Exports to China fall despite duty benefit

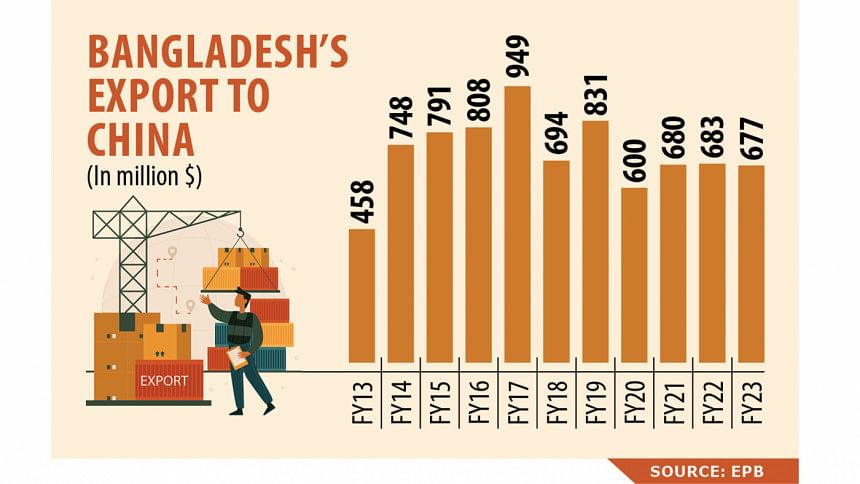

Bangladesh's export to China fell to its three-year low of $677 million in the last fiscal year as entrepreneurs could not take advantage of the duty benefits extended by Beijing.

If the earnings generated in 2019-20 when the Covid-19 pandemic wreaked havoc around the world are excluded, the receipts in 2022-23 would be the lowest in a decade, data from the Export Promotion Bureau (EPB) showed.

A limited number of products in the export basket and a lack of intermediate goods and technology products are standing in the way of increasing exports to the world's second-largest economy, which offers duty-free entry to 98 per cent of the items listed in its tariff schedule.

Bangladesh's shipment in FY23 was down 1 per cent from $683 million a year ago and was the lowest since FY20 when the pandemic hit Bangladesh and exports fetched $600 million in the year.

Garments and textiles account for 60 per cent of the earnings. Usually, readymade garment makes up 85 per cent of national export receipts.

"Bangladesh's main export products are garments but China also makes the products. It also imports $10-$12 billion worth of apparel and Bangladesh competes with Vietnam, Cambodia, India, Pakistan and Sri Lanka to get a pie," said Al Mamun Mridha, secretary general of the Bangladesh China Chamber of Commerce and Industry.

"So, there is not much prospect for garments export to China."

However, he said, there are potential for leather and leather goods, IT-enabled services and marine fishes.

"There is a high demand for mangoes, jackfruits and guavas. China has some standards for fresh foods, shrimp, crabs and eel fish. If we can comply with the standards, the export of the items will increase."

Bangladesh registered a fall in export earnings at a time when its trade imbalance with China is widening thanks to increasing purchases from the country.

China is the biggest trading partner of Bangladesh in terms of imports.

Local businesses brought in $19 billion worth of goods from China, mainly machinery and parts, cotton, fabrics, man-made filaments, staple fibre, plastics and articles, iron and steel, pharmaceutical products and chemical, according to Bangladesh Bank data.

Most of the items imported from Asia's largest economy are required for local businesses.

"We are inviting Chinese firms to set up factories for accessories and import-substitute products in Bangladesh," Mridha said, adding that the production of import-substitute products should be given priority at the Chinese economic zone in Bangladesh, which is under construction.

Mohammad Hatem, executive president of the Bangladesh Knitwear Manufacturers and Exporters Association, thinks exports to China will decline since a number of Chinese companies are shifting their focus to their domestic market amid the country's trade war with the US and Europe.

"As they are focusing on their local market, our opportunity will shrink."

However, the trade dispute and the shift in focus by Chinese manufacturers has created an opportunity for Bangladesh's apparel industry to raise shipments in other countries, he said.

Md Shaheen Ahamed, chairman of the Bangladesh Tanners Association, said the export growth of leather to China lower-than-expected.

"Chinese buyers don't offer good prices citing a lack of compliance."

Bangladesh exported raw hides and skins to the tune of $52.85 million in FY23, EPB data showed.

Khondaker Golam Moazzem, research director of the Centre for Policy Dialogue, blames the similarity in major export products for the lower shipment to China.

"We also don't have the raw materials and intermediate goods that China imports. India exports a huge quantity of raw materials to the country."

China offers duty benefits to Bangladesh's 5,000 products under the Asia Pacific Trade Agreement.

"Yet, manufacturers have not been able to make the most of the benefit owing to a higher value-addition requirement. It may be a strategy of China to protect its domestic industries," Moazzem said.

EPB Vice-chairman AHM Ahsan said they are aware of the decline in export earnings to China.

"China imports intermediate goods and items such as semiconductors. We don't produce them. We have to have the capacity to export the products that China imports."

He said the exports of live fish and crabs had been growing but the shipment dropped as China imposed strict compliance rules after Covid-19.

Ahsan said his office has not formally submitted any recommendations on how to reap the duty benefit extended by China.

The EPB shares the outcomes and minutes of the meetings of the Bangladesh-China Chamber with higher authorities from time to time, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments