Forex shock to remain as major challenge

With a huge deficit in its financial account balance and foreign exchange reserves depleting, Bangladesh's main challenge in the coming months will be tackling foreign exchange shocks, said economists yesterday.

A financial account is a component of a country's balance of payments that covers claims or liabilities to non-residents concerning financial assets.

This includes foreign direct investment, medium and long-term loans, trade credit, net aid flows, portfolio investment and reserve assets.

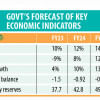

There was a deficit of $2.1 billion in the country's financial account at the end of fiscal year 2022-23, in contrast to a surplus of $15.5 billion a year earlier.

Bangladesh's foreign exchange reserve stood at $23.14 billion as of August 16, 2023 whereas it was $39.54 billion a year earlier, showed the latest data of Bangladesh Bank.

The economists were addressing a discussion titled "State of the Global, Regional, and Bangladesh Economic Outlook" organised by Mastercard Economics Institute at Sheraton Dhaka.

Post-pandemic challenges of high inflation, foreign exchange volatility and higher debt burden has impacted emerging markets severely, said David Mann, chief economist for Asia Pacific and Middle East Africa at the institute.

Commodity price is absolutely critical and the US policy rate is also a critical issue for Bangladesh, he said.

Bangladesh has two major external challenges, one of which is the financial balance deficit and depletion of foreign exchange reserves, he said.

The other challenge is that if the US policy rate continues to rise, there will be a ripple effect in other countries as well, aggravating the foreign exchange challenges, he said.

Mann recommended working on the ease of doing business, ensuring proper infrastructure and providing logistic support.

The government ought to work on developing skills of people through proper education so that they can adapt to the upcoming era of artificial intelligence, he added.

Exports and remittance earnings of Bangladesh are still growing at reasonable rates, said noted economist Ahsan H Mansur.

However, skills gap and capital flight are the main reasons for the low foreign exchange reserves even though a higher number of migrants have gone abroad, he said.

Bangladesh's financial account balance now has a deficit whereas there was a surplus for years. So, this is a new challenge for the country, said Mansur, who is the executive director of Policy Research Institute.

Now, many payments are pending, like deferral LC payments. Short-term debt of the private sector remains unpaid. "So, the government needs to prepare to tackle this situation," he said.

Actually, Bangladesh is paying the price of its long-term fundamental weakness in adopting reforms, he said.

So, its asset to GDP ratio is falling, tax to GDP ratio is eroding, and remittance and export to GDP ratio is retreating while investment has remained static, he clarified.

If steps are not taken for long-term fundamental rebalancing, the government will continue to print money to offset lower tax revenue earnings and ultimately fuel inflationary pressure, Mansur added.

Edimon Ginting, country director of Asian Development Bank, and Mamun Rashid, managing partner of PwC Bangladesh, spoke at the event.

Muhammad A (Rumee) Ali, a former deputy governor of Bangladesh Bank, Syed Ershad Ahmed, president of the Foreign Investors' Chamber of Commerce and Industry, Md Arfan Ali, a former president and managing director of Bank Asia, Md Moinul Huq, country officer of Citibank NA, Fahim Ahmed, CEO and president of Pathao, and Zia Uddin Ahmed, chairman of VIPB Asset Management, also spoke at the meeting.

They recommended working on strengthening the stock market, ensuring good governance in financial institutions and stricter market monitoring.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments