Lending, exchange rates still not market-driven: IMF

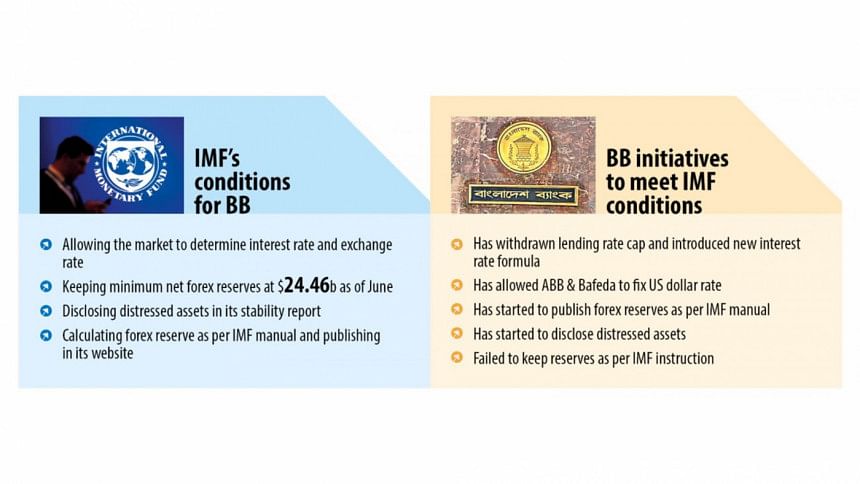

Bangladesh Bank introduced a new formula in June to determine the lending interest rate and brought about a single exchange rate recently but both are yet to be determined by the open market, the International Monetary Fund (IMF) has said.

The exchange and interest rates are still being controlled, said a visiting IMF delegation to senior central bank officials yesterday. The Daily Star learnt of the development from BB officials involved in the matter.

Led by its mission chief for Bangladesh, Rahul Anand, the IMF delegation met with the officials as a part of its review initiated since October 4 on whether Bangladesh met conditions on its $4.7 billion loan.

The delegation, which is in Bangladesh on a two-week visit, will review the performance in achieving the targets set for the first half of 2023.

The team suggested that the BB officials take policy measures for the rates to be determined by the free market.

In response, the central bank officials said the new lending interest rate formula was "nearly" market driven.

Bangladesh Bank in June this year withdrew the lending rate cap at 9 percent which was introduced in April 2020, as it was one of the IMF loan conditions.

As per the BB's new interest rate formula, banks can impose a 3 percent margin on the "six-month moving average rate of treasury bills", abbreviated as SMART.

The SMART was 7.20 per cent in September and it will be applicable for October, up from 7.14 percent in August.

As a result, the highest lending rate would be at 10.20 percent for October and in effect this is also an interest cap, the IMF mission explained to the BB officials.

On the other hand, the central bank announced a new monetary policy in June, declaring to implement a unified and market-driven single exchange rate regime.

This will enable the open market to determine the exchange rate between the local currency, taka, and the US dollar or any other foreign currency.

After that, the Association of Bankers, Bangladesh (ABB), a platform of CEOs of lenders in the country, and Bangladesh Foreign Exchange Dealers Association (BAFEDA) on August 31 fixed a single exchange rate.

The two bodies had been continually devaluing the local currency against the US dollar since last year as per unofficial directions of the central bank.

In response to the IMF delegation, the BB officials informed that if the exchange rate was totally left to the whims of the open market, it would spiral out of control, bringing about negative implications on the rest of the economy.

Furthermore, it will be difficult to bring it down later and that is why the BAFEDA and ABB are devaluing the taka in phases, they said.

The delegation also wanted to know the definition of loan classification and the situation regarding classified loans, said the BB officials

The delegation wanted to fix new targets but deferred it till the return of BB Governor Abdur Rouf Talukder who is now attending an annual IMF meeting in Morocco.

The IMF delegation also held separate meetings visiting Petrobangla and Bangladesh Petroleum Corporation (BPC).

A BPC official told The Daily Star that the delegation wanted to know about the progress in coming up with a "dynamic fuel pricing formula".

"We have told them that we have finalised a dynamic formula for fuel pricing and sent it to the ministry. The government will decide when they will implement it," he said, wishing anonymity.

The IMF delegation also asked about the operational and financial performance of the organisations and the situation regarding gas and fuel price adjustments.

"We said that there is no plan to hike the gas prices as of now as the government was providing subsidies in this sector," said a Petrobangla official.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments