Govt short of taka, USD due to financial distress

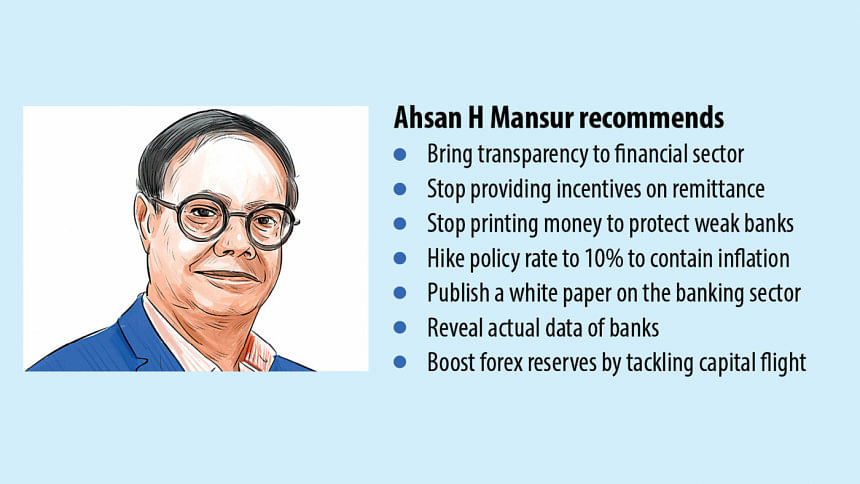

The government does not have adequate taka and US dollars to implement the budget because of financial distress and its failure to raise enough revenues, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, yesterday.

"Due to the crisis of the taka and US dollars, the government is now unable to pay the bills for various sectors, including the energy sector. Many foreign companies also can't repatriate funds from Bangladesh to their home countries," he said.

Mansur made the observations while addressing a discussion on the "Reason for the bad state of Bangladesh's banking sector" at the Economic Reporters' Forum (ERF) auditorium in the capital's Paltan.

Owing to liquidity shortage, Bangladesh is increasingly becoming dependent on debts day by day. The country's borrowing capacity from internal sources is gradually shrinking since banks are facing a liquidity crisis.

In the case of foreign debts, disappointment came from India and China as they did not respond to Bangladesh's requirements as expected, Mansur said.

"On the other hand, the government is not able to raise enough revenues."

Mansur, also a former economist of the International Monetary Fund, said banks are now showing profits by transferring the interest on loans to the income account without receiving it.

"We are selling the plates to buy biriyani."

The economist added banks are also distributing dividends from these profits, and the government is collecting taxes as well.

He said before the national election that took place in the first week of January, it was said that there would be mega reforms in the financial sector.

"However, six months have passed, and nothing has happened. This is very disappointing."

The economist said reforming the banking sector is crucial for the sake of the country.

"It is good that the IMF has given the loan to Bangladesh and has tagged some reforms with it. However, the reforms should be executed for our own sake."

He also talked about money laundering. "If the outflow of assets from the country continues, the current crisis will not be resolved. Political will is needed to deal with the crisis."

Mansur called for publishing a white paper on the state of the banking sector.

"There are more data anomalies in the banking sector than any other sector, including the export data mismatch."

He claimed actual non-performing loans (NPLs) are around 25 percent in the banking industry although it is hovering around 10 percent on paper.

"There is a question about whether savers will get back their bank deposits."

The economist recalled the banking sector was in bad shape in 1990 when a reform programme was initiated. The current regulations were borne out of the reform programme and the sector had received positive outcomes as well.

The second financial sector reform programme was initiated in 2001, which also yielded good results. The bad loans at both state-run banks and private banks came down.

Other indicators of the sector also showed improvements and the momentum continued till 2009 or 2010, Mansur said.

"Since then, the banking sector has been witnessing a downward trend."

"When the structure of governance changed, it has adversely affected not only the banking sector but also other sectors."

The economist urged the government not to support ailing banks by providing liquidity, and the central bank should stop supporting Islamic banks by printing money in the name of protection.

"If it continues, inflation will increase further."

Annual inflation rose to 9.73 percent in 2023-24, the highest since 2011-12. This is the second year in a row that the Consumer Price Index crossed 9 percent.

There are four components in the financial sector: banks, the stock market, the bond market, and the insurance sector.

Mansur said while the bond market has never fared well, the performance of the three other components worsened.

He criticised the unsuccessful bank merger initiative of the central bank.

Mansur said the foreign currency reserves are now being augmented by borrowing from other countries. "In this way, the reserves can't be increased for a long time."

In June, several bilateral and multilateral lenders approved $4.8 billion in loans for Bangladesh.

The economist said the reserves should be increased using sustainable methods like export incomes and remittance inflows and by tackling money laundering.

The gross reserves stood at $41.83 billion in June 2022 before falling to $26.81 billion at the end of 2024, BB data showed.

Mansur recommended discontinuing the 2.5 percent incentive given on remittance inflows. "This is because these incentives are being gobbled up by some firms in Dubai."

He said since the exchange rate is market-based, incentives are not required.

On May 8, the central bank relinquished its unwritten grip on the exchange rate and allowed banks to trade the US currency freely within a band.

ERF President Refayet Ullah Mirdha chaired the discussion, which was moderated by General Secretary Abul Kashem.

Daily Samakal's Special Correspondent Obaidullah Rony and Prothom Alo's Senior Correspondent Shanaullah Sakib presented a paper on the banking industry.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments