External debt nears $100b

Bangladesh's overall external debt stock nearly hit the $100-billion mark in June driven by increasing appetite for funds from both public and private sectors, central bank figures showed.

The debt buildup, which still within the threshold recommended by the International Monetary Fund (IMF), is becoming a headache for the country in view of the unfavourable developments on various economic fronts.

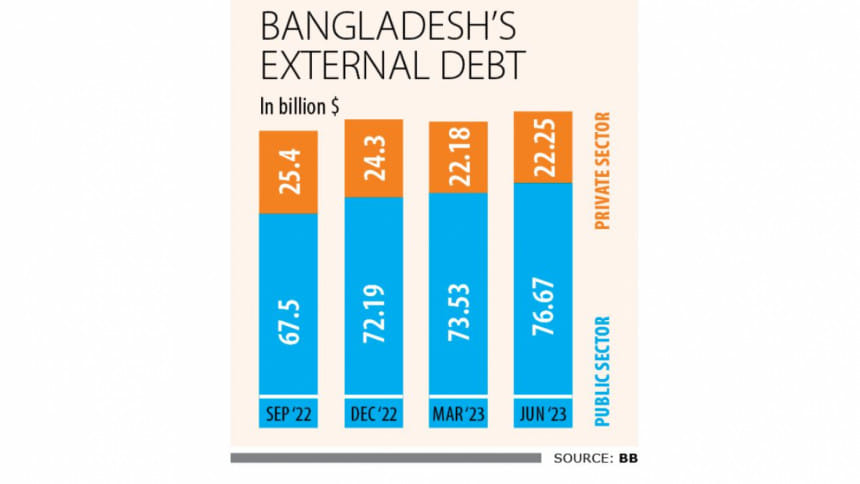

The overall external debt rose 3.35 percent to $98.93 billion in June. It was $95.7 billion in March, central bank data showed.

A year ago, in September, the amount of foreign debt was $92.9 billion, meaning borrowing from foreign sources by the government and the private sector has increased 6.48 percent since then.

The external debt, which increased as high as 73.5 percent from $57 billion in 2018, shows that public sector borrowing from multilateral and bilateral sources grew by 4.27 percent.

The private sector's foreign loans increased slightly mainly because of a spike in their long-term debt. On the other hand, their short-term external loans declined owing to a fall in buyers' credit.

Zahid Hussain, a former lead economist at the World Bank Bangladesh, says a reduction in short-term debts is good news during normal times when the economy is in good shape and there is prosperity.

"But in Bangladesh, it is not good news now as debt has not been reduced driven by prosperity. Rather, the debt reduction has been driven by difficulty. As a result, the foreign exchange shortage has deepened."

Of the external debt, the government's portion stands at 77.5 percent while the rest belonged to the private sector, according to BB data.

The private sector's short-term credit from the external sector fell to $13.65 billion in June from $14 billion three months ago.

Hussain blamed multiple factors such as delayed settlement of payments and negative outlook regarding Bangladesh's economy by global rating agencies for the drop in the short-term foreign debt.

"This has spooked the confidence of our creditors abroad," he said, adding that the cost of credit has edged up as creditors' credit risk premium, along with non-interest costs, have gone up.

"Even after that, many are unwilling to lend. This has affected the credit rollover."

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said the decrease in the short-term external credit for the private sector at this time is not a good sign.

"It is piling up pressure on our foreign exchange reserve."

The reserve stood at $21.15 billion last week, down from $33.4 billion at the end of 2021-22.

Mansur said Bangladesh needs to roll over credits. "But many foreign banks are cutting lending. As a result, the net availability of funds is falling."

He called for initiating steps so that foreign creditors reschedule the repayment period and roll over funds.

The former economist of the IMF says the increase in long-term loans is a sign of stress in the economy.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, says the imposition of taxes on external loans and the increase in interest rates are among other factors behind the drop in the short-term foreign loans.

"In one sense, the decline is not good. It was an alternative source of foreign exchanges and an increased flow of short-term credits would help better manage the forex."

Mansur says Bangladesh's external debt is rising fast and it is not a healthy sign since export receipts are not growing at the expected pace.

Currently, Bangladesh has to repay foreign loans worth $2 billion to 2.5 billion annually. And the amount is expected to rise in the coming years, prompting economists to urge the government to focus on enhancing revenue collection.

Bangladesh has one of the lowest tax-to-GDP ratios in the world.

Hussain said since a large portion of the public sector's external debt was concessional loans with low-interest rates and longer repayment periods, the overall debt dynamics have been favourable to Bangladesh.

According to the IMF's sustainability threshold, foreign debt should be less than 40 percent of the gross domestic product (GDP). It is less than 20 percent for Bangladesh.

In an unwelcome development, the proportion of concessional loans from multilateral lenders in the overall debt stock is declining while the interest rate is rising.

"So, it would not be wise to take it for granted that the favourable dynamics that we had in the past will remain favourable forever," Hussain said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments