Four state banks’ bad loans jump 27% as delinquencies rise

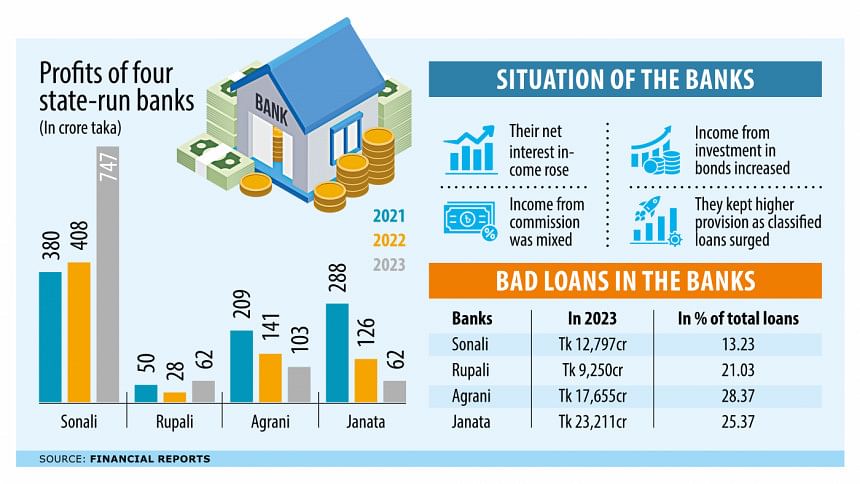

Although four state-run commercial banks -- Sonali, Agrani, Rupali and Janata -- saw a mixed trend in profits in 2023, they were consistent in logging higher bad loans.

The combined bad loans of the banks surged 27 percent year-on-year to Tk 62,913 crore at the end of last year. Two years prior, total bad loans of the four state banks stood at just over Tk 38,200 crore, according to financial statements.

The latest data showed that Janata Bank had the highest amount of bad loans at the end of last year due to alleged irregularities in lending, particularly to AnonTex and Crescent Group, which turned the loans into toxic assets.

Janata's bad loans surged 53 percent year-on-year to Tk 23,211 crore in 2023.

Agrani Bank had the second-highest amount of bad loans at Tk 17,655 crore at the end of last year. The state bank said soured loans rose 23 percent compared to a year prior.

Meanwhile, Sonali Bank, the largest bank in Bangladesh, registered 7.9 percent increase in loan defaults. At the end of 202 3, Sonali Bank's bad loans swelled to roughly Tk 12,800 crore.

Finally, Rupali Bank showed a 14 percent increase in bad loans, which climbed to Tk 9,250 crore at the end of last year.

Financial data published by the banks showed that they had to keep higher provisions due to the large amount of bad loans, which ultimately impacted their bottom line.

At the same time, growing income from interest and investment in treasury bonds contributed to their bottom line positively.

As a result, Sonali Bank logged 83 percent higher profits in 2023, bringing in Tk 747 crore, while Rupali Bank's profits more than doubled to Tk 62 crore.

On the other hand, Agrani Bank's profits dropped 27 percent to Tk 103 crore and Janata's profits fell 50 percent to Tk 62 crore.

Bad loans hit the profits of a bank directly as the lender needs to keep provision if its bad loans rise, said Mohammad Shams-ul Islam, former managing director and chief operating officer of Agrani Bank.

Consequently, the state-run banks' profits fell despite their operating profits rising.

The banks have already realised that they need to reduce default loans to raise profits, he added.

"They also know how default loans can be reduced, so they are walking in the right direction with the help of Bangladesh Bank. So, hopefully, the bad loans will be lower in the upcoming years," he said.

Islam blamed the recent economic heat-up and business scenario in the country alongside the tougher international economic situation for the increase in bad loans.

Many export-oriented firms saw lower income while import-dependent companies struggled. So, their bottom line was hit, which ultimately impacted their ability to repay loans, he said.

Classified loans -- which are loans that are in danger of default -- rose in Agrani and Janata Bank while falling at the other two.

The rate of classified loans to total loans was 13.23 percent in Sonali, 21.03 percent in Rupali, 28.37 percent in Agrani and 25.37 percent in Janata Bank at the end of 2023.

Once, Agrani Bank brought in the most remittance among all banks, but they are now lagging behind because state-run banks cannot offer rates higher than the central bank's ordered rate. However, other banks can do so.

So, state-run banks lag behind in bringing remittances as they are compliant.Here, the central bank needs to work so that all the banks follow the same rules, Islam said.

Agrani Bank has no big scams like other state-run banks so it can recover loans if it tries strongly, he added.

Islam recommended bringing more deposits, giving good loans, diving deep to recover loans, and placing emphasis on non-interest income to make profits like other banks.

The four banks' net interest income rose in the last year as the central bank allowed higher interest rates to be imposed on lending whereas it used to be capped at 9 percent before.

The higher yield of treasury bonds also led to higher income for the banks. However, the state-run banks' investment in bills and bonds was comparatively lower compared to foreign and private banks.

Their combined net interest income more than doubled to TK 1,189 crore in 2023. At the same time, their net investment income rose 14 percent to Tk 9,567 crore.

A mid-level official of a state-run bank, preferring anonymity, said the banks need government support to recover bad loans and get continuous repayment because many of the defaulted loans were taken by borrowers who are linked with politically influential people.

Without political will, state-run banks will be unable to get rid of bad loans, he said. If banks lend for political reasons, then bad loans will continue to rise in upcoming days, added the official.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments