Lingering Red Sea crisis pushes up trade costs for Bangladesh

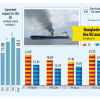

The protracted Red Sea crisis has started to hit Bangladesh as the country's international trade costs have risen, a development that may hurt exports, stoke inflationary pressures, and delay the recovery of the economy.

The blow comes at a time when the newly formed government said its main target is to contain the runaway inflation and rein in the prices of essential commodities. The Consumer Price Index has posted an increase of more than 9 percent since March this year.

The added uncertainty means Bangladesh's renewed fight against the inflationary pressure would become harder to win after fresh disruptions to the global supply chain because of the Red Sea Crisis.

The Red Sea connects Asia to Europe and the Mediterranean, via the Suez Canal. About 12 percent of global trade passes through the Red Sea, including 30 percent of global container traffic.

The route emerged as the heart of global tension after Houthi rebels began attacking Israel-linked ships in response to the latter's devastating war in the Gaza Strip in the third week of October. The crisis deepened after the intensification of counter-attacks on the rebel groups by the UK and the US.

Six of the 10 biggest container shipping companies — namely Maersk, MSC, Hapag-Lloyd, CMA CGM, ZIM and ONE — are largely or completely avoiding the Red Sea because of the threat from the Houthi militants, according to a CNN article.

The danger to crew, cargo and vessels has forced carriers to reroute ships around the Cape of Good Hope in South Africa, resulting in delays of up to three weeks since they would have to travel an additional 3,500 kilometres.

The mounting tension has huge ramifications for countries such as Bangladesh, which uses the route to send products to Europe, accounting for 45 percent of the country's overseas sales in the last financial year.

Nurul Qayyum Khan, president of the Bangladesh Inland Containers Depot Association, said shipping lines are charging 30 percent to 40 percent more in freight charges.

"It is a global crisis as almost all major shipping lines have rerouted the transportation of commercial goods vessels to avoid the Red Sea."

Shovon Islam, managing director of Sparrow Group, a garment supplier, said one of his buyers has shifted work orders worth $1.5 lakh to Indonesia considering the lead time.

"The buyer thinks that if the products are manufactured in Indonesia or Vietnam, they can save 10 days in lead time."

"Actually, buyers want to save time and money as the alternative Cape of Good Hope route is both expensive and time-consuming."

Islam was supposed to supply the products in May and June. However, his buyer has later placed another order with him.

A European garment buyer says the cost of freight has increased between 25 percent and 30 percent due to the Red Sea crisis.

So, he is talks with local suppliers to renegotiate prices and what consignments would be accepted now and what consignments would be taken later.

Another European buyer says the freight charge will increase by 40 percent. "However, no consignment has been suspended yet."

The fare of moving goods from China to Northern Europe rose from $1,500 to $4,000 per 40-foot container, according to media reports.

Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), said the shipment of garment items from Bangladesh is already witnessing the impacts.

He says garment exporters will have to choose expensive air shipments if suppliers fail to deliver products within the agreed time. "In the case of air shipments, the cost is too high."

For instance, it costs less than 30 US cents to move one kilogramme of goods from Chattogram to European destinations through sea routes whereas the carrying cost for the same quantity is $3.50 if air freight service is used.

Usually, shipping costs are borne by importing retailers and brands under the arrangement of free on board (FoB) whereas suppliers bear the carrying costs under the cost and freight (C&F) arrangement.

"The cost of doing business for local suppliers has already increased," said Hassan, adding buyers will ultimately pass on the cost to suppliers for the goods supplied under FoB.

"So, at the end of the day, suppliers are losing money due to extra trade costs."

Mohammad Ali Khokon, president of the Bangladesh Textile Mills Association, said the freight charge for carrying goods has gone up.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said exports have been affected more than imports due to the Red Sea conflict as most of the exported goods from Bangladesh are bound for Europe and the US.

Bangladesh's exports have already come under stress owing to global economic slowdown. If it suffers further troubles, the foreign currency reserves, which have plunged to a record low level, will not receive much-needed support from the external sector. Then, the taka will continue to be under pressure, keeping imports costlier and inflation at an elevated level.

In a relief, Bangladesh does not use the Red Sea to import goods, Mansur said.

China is the top supplier for Bangladesh, making up 26.1 percent of the country's $68.45 billion import in 2022-23, central bank data showed. India came second with a share of 13.9 percent.

The next major suppliers are Malaysia, Indonesia, Brazil, Qatar, the United States, Singapore, Japan, Saudi Arabia, the United Arab Emirates, and South Korea.

"The goods that are imported from the countries such as Brazil, Argentina, the US and Europe will be affected owing to the higher freight charge," said Mansur.

"In such cases, the prices of some goods will go up a bit and this may trigger inflation in the domestic markets."

In a recent report, the World Bank said recent attacks on commercial vessels transiting the Red Sea have already started to disrupt key shipping routes, eroding slack in supply networks and increasing the likelihood of inflationary bottlenecks.

"In a setting of escalating conflicts, energy supplies could also be substantially disrupted, leading to a spike in energy prices. This would have significant spillovers to other commodity prices and heighten geopolitical and economic uncertainty, which in turn could

dampen investment and lead to a further weakening of growth."

In an article in the Guardian on January 13, John Llewellyn, a former chief economist of the Organisation for Economic Co-operation and Development, put the probability of serious disruptions to world trade at 30 percent, up from 10 percent a week ago.

"There is a horrible and inevitable progression that could see the situation in the Red Sea spread to the strait of Hormuz and the wider Middle East."

William Bain, trade expert of the British Chamber of Commerce, said: "About 500,000 containers were going through the Suez Canal in November and that had dropped 60 percent to 200,000 in December."

The Houthis have made it clear that they have no intentions of stopping until Israel ends its war in Gaza. This means the crisis facing the global supply chain and the resultant woes for Bangladesh would linger.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments