Foreign debt servicing surges 25.73% in FY24

Bangladesh's foreign debt servicing surged 25.73 percent in financial year (FY) 2023-24 compared to the year prior, owing to rising global interest rates and an expanded foreign loan portfolio.

According to finance ministry data, interest payments on external borrowing alone soared 44 percent in the 12 months from July 2023 to June 2024.

Total foreign debt servicing, including repayment of the principal amount as well as interest, rose to $3.35 billion in financial year 2023-24 from $2.67 billion in 2022-23.

Interest payments alone accounted for $1.35 billion, accounting for more than a third of the total amount. It stood at $935.66 million in FY23.

The repayment of principal amount rose to $2 billion from $1.73 billion.

Interest payments will continue to rise gradually in the coming years, the finance ministry said in a report, titled Medium-Term Macroeconomic Policy Statement (MTMPS).

The proportion of external interest payments as a percentage of the national budget will rise to 2.6 percent in FY27 from 0.9 percent in FY22, reflecting the growing impact of external debt on the budget, according to the report.

It also said two major factors contributed to the increase in interest payments for foreign loans.

One factor is that the reference rates in advanced economies are expected to stay high. A reference rate is an interest rate benchmark that is used to set other interest rates. The Fed Funds Rate, the Secured Overnight Financing Rate (SOFR), and the prime rate are among the most common reference rates.

The other is that Bangladesh's graduation from the category of least developed countries in 2026 will gradually narrow the window to obtain concessional loans from external sources, according to the report. So, the pressure is higher now.

The report added that the implicit interest rate on external borrowing exhibited a gradual increase from 1 percent in FY21 to 2.6 percent in FY27.

"This increase is attributed to a higher proportion of borrowing through floating and semi-concessional rates, which are more sensitive to market fluctuations compared to fixed-rate financing."

It also mentioned that the depreciation of the taka against the US dollar has elevated the value of external debt when measured in terms of local currency.

According to finance ministry data, in terms of the local currency, foreign debt servicing rose nearly 40 percent, reaching Tk 37,307 crore in FY24 from Tk 26,772 crore in FY23.

This highlights the influence of currency fluctuations on the debt portfolio and the importance of managing external debt exposure in the face of exchange rate volatility.

Referring to the gradual increase in foreign loan repayments, the report said that managing these debt service obligations is essential for ensuring financial stability and preventing liquidity crises.

"The impact of currency depreciation on external debt levels underscores the need for careful monitoring and management of external debt risks to maintain economic stability and resilience," the report said.

It also stated that, despite the increasing amount of external debt repayment, it is expected to remain within tolerable limits, supported by the government's efforts to diversify funding sources and build up foreign exchange reserves.

Besides, the total volume of loans has increased thanks to the mega-projects, including the Rooppur Nuclear Power Plant in Ishwardi upazila of Pabna, which involves foreign loans amounting nearly $12 billion.

Decades ago, the government would utilise foreign loans amounting to about $3 billion annually, but now it utilises around $10 billion.

As of March 2024, Bangladesh's total foreign debt stood nearly at $68 billion, according to Bangladesh Bank statistics.

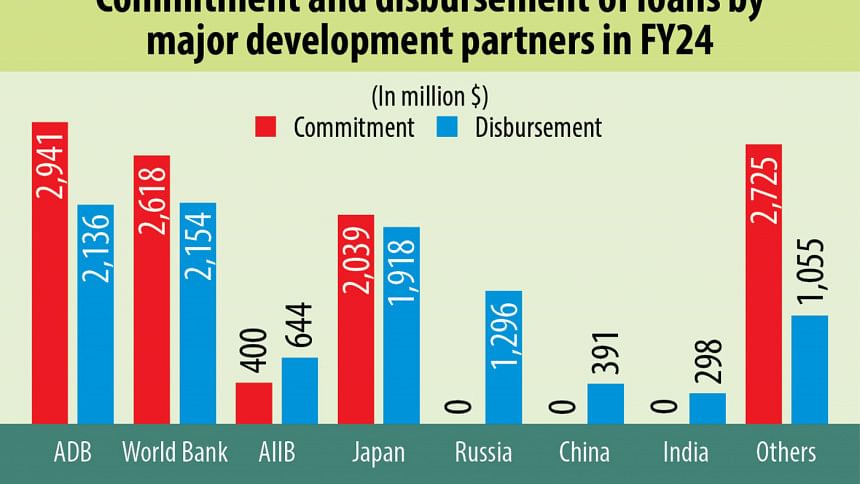

Meanwhile, loan disbursement by global lenders and multilateral partners rose 7 percent to $9.86 billion in FY24 from $9.21 billion in FY23.

Between July 2023 and June 2024, the highest amount of loans disbursed were by the World Bank, amounting to $2.15 billion, and the Asian Development Bank (ADB), which provided $2.14 billion.

Among multilateral partners, Japan disbursed the highest amount of loans, lending $1.92 billion, followed by Russia's $1.3 billion.

In the same period, the ADB committed to disbursing $2.94 billion, the World Bank $2.61 billion, Japan $2.03 billion, and the Asian Infrastructure Investment Bank $400 million.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments