IMF explains its latest loan

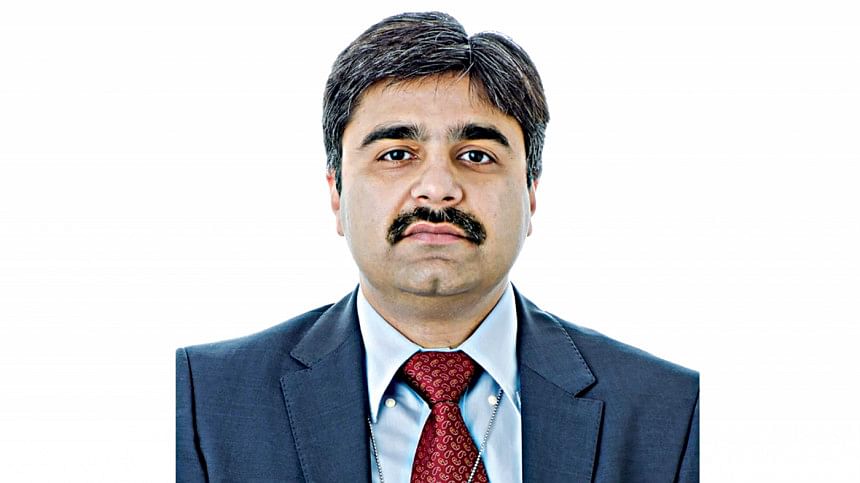

With the approval of a $4.7 billion loan by the International Monetary Fund (IMF) for Bangladesh easing much of the concerns regarding its economy, IMF Mission Chief to Bangladesh Rahul Anand answers some questions about the arrangement.

What was the rationale for the IMF to consider and approve the financing?

In light of the sustained risks that confront the global economy, Bangladesh has requested an IMF-supported programme to restore macroeconomic stability. And even as Bangladesh tackles these immediate challenges, it also recognises the need to undertake some long-due structural reforms, such as raising more tax revenues, which is critical to increase public investments to support the poor and vulnerable.

The IMF always recommends countries to come early. The authorities made the right decision to come to the IMF—and most importantly, to come to the IMF early. Turning to the IMF when countries are already in crisis could make the adjustments particularly hard on people.

What is the IMF's assessment on Bangladesh's near-term economic outlook?

Bangladesh is not in crisis. Just like countries around the world, Bangladesh is dealing with the impact of global shocks – first from the pandemic and then from the ongoing war in Ukraine. Bangladesh's robust economic recovery from the COVID-19 pandemic was interrupted by Russia's war in Ukraine.

Near-term growth is projected to slow to 5.5 per cent in fiscal year (FY) 2022-23 and 6.5 per cent in FY24, compared to the pre-war growth projections at above 7 per cent.

Rising global commodity prices, supply disruptions, and slowdown in external demand have led to high inflation, a sharp widening of the current account deficit, depreciation of the taka and the rapid decline of foreign exchange reserves. Nevertheless, Bangladesh's overall risk of debt distress remains low.

How does the IMF assess Bangladesh's policy response to recent global shocks?

The authorities took the necessary steps to navigate these challenges, including tightening of the monetary stance, allowing for a more flexible exchange rate, imposing temporary restrictions on non-essential and energy-related imports, and adopting measures to reduce electricity demand.

Steps were also taken to reprioritise spending to protect the vulnerable. Bangladesh's request for an IMF-supported programme is part of the authorities' measures to cushion its economy from the disruptions caused by these global challenges.

What are the key policy priorities for Bangladesh?

The IMF-supported programme aims to support the government's plans to preserve macroeconomic stability and foster growth. The authorities and IMF staff have worked closely to come up with a programme that is most relevant to the country's economic and development priorities. The authorities laid out the reform agenda and the programme will support their efforts in addressing the longstanding structural issues of mobilising revenue, scaling up social spending, modernising the monetary policy framework, strengthening the financial sector, and building climate resilience.

How will the programme help the poor and the vulnerable in Bangladesh?

The IMF financing plays the role of a shock absorber by protecting the broader economy, especially the vulnerable populations, from even greater economic disruption than what might otherwise occur.

The programme aims to preserve macroeconomic stability, lay the foundations for further growth, while preventing disruptive adjustments to protect the vulnerable. In fact, the programme focuses on social spending, safety net programmes and protecting the poor in several ways.

First, by raising progressive taxes it aims to increase financing for spending on healthcare, education and clean water, as well as increase access to electricity, transportation and other infrastructure.

Second, keeping in mind that social spending is a core component of the social contract, the programme also aims to protect and increase social spending by including social spending floors.

Third, expanding well-targeted social spending under the programme will help improve access to basic services and provide economic opportunities for disadvantaged groups.

Why is the IMF asking to cut subsidies that will hurt the poor most?

Not all subsidies are helping the poor and vulnerable. In Bangladesh, where gas and electricity are being subsidised, the rich drive more cars and use more air conditioning.

Rationalisation of untargeted subsidies will free fiscal resources to strengthen social safety nets and increase development spending. In addition, the programme aims to protect and increase social spending by including social spending floors. This will allow expanding well-targeted social spending to protect the poor and vulnerable.

How will the Resilience and Sustainability Facility (RSF) arrangement support Bangladesh's efforts toward strong, inclusive, and green growth?

The RSF arrangement under this programme aims to help manage climate change related macroeconomic risks. Reflecting Bangladesh's large climate financing needs, the IMF-supported programme will expand the fiscal space to finance climate priorities identified in the authorities' plans, including by catalysing other financing.

Bangladesh is the first country in Asia to receive financing under the RSF.

What is the timeline of the program? When will the arrangement be disbursed?

The Executive Board of the IMF approved a 42-month extended credit facility (ECF)/ extended fund facility (EEF) arrangement of Special Drawing Rights (SDR) 2.5 billion (equivalent to 231.4 per cent of quota or about $3.3 billion), and a concurrent RSF arrangement of SDR 1 billion (equivalent to 93.8 per cent of quota or about $1.4 billion) to support Bangladesh's economic policies.

The SDR is an international reserve asset created by the IMF to supplement the official reserves of its member countries.

The SDR is not a currency. It is a potential claim on the freely usable currencies of IMF members. As such, SDRs can provide a country with liquidity.

A basket of currencies defines the SDR: the US dollar, Euro, Chinese Yuan, Japanese Yen, and the British Pound.

Quotas are the building blocks of the IMF's financial and governance structure. An individual member country's quota broadly reflects its relative position in the world economy. Quotas are denominated in Special Drawing Rights (SDRs), the IMF's unit of account.

The SDR figures for the programme are converted at the market rate of US dollar per SDR on the day of the programme approval. Approval of the ECF/EFF arrangement enables immediate disbursement of SDR 352.35 million or $476 million.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments