Exports to US slide

The slowdown in the global economy stemming from the fallout of Covid-19 and the Russia-Ukraine war sent merchandise shipment to the United States from Bangladesh lower in the just-concluded fiscal year.

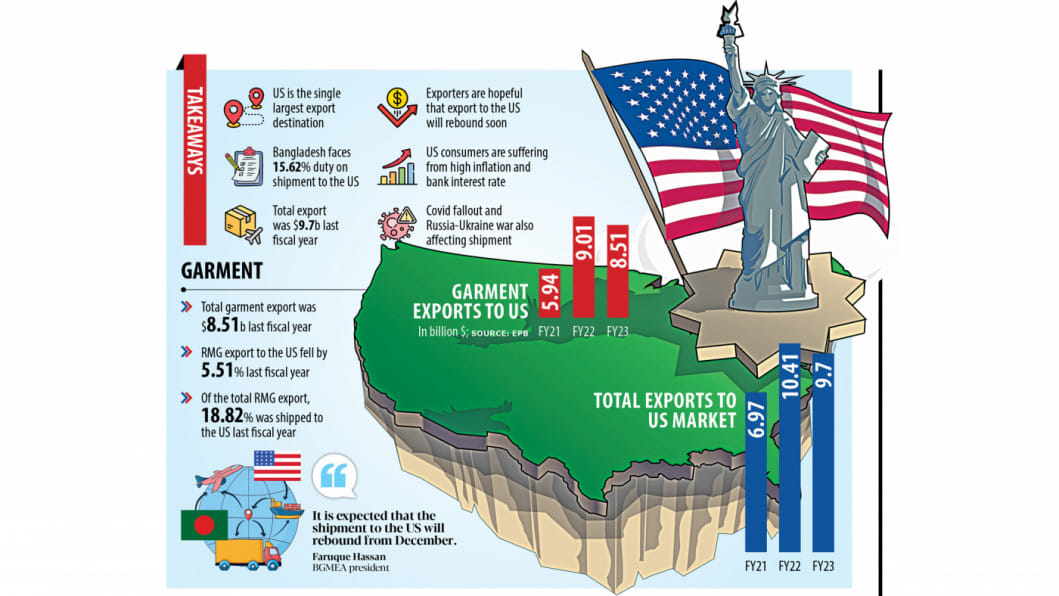

The shipment to the largest export destination for the country was down 6.82 per cent at $9.70 billion in 2022-23. It was $10.41 billion in 2021-22, according to data from the Export Promotion Bureau.

Local exporters are, however, hopeful that the export will make a comeback after a few months thanks to the rebounding economy and falling consumer prices.

Bangladesh is not the only country that witnessed a slower export to the US. In fact, the overall import by the country declined owing to higher inflationary pressure, stockpiling of unsold goods, and slower job growth.

Local exporters had performed strongly in American markets before the last financial year as demand rose after the economy rebounded from the pandemic. Receipts jumped more than 50 per cent year-on-year in 2021-22.

Bangladesh also performed better than other exporting nations such as China, Vietnam and India.

Garments are the main export item of Bangladesh to the US despite a 15.62 per cent duty, accounting for more than 90 per cent of earnings from the country.

US imports of textiles and apparel fell 22.05 per cent to $33.78 billion in the first four months of 2023. It was $43.333 billion during the same period in 2022.

In a statement on July 6, the National Retail Federation (NRF) of the US said the year is half over and the economy is still moving in the right direction.

"While its rhythm, tone and pattern have slowed, it has not stalled, and recently revised data shows underlying strength that seems to be rolling forward."

There was clearly better momentum in the first half of 2023 than was recognised at first.

Based on more complete data now available, the Bureau of Economic Analysis says the first-quarter gross domestic product grew at an annualised rate of 2 per cent adjusted for inflation, rather than the 1.1 per cent previously reported.

The upward revision was driven, in part, by stronger consumer spending, which accounts for 70 per cent of the GDP and grew at a 4.2 per cent annual rate despite the strong headwinds of high-interest rates and elevated inflation, the NRF said.

Inflation, however, rose 3 per cent in the year to June, the slowest price growth in more than two years. It was 9 per cent in June last year. However, analysts still expected the US Federal Reserve to raise rates again this month, according to the BBC.

Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association, said although inflation is declining in the US, the interest rate is still higher there which is impacting consumers.

"It is expected that the shipment to the US will rebound from December."

Asif Ashraf, managing director of Urmi Group, describes the current shipment slowdown to the US as temporary.

"The export prospect will be brighter soon as American retailers and brands are sitting on unsold goods," said Kutub Uddin Ahmed, chairman of Envoy Legacy.

Anwar ul Alam Chowdhury Parvez, a former president of the BGMEA, says Bangladesh has performed comparatively well in the US markets.

"The lower import by the US is not a problem for just Bangladesh. This is because America has cut imports from all over the world."

MA Jabbar, managing director of DBL Group, one of the top garment exporters in Bangladesh, said American clothing retailers and brands are slow in confirming orders.

MA Razzaque, research director of the Policy Research Institute, says Bangladesh is benefiting from the dragging trade war between the US and China and it will continue in the near future.

"The gas and power supply situation at home should be better so that exporters can make the most of the trade potential in the US."

He said the depreciation of the local currency against the US dollar has made Bangladesh's exports to the country competitive to some extent.

The taka has lost its value by about 25 per cent against the American greenback in the past one year owing to the depletion of the foreign currency reserves.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments