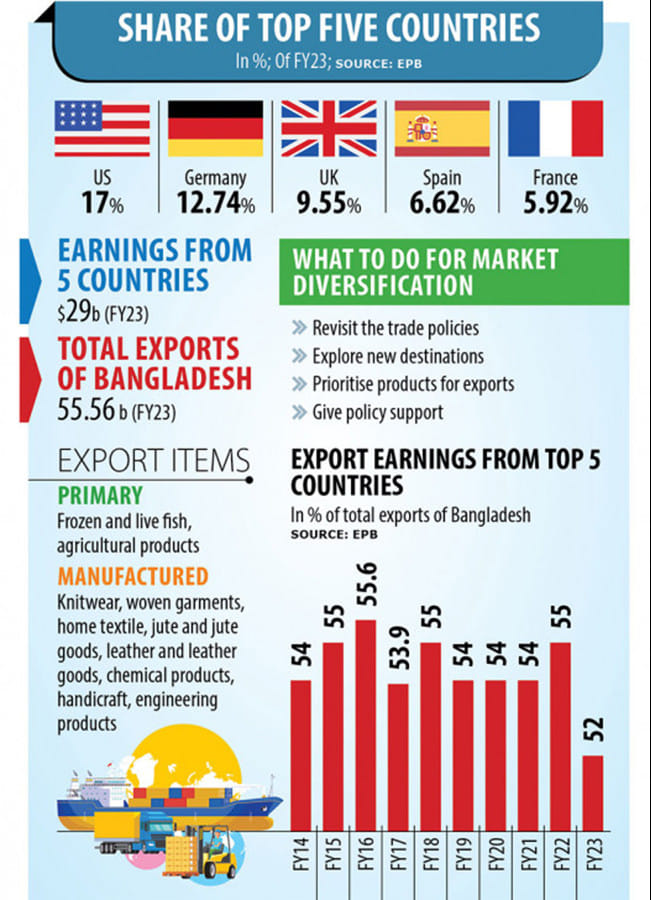

Exports continue to depend on five key markets

Five developed nations have continued to account for more than half of Bangladesh's export earnings, highlighting the country's narrow market base and the vulnerability it faces.

This also means Bangladesh's efforts aimed at diversifying exports in terms of both markets and products over the last decade have not brought about expected results.

The five countries -- the United States, Germany, the United Kingdom, Spain and France -- sourced products worth $29 billion in the last fiscal year of 2022-23, making up more than 52 per cent of Bangladesh's annual receipts of $55.56 billion, data from the Export Promotion Bureau showed.

The US led the pack with a 17 per cent share. Germany, the United Kingdom, Spain and France accounted for 12.74 per cent, 9.55 per cent, 6.62 per cent and 5.92 per cent of the earnings in FY23.

The five countries have been the top export destinations for Bangladesh for at least one decade, with their purchases making up about 50 per cent of the country's export receipts on average.

"Bangladesh's export market is still confined to a handful of countries and to some products such as readymade garments," said Muhammad Abdur Razzaque, chairman of the Research and Policy Integration for Development, a think tank.

Due to a lack of diversification of products, the country has not been able to explore other markets. As a result, export earnings have not increased either, he said.

"Diversifying both markets and products simultaneously is challenging but we need to do that to ensure a sustainable journey of the economy."

Razzaque thinks relying on a small basket of products and a small number of countries poses risks.

The economist explains that Germany, for example, is facing shocks due to recessionary effects and this may create an untoward situation for Bangladesh.

"The growth rate of Bangladesh's export has already slowed in the last six months."

Germany is the second-largest export destination of Bangladesh, taking in around $37 billion worth of products in the last five fiscal years.

Razzaque said Bangladesh should retain the existing markets and explore new ones as local manufacturers have the capacity to supply goods.

India and China are two countries that can offer huge opportunities to Bangladesh thanks to their vast markets with around 2.8 billion people collectively.

India was the seventh-largest importer from Bangladesh in FY23 as it purchased products worth $2.1 billion, up from $1.7 billion a year ago.

"Bangladesh can intensify its efforts to explore export opportunity in the neighbouring markets through diversified products," the economist said.

Bangladesh lags far behind in the Chinese market.

Electrical and electronic products and leather and leather goods could help Bangladesh consolidate its share in the existing markets and reach new destinations, according to industry people.

"Vietnam has already captured a major share of the global market in the two segments over the years. Why should we then remain far behind?" Razzaque asked.

Bangladesh also has potential in agro products, shrimp, and non-leather footwear.

"If exporters can ensure supply quality agro-foods, it will bring huge success," said Razzaque, also the research director of the Policy Research Institute.

Towfiqul Islam Khan, a senior research fellow at the Centre for Policy Dialogue, urged the government to revisit trade policies to allow manufacturers to explore market opportunities.

"We must find out new destinations while retaining existing markets," he said, adding that Latin American markets such as Mexico, Argentina and Brazil could be significant market for local exporters.

Khan thinks Bangladesh should think beyond RMG products, which currently account for nearly 85 per cent of national export earnings.

"We have to set our strategies to increase the shipment to new destinations."

Anwar-ul Alam Chowdhury, president of the Bangladesh Chamber of Industries, said Bangladesh is gradually raising its export share in the non-traditional markets.

For example, the export earnings have increased significantly in Japan and Australia over the last few years, he said.

Citing global fashion brands, the former president of the Bangladesh Garment Manufacturers and Exporters Association, says Bangladesh's future as a manufacturing hub is bright given its youth work force and the country's growing adoption of technologies.

"Bangladesh has to develop its market. If the government takes necessary steps, the export scenario will be better."

He, however, noted that consumption has decreased globally owing to higher inflationary pressures.

According to the World Bank, Bangladesh's progress towards upper-middle-income may waver without diversifying exports by increasing trade competitiveness.

Development of export infrastructure and negotiation of free trade agreements with main trading partners to provide a sustainable boost to exports of goods and services should be accompanied by further investment regime liberalisation and a reduction in tariffs, it said in April.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments