Export rebound in May provides some relief

Bangladesh's exports bounced back in May after declining in the preceding two months riding on increased shipment of garments, the main export earning sector, according to data released by the Export Promotion Bureau (EPB) yesterday.

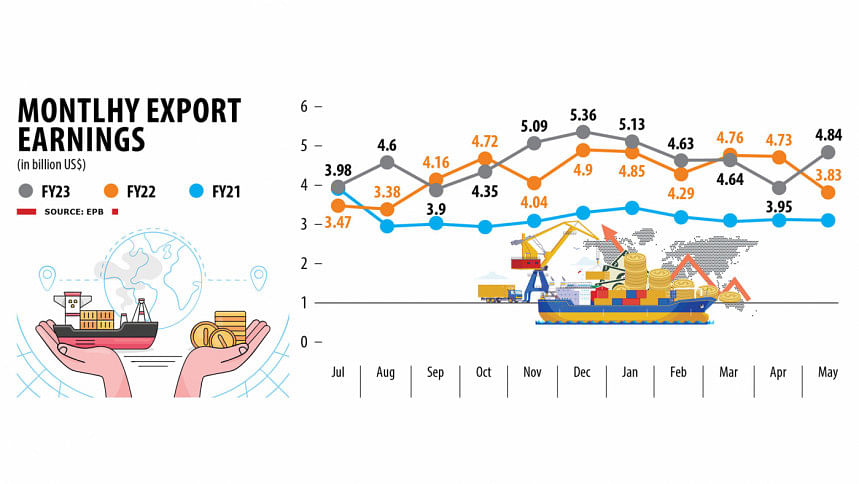

Exporters shipped $4.84 billion worth of goods in May, up 26.6 per cent year-on-year. It was $3.83 billion in the same month a year ago.

Overall exports in the July-May period of the fiscal year of 2022-23 soared 7.1 per cent year-on-year to $50.5 billion with the major export earning sectors, excluding garments, registering a decline.

The data of recovery in export receipts provides relief at a time when Bangladesh's foreign exchange reserves are gradually falling as combined receipts from exports and remittance fall short of the requirement to pay import bills, although overall imports have declined.

In May, remittance inflow declined 10 per cent. And in the first 11 months of FY23, it rose 1.13 per cent to $19.19 billion, according to Bangladesh Bank data released last week.

EPB data showed that garment exports grew 10.67 per cent year-on-year to $42.6 billion in the 11 months to May.

In May, garment exporters fetched $4.05 billion, which was 28 per cent higher year-on-year, according to data from the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

Factories were able to run on 20 days in May last year because of Ramadan and the Eid-ul-Fitr festival, said Md Shahidullah Azim, vice-president of the BGMEA.

"Last month there was no such occasion. Besides, a section of exporters deferred their shipments to May as there were Eid holidays in April," he said, explaining the reasons for the export growth.

Compared to April, export receipts grew 13 per cent in May.

"But there is no improvement in the flow of orders," he said.

Exporters have been blaming a slowdown in orders from importers in Europe and the US because of high inflation and economic slowdown in these two major markets.

Factories are running at 65 per cent to 70 per cent of their capacity for a lack of work orders and power cuts, said Azim.

While the apparel sector suffers from a slowdown in export growth, the leather industry, the second-biggest sector in terms of export earnings, registered very little growth in shipments. Leather and leather product exports edged up only 0.42 per cent year-on-year to $1.12 billion in July-May.

Shipments of leather footwear, the main product of export earnings, declined 4 per cent to $644 million.

Europe is the biggest market for the leather sector of Bangladesh but orders have reduced due to the economic slowdown there, said Abul Islam, general manager of SAF Leather, a concern of Akij Group.

"For this reason, the export of shoes and leather products from Bangladesh has reduced a lot."

According to him, the sector has fallen into difficulties in sustaining business because the prices of the products and the cost of labour increased but the prices of the export product have remained the same.

Japan is the second-biggest market for the leather industry. But Japanese buyers did not increase prices in the last decade despite a rise in production costs, Islam added.

Islam does not see any immediate possibility of a rise in exports of the leather sector.

Apart from garment and leather, export earnings from frozen and live fish, agricultural products, jute and jute goods and home textiles dropped, according to the EPB.

The garment industry remains strong but the worrying part is that exports of other sectors are falling, said Mohammad A Razzaque, chairman of the Research and Policy Integration for Development.

"The growth in overall exports provides some relief against the backdrop of falling foreign exchange reserves."

"But it is not certain what the future is going to look like. There is a lot of uncertainty. Work orders are likely to be low in the coming months. Business prospects are still gloomy as the global economic prospect remains bleak."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments