Feeling the pulse of local startup ecosystem

In Dhaka, the teeming capital of Bangladesh, distance is not measured in kilometres, but in increments of time -- minutes and hours, or entire portions of a morning or evening. The city's notoriously glacial traffic has made the act of commuting less about movement and more about endurance, a daily ritual of patience for its 22 million residents.

So, it is unsurprising that innovative solutions to this worsening problem would give rise to startups in Bangladesh. One of the most notable efforts to tackle this problem is Pathao, a homegrown startup launched in 2015.

The name Pathao, which translates to "send", hints at its mission: helping Dhaka's residents navigate the labyrinthine chaos of the city's streets. Its founders were spurred into action shortly after the World Bank released a sobering report titled Can We Build Dhaka Out of Traffic Congestion? For Pathao's founders, the answer was not to circumvent the problem, but to work through it.

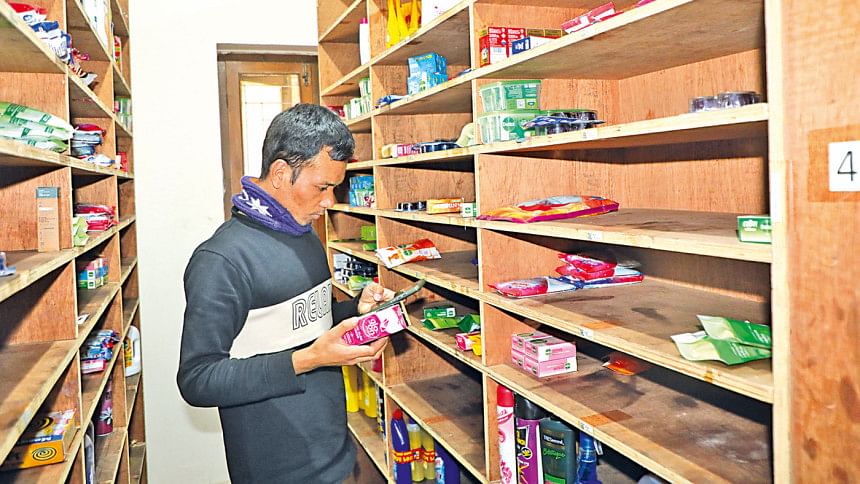

Two years earlier, in 2013, another startup, Chaldal, came to the market and started reshaping how people would buy daily essentials and groceries.

Also in 2013, food delivery startup foodpanda began to generate excitement by bringing favourite restaurant meals directly to the doorsteps of its young and tech-savvy customers.

From groceries to food and commuting, these startups, founded by innovative young people, quickly became popular brands, instead of just "another company beginning the journey".

Offering innovative solutions to existing problems and logging rapid growth -- these are two main characteristics that define a business model as a startup.

Now, after a decade, it is difficult to find anyone in Dhaka who has never used foodpanda or Pathao even once.

But it is difficult to find the answers to questions like are these startups truly successful? Are they generating a lot of revenue or are anywhere near achieving a valuation of $1 billion to become the "unicorn"?

The Bangladeshi startup ecosystem is thriving, with over 1,200 active startups and an additional 200 plus newcomers emerging each year, according to LightCastle Partners, a management consulting firm that tracks startup funding in the country.

But the Bangladeshi unicorn herd so far has only one member: bKash -- a mobile financial service provider founded in 2011.

So why are the remaining startups struggling to expand their reach? Do they need more time or a more favourable landscape to thrive?

TOO MANY CHALLENGES

Bangladesh's startup ecosystem is grappling with significant challenges in expanding its reach and customer base despite a decade of effort.

Experts attribute these challenges to a combination of market limitations, regulatory barriers, and structural issues.

The addressable market for startups remains limited, with less than 10 million potential customers in popular sectors like e-commerce, food delivery, logistics, mobility, education, healthcare and digital content, according to industry insiders.

The year 2024 was no exception as startup funding in Bangladesh declined by 66 percent to $44.5 million in the first six months, according to LightCastle Partners.

The data also reports that over the past decade, Bangladesh startups collectively raised $989 million across more than 400 deals since 2013.

Venture capital (VC), a form of private equity and financing for startup companies and small businesses with long-term growth potential, has been the primary driver of this growth, contributing $753 million across 171 deals during this period.

International investors dominate the landscape, accounting for 92 percent of total funds.

However, this figure pales in comparison to neighbouring India, where startup funding surged by 53.1 percent in the first eight months of 2024, reaching $7.5 billion compared to $4.9 billion the previous year, as reported by GlobalData and published in the Economic Times.

Fahim Mashroor, former president of the Bangladesh Association of Software and Information Services (BASIS), said that investment in Bangladesh has slowed significantly, weighed down by political uncertainty and macroeconomic challenges.

"Startups are facing a particularly tough environment as most investors remain cautious, adopting a wait-and-see approach ahead of the upcoming elections," he added.

He also said that the volatile dollar exchange rate has alarmed foreign investors, who fear their investments could lose value due to currency devaluation, adding to the already uncertain circumstances. These factors have collectively dampened the country's investment sentiment, leading to a marked decline in activity.

He also expressed cautious optimism that this challenging phase will end within the next six months as discussions regarding significant investments are underway.

A resolution of the political situation and stabilisation of the macroeconomic environment could restore confidence, potentially unlocking new opportunities for growth in the startup ecosystem and the broader investment landscape, Mashroor added.

FINTECH PROMISES

In Bangladesh, the main sectors attracting startup funding include fintech, e-commerce, logistics, education technology, and healthcare.

Fintech leads with significant investments in mobile financial services and digital payment solutions, while e-commerce and logistics benefit from rising online shopping demand.

However, none of these sectors has met expectations in market expansion, ecosystem building, or attracting funds.

In fintech, some startups have witnessed growth, with bKash leading the sector.

In 2021, SoftBank's Vision Fund 2 invested $250 million in bKash, acquiring a 20 percent stake and valuing the company at around $2 billion -- a milestone for Bangladesh's fintech sector. However, bKash does not consider itself a startup.

Nagad has also disrupted the mobile financial sector, attracting 9 crore customers in just five years, but has been mired in controversy.

Pathao, originally a logistics company, launched Pathao Pay, a digital wallet, and Pay Later, Bangladesh's first buy-now-pay-later solution.

Other fintech startups are addressing financial challenges but have yet to secure significant funding or gain a strong foothold.

FRAGILE CONFIDENCE

Bangladesh's e-commerce sector continues to grapple with a trust deficit, stemming from the wave of scams that engulfed the industry in 2021. Fraudulent activities left thousands of customers uncertain about recovering investments worth thousands of crores of taka.

These controversies have significantly hindered the sector's growth, which had been steadily expanding from 2018 to 2021. The turmoil became evident at the start of 2021 as customers increasingly filed complaints against various platforms.

A Bangladesh Bank inspection, initiated by the commerce ministry in mid-2021, revealed Evaly's massive liabilities to customers and merchants, which far outweighed its assets. This revelation uncovered a series of scams by other platforms like Eorange, Qcoom, Dhamaka, and others that adopted Evaly's flawed business model.

As a result, thousands of customers remain uncertain about recovering their money while reputable platforms still operating in the sector struggle to rebuild trust and grow their businesses.

"The unresolved issue of customers not recovering their money from fraudulent e-commerce platforms has severely damaged trust in the sector," said Morin Talukder, CEO of Pickaboo.

"Many now perceive e-commerce as a scam, resulting in minimal penetration in rural areas."

LOGISTICS STARTUPS FIND NEW PATHS

Talukder added that logistical challenges exacerbate the situation. While some reliable logistics companies exist, delivery inefficiencies remain. For instance, delivering a television can take up to four days.

Additionally, low order volumes in certain areas have made operations unsustainable for many businesses.

E-commerce remains urban-centric, with fear and scepticism persisting among suburban and rural consumers, further slowing growth. The market is progressing sluggishly, with electronic product sales particularly weak.

Despite these challenges, logistic startups are finding a niche by leveraging the rise of f-commerce and supporting women-led small businesses.

Startups offer tailored solutions like last-mile delivery and cash-on-delivery services, empowering entrepreneurs to access broader markets.

"Our growth relies heavily on e-commerce, but social media has kept the sector afloat," said Biplob G Rahul, CEO of eCourier.

The number of logistics firms has declined due to the downturn in e-commerce. However, the logistics industry in Bangladesh holds immense potential, driven by growing demand across sectors.

"Cities like Chattogram and Cumilla are accessible, but deliveries to remote rural areas often take more than 24–48 hours. Improved infrastructure is essential for efficient last-mile delivery," Rahul added.

HEALTH, EDTECH BUILD MOMENTUM

Bangladesh's healthcare startup sector is growing steadily, driven by increasing digital adoption and rising demand for accessible solutions.

Startups are leveraging technology to offer telemedicine, diagnostics, and subscription-based services, addressing critical gaps in healthcare access, particularly in rural areas.

However, Sylvana Quader Sinha, founder and CEO of Praava Health, said technology alone will not solve healthcare challenges.

"The real problem isn't about booking appointments or visiting pharmacies; it's about trust," she said.

Patients often lack confidence in Bangladesh's healthcare system, leading many to seek treatment abroad. Sinha highlighted that while technology can enhance quality, well-trained doctors and reliable lab tests are essential for building trust.

Edtech startups in Bangladesh hold significant potential but have seen limited growth.

Shahir Chowdhury, founder and CEO of Shikho, said that while the market has matured since 2019, challenges like expensive mobile internet and inadequate funding hinder progress.

"Bangladesh has the demand and talent. What we need now is connectivity -- both physical and financial -- to bridge the gap," he said.

He highlighted that venture funding for Bangladesh's edtech sector is meagre compared to India, which secured $10 billion in 2023 while Bangladesh has raised only $17 million for edtech, with over 98 percent of the funding coming from foreign sources.

DIGITAL DREAMS SEEK POLICY BACKING

Regulatory barriers also restrict market growth. High internet costs, driven by telecom licensing and corporate policies, limit accessibility.

The financial sector remains constrained by inadequate digital frameworks and data-sharing policies.

"Without consent-based APIs or pricing mechanisms for data sharing, startups face high costs in managing data," said Fahim Ahmed, CEO of Pathao.

Ahmed also pointed to a lack of quality founders focused on problem-solving and revenue generation. He stressed that stable regulatory reforms are essential for consistent investor confidence.

Accurate data is another critical challenge. Adnan Imtiaz Halim, CEO of Sheba Platform, said that misleading government statistics on internet users result in flawed forecasts. He called for affordable mobile devices, improved rural access and reduced data costs.

He also stressed the importance of giving incentives to traditional businesses and consumers to adopt technology, bridging the learning curve.

Regarding key challenges, Waseem Alim, founder and CEO of Chaldal, said they keep hitting speed-breakers due to macro issues. "Losing momentum can be fatal for a startup. It affects company culture and creativity."

"Besides, we are competing against startups in other countries to create the winning product, so when macro issues affect our plans, we fall behind in the race," said Alim.

On the positive side, the CEO said Bangladesh has a competitive advantage in terms of talent pool thanks to the country's large young population.

"Once the ecosystem matures, we can aim for creating world-changing ventures," he commented.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments