Govt borrowing from domestic sources surges

Government borrowing from domestic banks and non-bank sources rose 55 percent year-on-year during the July-April period of the fiscal year (FY) 2024-25, due mainly to weaker foreign loan disbursements and poor tax collection.

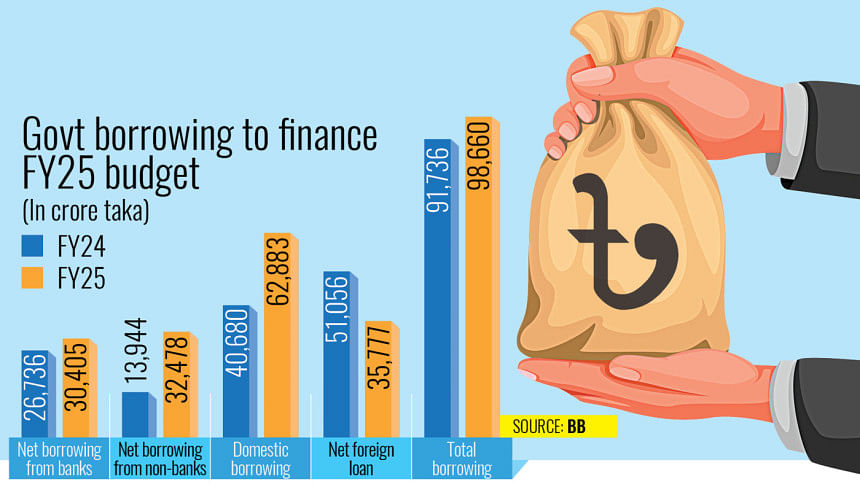

The government borrowed Tk 62,880 crore in net terms during the first ten months of FY25, compared to Tk 40,680 crore a year earlier.

In July-April of FY25, net foreign loans from multilateral and bilateral lenders fell by 30 percent, forcing the government to rely more heavily on local sources.

The shortfall in external funds was covered by large-scale borrowing from banks and non-banking channels. Borrowing through treasury bills and bonds from institutions and individuals outside the banking sector more than doubled, reaching Tk 32,480 crore.

Meanwhile, net borrowing from banks rose 14 percent year-on-year to Tk 30,404 crore, according to the Bangladesh Bank (BB).

Ashikur Rahman, principal economist at local think tank Policy Research Institute of Bangladesh (PRI), said the government's growing dependence on domestic borrowing is a direct result of sluggish foreign loan inflows and weak tax performance.

The National Board of Revenue (NBR) collected Tk 289,268 crore in the first ten-month period of FY25, a mere 4 percent rise from the July-April period a year earlier.

This fell short of the tax authority's revised target by Tk 69,500 crore. By May, this gap had widened further.

Now the NBR would need to collect Tk 141,000 crore this month to achieve the full-year target of Tk 463,500 crore — a highly unlikely outcome given the current economic conditions.

Rahman said the revenue shortfall could cross Tk 70,000 crore in FY25, deepening the government's reliance on local borrowing.

"This trend has serious implications," said the economist. "It risks crowding out private investment, pushing up interest rates, draining banking sector liquidity, and weakening overall fiscal stability."

He added that urgent fiscal reforms are needed to improve tax collection and rationalise spending, or the situation could damage macroeconomic stability and erode business confidence further.

In the revised budget for the current FY25, the finance ministry projects borrowing Tk 117,000 crore from domestic sources. Of this, Tk 99,000 crore is expected from banks, with the rest from non-banking channels.

The latest data shows that the government's borrowing from non-bank sources — institutions and individuals — has already surpassed the full-year target.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments