Govt targets lower export growth for global turmoil

Bangladesh is targeting a lower export growth in 2022-23 despite raking in a record $52.08 billion in the last fiscal year largely because of insignificant strides in products and markets diversification and ongoing global turmoil.

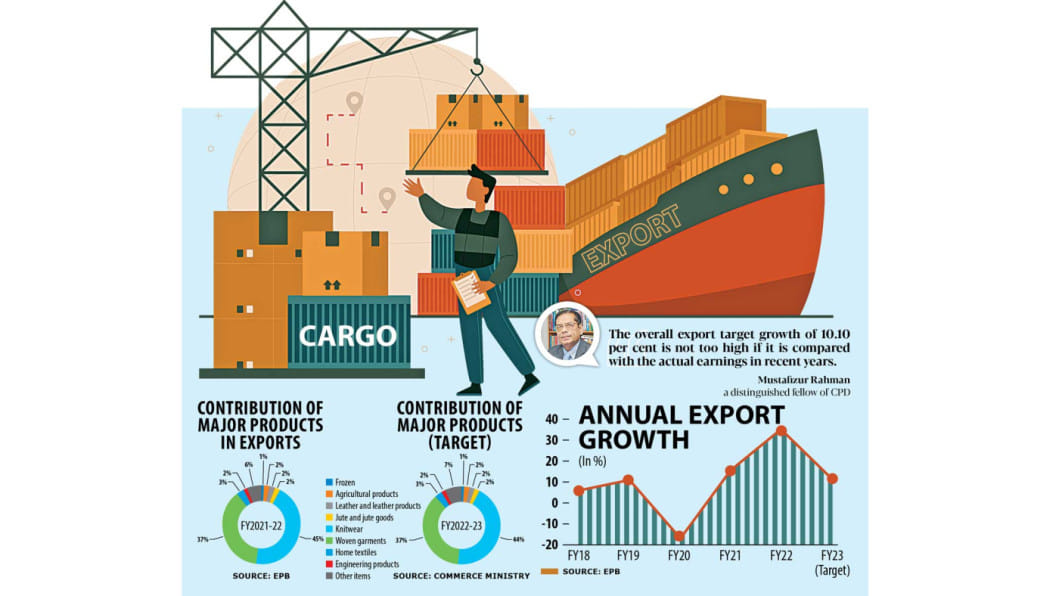

The goal is up only 11.36 per cent from the actual receipts in 2021-22, when overseas sales surged 34.38 per cent, one of the sharpest paces of growth in recent years.

Like in previous years, the government will bank on traditional items such as knitwear and woven garments, which account for more than 80 per cent of national exports, to steer the growth since diversification of products did not take place as expected.

Apart from the two, only five items were able to fetch more than $1 billion in earnings in the last fiscal year.

The export target from the services sector has been fixed at $9 billion for 2022-23, an increase of 12.5 per cent from the actual earnings a year earlier. Together, merchandise and service exports are expected to bring in $67 billion, which is 10.10 per cent higher than the total receipts in FY22.

Commerce Minister Tipu Munshi announced the new export targets at a press conference at his secretariat office in Dhaka yesterday.

"The targets are attainable," he said.

Economists and business leaders also say the targets are achievable although there are some challenges.

In the last fiscal year that ended on June 30, Bangladesh's merchandise shipment was 19.73 per cent higher than the target of $43.5 billion. Another $8 billion came from services exports, which surpassed the $7.5-billion target by 6.67 per cent.

The knitwear export target has been fixed at $25.6 billion from last fiscal year's $20.98 billion, while the country would depend on woven items to net $21.4 billion, which was $17.53 billion in FY22.

"The overall export target growth of 10.10 per cent is not too high if it is compared with the actual earnings in recent years," said Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue.

There are some disquieting factors both in domestic and international markets.

For instance, the issuance of utilisation declaration certificates from the Bangladesh Garment Manufacturers and Exporters Association and the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) is declining.

The demand for deferral payments from buyers and higher inflation are among the major challenges facing the export sector, Rahman said.

Bangladesh's higher export earnings in FY22 were driven by higher prices for garment items paid by international retailers and brands owing to the sharp increases in commodity prices and freight costs. The weakening of the local currency against the US dollar amid abnormally high imports also pushed up export earnings.

So, Rahman called for diversifying products and markets to retain the strong export momentum.

"Bangladesh should go for non-cotton garment items as the demand and prices of such items is higher in the international markets than the cotton-made garment items."

Mohammad Hatem, executive president of the BKMEA, thinks a higher export target from the garment sector is possible although an 8 per cent growth has been fixed.

In FY22, Bangladesh exported garment items worth $42 billion and the new target for the sector is $46 billion.

"It is possible to achieve the target despite the Russia-Ukraine war because we are strong in basic garment items. The demand for basic items is always there whereas the consumption of high-end items falls during uncertainty and higher inflation," Hatem said.

The energy crisis, global economic slowdown and high inflationary pressures will pose as major threats to Bangladesh in pulling off the export target.

The recovery from the pandemic, the global supply chain crisis, the Ukraine war, the recent trends in Bangladesh's overall economic and export growth, and the government's fiscal and non-fiscal incentives have been considered in setting the export targets, Munshi said.

Two more sectors -- plastic and light engineering -- have the potential to earn more than $1 billion in the near future as they have higher demand in the global markets, said Abdur Rahim Khan, additional secretary of the commerce ministry.

The target for agricultural products has been fixed at $1.3 billion against $1.10 billion in FY22. Leather and leather goods exporters have been given the task of generating $1.3 billion in FY23 from $1.11 billion a year ago and jute and jute products exporters $1.2 billion, from $1.05 billion a year earlier.

Home textiles are expected to earn $1.8 billion in FY23, which was $1.46 billion in FY22. Some $604 million are being targeted from the sales of frozen and live fish and $964 million from engineering products.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments