports did not pick up enough to bolster the forex flow despite a contraction in imports due to policy measures by the central bank.

Industrial production growth slowed sharply, suffering from a decline in the people's purchasing capacity amid high inflation and sluggish exports.

After posting only 4.2 percent growth in the 2023-24 fiscal year that ended in June, the general index of large-scale industrial production fell by 0.71 percent year-on-year during the July-September of FY25 compared to 11.87 percent growth during the same period a year ago, according to the Bangladesh Bank.

There was no good news in private investment.

Amid high inflation, rising interest rates and uncertainty, the appetite for investment waned as evinced by a dip in imports of capital machinery, a key indicator of private investment. Growth of private credit declined as well in the outgoing year.

And the challenges increased further amid the deepening banking crisis. Non-performing loans surged to a multiyear high -- around 17 percent of the total outstanding loans of Tk 16.82 lakh crore -- in September this year.

One good news is the revival in the flow of remittances as the use of informal channels for transferring money reduced after the political changeover in August that ended the 15-year rule of Awami League.

Against this backdrop, the International Monetary Fund (IMF) and other major multilateral agencies predicted a slower growth of Bangladesh's economy.

Recently, the IMF said Bangladesh's economy may grow 3.8 percent in FY25, the slowest since FY20, because of output losses caused by the July uprising, floods and tighter policies.

It said annual average inflation is anticipated to remain around 11 percent in FY25 before declining to 5 percent in FY26, supported by tighter policies and easing supply pressures.

However, the outlook remains highly uncertain, with risks skewed to the downside, it added.

"The year 2024 has been an unprecedentedly challenging year marred by numerous obstacles, be it the economic slowdown, environmental disasters or mass uprising in July-August," said Zaved Akhtar, president of the Foreign Investors Chamber of Commerce and Industry (FICCI).

"Businesses had to work with three multifaceted stakeholders and environments, one pre-election, one post-election and then the final set with the interim government."

Deen Islam, associate professor of economics at the University of Dhaka, said 2024 was an especially difficult year for poor and vulnerable groups.

"Rising prices of essential commodities, such as food and fuel, disproportionately affected those with limited financial resilience. Price hikes of basic necessities, including rice, wheat and edible oil, placed a significant strain on household budgets, exacerbating poverty and inequality."

"The economic pain was further compounded by two devastating floods, which disrupted agricultural production and threatened local food security," he added.

Islam further said that the year 2024 stands out as one of the most eventful and challenging periods in Bangladesh's economic history.

Shams Mahmud, managing director of Shasha Denims Ltd, an apparel exporter, said the year 2024 will be remembered as a watershed year for Bangladesh.

"We had seen the policies undertaken by the previous government stifle private sector growth as well as reinvestment," he added.

"Oligarchs and their businesses were prioritised at the expense of the private sector of Bangladesh."

Tanvir Ahmed, managing director of Sheltech and Envoy Legacy, said the political uncertainty has impacted consumer confidence on products and services offered by local industries.

"From construction and real estate to ceramics, steel, cement, rod, commodity industries and also the stock market, are all experiencing low demand for their products."

"While prices have driven the elasticity of demand in previous situations, this time it is more of socio-political issues that are keeping customers and consumers from spending their disposable income," he added.

LOOKING FORWARD TO 2025

Ashikur Rahman, principal economist at the Policy Research Institute of Bangladesh, said the outlook for FY25 is also cloudy primarily owing to the difficult law and order situation and political uncertainties.

"While there is an encouraging recovery in exports and remittances, import recovery is lukewarm and both public and private investment are down. The ADB, IMF and World Bank have all revised their growth projections downwards for FY25," he added.

Deen Islam said global market trends suggest the prices of essential commodities like rice, wheat and edible oil are likely to rise further, driven by supply chain disruptions and climatic challenges.

To prevent a deepening crisis, the interim government must adopt proactive policies to safeguard the food supply and protect vulnerable populations.

Zaved Akhtar, also chairman and managing director of Unilever Bangladesh, said the global business environment will continue to be difficult given the geopolitical tensions and higher global energy and commodity costs in 2025.

He said in recent periods, businesses have seen challenges with the exchange rates of currencies.

While currencies tend to depreciate to adjust their values amid market forces, sudden and sharp depreciation creates an immediate impact on businesses and the economy as business plans and assumptions are based on currency forecasts.

"In addition, given our country's import dependency, inflation is now unlikely to be abated soon and the cost of operations will likely go up. Companies that have exposure to foreign currency will have increased cost exposure," Akhtar said.

Kanti Kumar Saha, chief executive officer of Alliance Finance PLC, said following the political changeover in August, there has been growing optimism for reform on the macroeconomy and business fronts.

However, he said much will depend on reforms in the financial and other sectors alongside timely utilisation of the annual development fund to bring back the country's growth momentum.

Also, the adoption of market-based exchange rates is needed to support international trade, which is a lifeline for the domestic economy.

Ease of doing business, bringing down inflation and non-performing loans, maintaining remittance and export growth, and improving revenue collection will be key challenges in 2025, Saha said while suggesting that the right reforms for the capital market can boost investor confidence in the new year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments