Forex crisis spills over to bond market

Banks in Bangladesh are already in a tight liquidity situation since they have to buy US dollars at higher rates to settle import bills.

So, they are not keen to invest in the government's long-term securities and bonds although the investment tools offer much higher rates compared to a year ago. Rather, they are on the lookout for higher returns in order to make the most out of their limited funds.

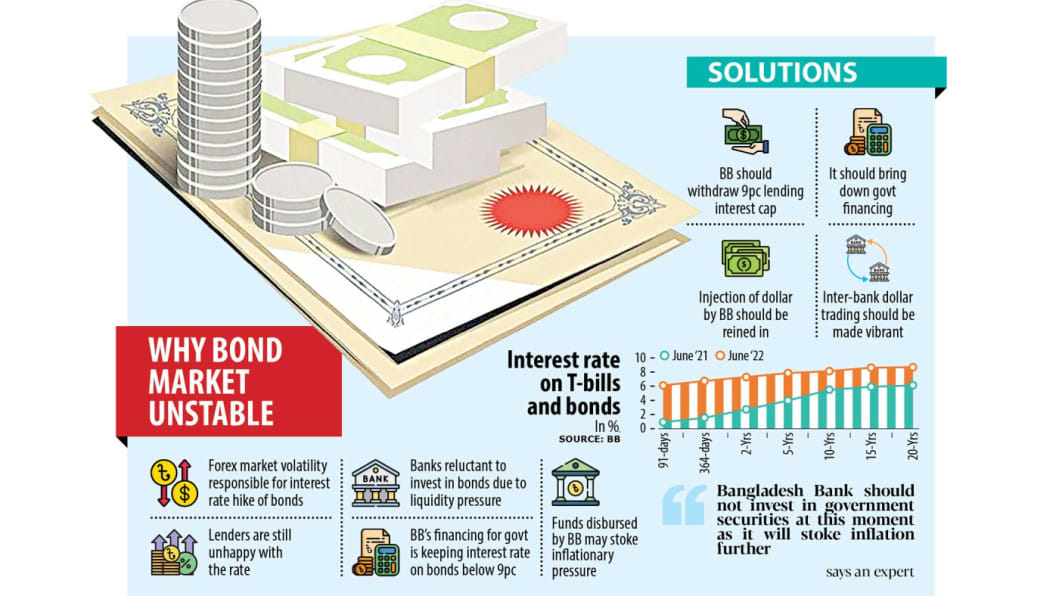

As a result, the government is struggling to raise funds from commercial banks to meet its expenditures by issuing Treasury bills and bonds with yields ranging from 6 per cent to 8.65 per cent. The yield ranged from 0.79 per cent to 6 per cent a year ago.

In order to support the government, the central bank itself is investing in the securities in a massive way, a move that may fan inflation, which hit a nine-year high in June owing to the volatility in global commodity markets.

Experts warn that banks' capacity to lend to the government will erode in the days to come due to the ongoing instability in the foreign exchange market of Bangladesh.

The central bank has lent Tk 7,792 crore to the government so far in July through the purchase of T-bills and bonds.

The government has set a bank borrowing target of Tk 106,000 crore for the current fiscal year. But it may overshoot the target owing to weak revenue collection.

The government borrowed Tk 72,749 crore from banks last fiscal year in contrast to Tk 24,292 crore the year before.

In the last fiscal year that ended on June 30, banks bought a record $7.62 billion of US dollars from the central bank with a view to meeting the demand of importers. This means a large amount of local currency was automatically mopped up, creating liquidity pressure in the banking system.

Excess liquidity at banks stood at Tk 189,183 crore in May, down 11 per cent year-on-year.

The central bank has injected $808 million into the money market in the first couple of weeks of the current fiscal year to keep the foreign exchange market stable.

Bangladesh's international currency reserves fell to $39.67 billion on Wednesday in contrast to $46.15 billion in December, owing to abnormally high imports, which swelled by 39 per cent to $75.40 billion between July and May.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, says the interest rates on the T-bills and bonds have increased significantly in recent months, but they are not good enough to draw banks.

This is because many banks have to collect deposits at 7.50 per cent, which makes it difficult for them to invest in long-term T-bonds.

The interest rate on the 10-year T-bond is 8.1 per cent.

"Nobody can predict the market behaviour, which is now facing liquidity pressure. Besides, a majority of deposits are short-term with tenures standing at six months and below," Rahman said.

A BB official, on condition of anonymity, says that some lenders are quoting more than a 9 per cent interest rate at the auction of government securities.

Since banks are seeking more than 9 per cent interest rate on government securities, the central bank is now purchasing those bills and bonds to keep the interest rate below 9 per cent, he said.

"The ongoing tight liquidity situation will improve thanks to the BB's investment in the securities," said Mirza Elias Uddin Ahmed, managing director of Jamuna Bank.

"Such investment will create new money in the market."

However, there is a possibility that the BB's investment will leave an adverse impact on inflation.

"So, banks should place an emphasis on disbursing loans to the productive sector in order to offset the prices hike," Ahmed said.

In Bangladesh, inflation raced to a nine-year high of 7.56 per cent in June.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, says that the central bank has recently taken a contractionary monetary policy to tackle inflationary pressure.

"It is now financing the government in a massive way, going against its tight monetary policy. But the central bank should not invest in government securities at this moment as it will stoke inflationary pressure."

According to Mansur, the only way to bring stability to the bond market is to withdraw the lending cap on loans.

The central bank has been following a 9-per cent interest rate cap on all loans except credit cards since April 2020. It is now trying to follow the same in the bond market.

Mansur also suggested the central bank not inject foreign currencies into the market massively as reserves are squeezing at a faster pace.

"State-run banks, which are now receiving the greenback from the BB to import petroleum and other essential commodities, should manage funds from other banks," he said.

The former official of the International Monetary Fund thinks ensuring a floating exchange rate of the taka against the US dollar will help make the inter-bank forex platform vibrant as many lenders are showing reluctance to sell dollars using the window.

Banks are now imposing much higher rates on importers than what the central bank has asked them to follow, rendering the inter-bank platform almost inoperative.

The exchange rate of the taka stood at Tk 94.45 per USD yesterday, down 11.38 per cent year-on-year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments