High bank borrowing by govt to crowd out private sector

The government plans to borrow Tk 137,500 crore from the banking sector in the fiscal 2024-25 to finance the budget deficit. If the Bangladesh Bank does not provide any fund, the entire amount will need to come from the commercial banks.

This will crowd out the private sector borrowers, said economists and businessmen yesterday.

"Crowding out will remain a major problem in FY25," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh (PRI).

He said the government's dependence on the domestic banking system has increased, contributing to slower growth in private sector credit and higher interest rates.

The government's plans to finance its deficit budget for fiscal year 2024-25 by borrowing Tk 90,700 crore from foreign sources and Tk 160,900 crore from domestic sources.

The government plans to borrow Tk 137,500 crore from banks to finance the deficit.

Mansur was addressing a post-budget discussion titled "Budget Insights: Challenges and Opportunities" organised by the Metropolitan Chamber of Commerce and Industry (MCCI), Dhaka and the PRI at Police Plaza Concord Shopping Mall in the capital.

Presenting a keynote titled "Budget Insights: Challenges and Opportunities", the economist said the government's borrowing from the central bank however has declined, which would help curb inflation.

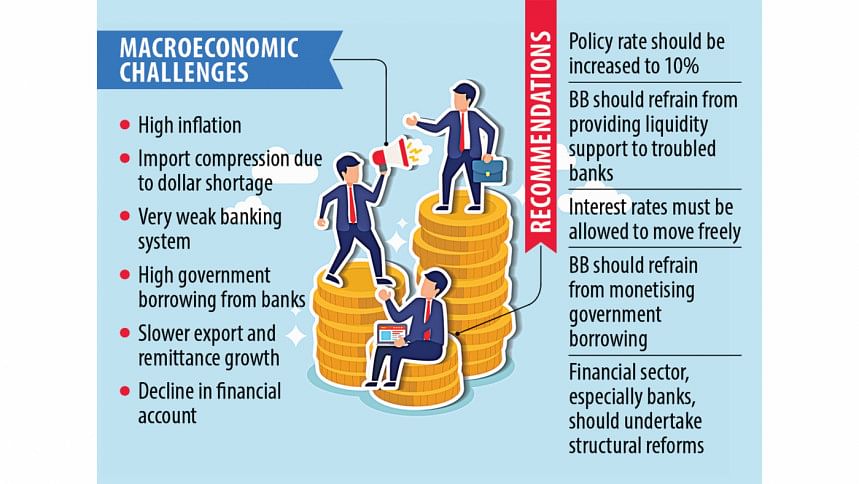

Inflation has reached almost 10 percent and for the last 13 months it has remained above 9 percent, he said.

To counter this, Bangladesh Bank adopted major policy shifts in May this year, he said.

If the central bank strictly sticks to those and refrains from printing money to finance the budget deficit, the inflation rate should start coming down within 6 months to 9 months, he said.

Mansur recommended that the policy rates should be increased further from the current 8.5 percent to at least 10 percent without further delay to curb inflation.

He also said the central bank should refrain from providing liquidity support to the troubled banks until it is possible to bring about reforms and ensure accountability.

Attaining stability in the exchange rate through a tighter monetary stance will be key to achieving the inflation objective, he said, adding that the interest rate structure must be allowed to move freely with market forces.

Mansur said the budget did not contain structural reforms needed in the financial sector, with particular focus on banking and fundamental reforms in tax policies and administration.

He said the initiative taken by the BB to merge troubled banks with strong ones appears to have failed due to a lack of political support.

Zaidi Sattar, chairman of PRI, said the budget was designed towards the right direction, that is being much more pragmatic and realistic in terms of expenditure.

He said the budget is expansionary compared to the last revised budget although some are saying that it is contractionary.

"The budget deficit is the lowest in the last 15 years. Ideally, budget deficits support contractionary fiscal and monetary policies," Sattar said.

Kamran T Rahman, president of MCCI, lauded a 2.5 percentage point corporate tax reduction for unlisted and single person companies and recommended offering it to listed companies too.

He said the opportunity to whiten undisclosed wealth by paying a 15 percent tax would demotivate honest taxpayers.

Mashiur Rahman, the prime minister's adviser on economic affairs, said the exchange rate instability would dissipate through the introduction of current crawling peg system, which was the right move.

On bank mergers, he said those should come about based on the financial health of the banks.

Adeeb H Khan, member, Tariff and Taxation Committee of MCCI, presented a keynote on income tax and VAT provisions from the Finance Bill 2024-2025. The discussion was moderated by Habibullah N Karim, senior vice-president of MCCI.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments