Fighting inflation, forex crisis: Is hiking policy rate the next tool for BB?

Central banks around the world have commenced hiking policy rates in order to contain the inflationary pressure stemming from the ongoing global supply chain disruption and demand recovery.

Bangladesh has also not been spared from the rising prices, which have also been driven by higher commodity costs.

In addition, the taka is facing depreciation pressure against the US dollar as the Bangladesh Bank has moved to contain the soaring import payments amid an acute shortage of the American greenback in the local market.

The Daily Star talked to four economists to know whether the BB should revise its policy rate, the rate at which a central bank lends money to banks on a short-term basis.

Of them, three economists have suggested the BB increase the benchmark rate immediately and the rest has advised the central bank to monitor the situation before bringing in any change.

The policy rate, which is termed the repurchase agreement in Bangladesh, is a pivotal benchmark interest rate, which is followed by commercial banks to set the interest rates on both loans and deposits.

An increase in the policy rate means a higher cost of funds for banks when they borrow from the central bank. This ultimately pushes up the interest rate on loans as well.

Central banks usually consider raising the policy rate when they plan to lower the supply of money in the market at a time of higher inflation.

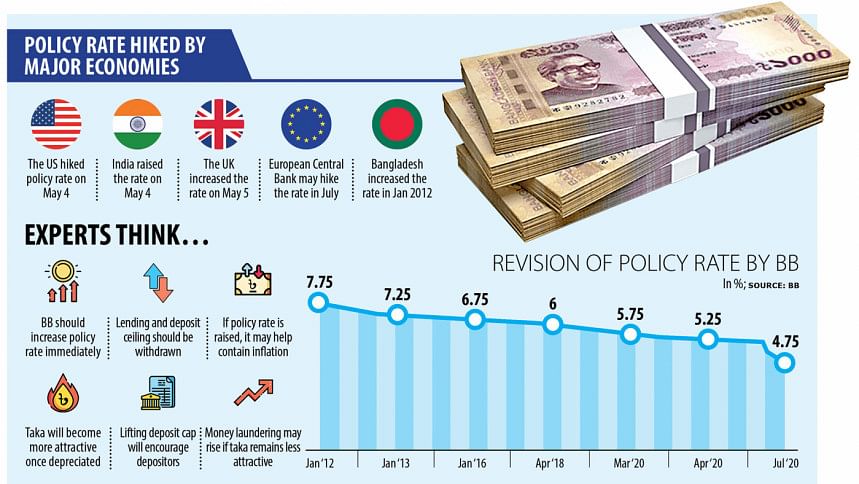

In Bangladesh, the central bank last increased the policy rate on January 5, 2012, raising it by 50 basis points to 7.75 per cent. The rate has gone down over the years.

The central bank cut the policy rate three times in 2020 in order to implement its unconventional monetary policy, which helped businesses borrow from banks at a lower cost.

In July 2020, the BB slashed the rate by 50 basis points to 4.75 per cent.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, urged the central bank to raise the policy rate immediately.

He also suggested the central bank depreciate the local currency against the USD in line with the demand and supply.

The former economist of the International Monetary Fund argued that the taka would become more attractive if the BB devalues it along with hiking the policy rate.

He explained that exporters might not feel interested in bringing back export proceeds unless they get their desired exchange rate of the dollar.

In addition, the withdrawal of the ceiling on the interest rate on deposits would encourage savers, both individuals and businesses, to park their funds with banks.

"Businesses might launder money abroad to get a higher return as many central banks have increased policy rates, which have subsequently pushed up the lending rates," said Mansur.

Central banks in the United States, the United Kingdom and India hiked policy rates in the first week of May to tamp down inflation. The European Central Bank is expected to hike the rate in July, for the first time in over a decade.

Mansur said both consumption and investment should be curbed in order to help Bangladesh get relief from the ongoing foreign exchange crisis.

Foreign sources, which lend funds to governments and businesses, are now keeping an eye on Bangladesh. If the regular flow of foreign exchanges faces any roadblock, they will shy away from giving out funds.

"In such a situation, the country will see the deepening of the crisis," said Mansur.

Monzur Hossain, research director of the Bangladesh Institute of Development Studies, raises questions why the central bank is not using monetary tools to contain inflation.

He recommended the BB increase the policy rate.

Inflation shot up to 6.29 per cent in April, the highest in 18 months, according to data from the Bangladesh Bureau of Statistics.

Hossain also called for the lending cap to be withdrawn in order to squeeze the money supply. An increase in the lending rate will also discourage imports.

A huge surge in imports has put the foreign currency reserves under pressure and made the forex market volatile. This has forced the central bank to devalue the taka six times this year.

The ceiling on the deposit rate, which is set in keeping with the inflation rate, has to be scrapped as well in order to attract deposits from the public, according to Hossain.

Zahid Hussain, a former lead economist of the World Bank's Dhaka office, also supported the idea of hiking the policy rate and making the lending rate flexible.

"If the lending rate can't be made flexible, there will still be room for the policy rate to increase."

"Even if such a move does not bring visible differences, it creates a psychological value in the case of taming inflation. The cut in the policy rate even goes on to discourage banks from extending retail loans even if when there is little demand."

Salehuddin Ahmed, a former governor of the central bank, thinks that the higher inflation is largely not the result of demand; rather, it has been driven by supply constraints.

"So, the central bank should take more time before taking any decision on the policy rate."

Ahmed, however, suggested removing the lending cap.

Md Habibur Rahman, chief economist of the central bank, says the money supply in the market has already tightened.

"So, the central bank has no plans to raise the policy rate at the moment."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments