Luxury car sales in fast lane

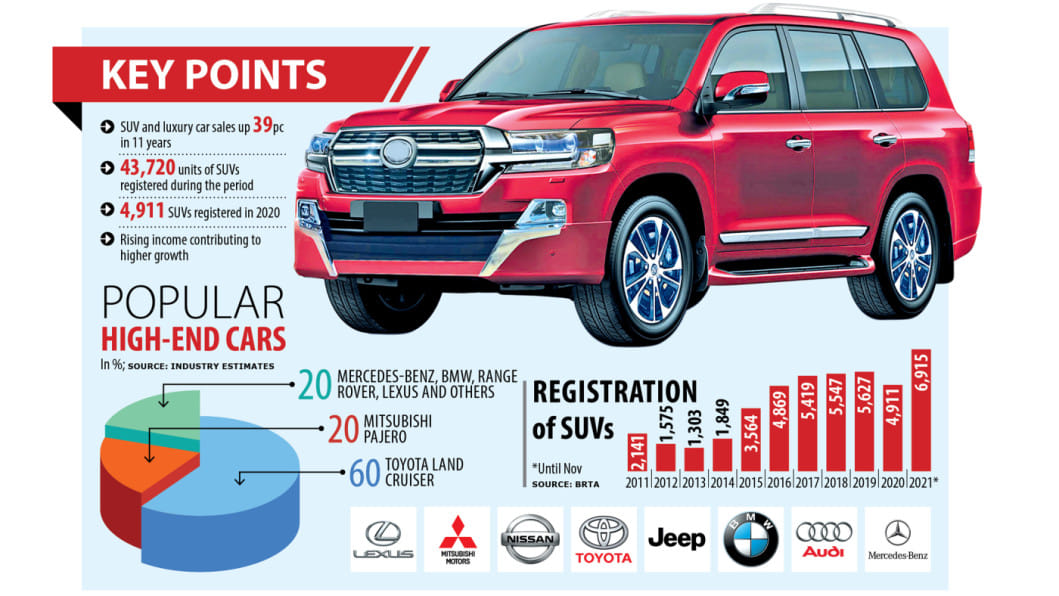

Sales of sport utility vehicles (SUV) and luxury cars grew at an annual average of 39 per cent in Bangladesh in the past decade as more people, armed with rising income, are buying automobiles in higher numbers.

A total of 43,720 units of SUVs and luxury cars, including reconditioned ones, were registered in the 11 years to November 2021. The growth is 434 per cent compared to 2011.

Popular sedan cars clocked 145 per cent growth during the period and 13 per cent on an average annually. Customers buy high-end cars because they perform better than economy cars, and they give their owners a sense of achievement, say industry people and users.

These types of cars are often equipped with the latest safety features, technology integrations, and performance components.

Syed Mahmudul Haque, president of the France Bangladesh Chamber of Commerce & Industry, has been using Toyota Land Cruiser for long time as the SUV is suitable for the roads of Bangladesh.

"There are a lot of rains in Bangladesh, so a high ground clearance vehicle is suitable for the local condition. So, many people like to use SUV."

Ground clearance means that the wheels have more vertical room to travel and absorb road shocks and the car is more capable of being driven on roads that are not level, without the scraping against surface obstacles and possibly damaging the chassis and underbody.

"Besides, SUV is suitable for long drive. Businesspeople and industrialists have to move a lot," said Haque.

The gradual shift to economy cars to luxury cars came as Bangladesh's wealthy class and the number of high-net worth individuals are expanding in an economy that has been one of the fastest-growing in the world for the past decade.

In fact, Bangladesh has topped the list of countries that saw the quickest growth in the number of ultra-wealthy people between 2012 and 2017, according to a recent report of New York-based research firm Wealth-X.

The number of ultra-high net-worth individuals rose 17.3 percent during the period. The upward movement of the rich people will continue as Bangladesh is said to see the third quickest growth in the number of high net-worth individuals in the world in the next five years, said Wealth-X in 2019.

These are the people who are driving the growth of the high-end passenger car market.

Now the vehicles of luxury brands such as BMW, Audi, Mercedes-Benz, Lexus, Jaguar, Porsche and Range Rover as well as the high-end models of Toyota, Nissan and Mitsubishi are a common sight on the roads of large cities like Dhaka and Chattogram.

Toyota Land Cruiser dominates the luxury car segment, accounting for 60 per cent of the premium cars. Mitsubishi Pajero comes second with 20 per cent share.

On Saturday, Toledo Motors Ltd, a subsidiary of Anwar Group of Industries, authorised distributor of Jeep (Stellantis), launched three models of SUV.

Syed Rayhan Kawsar, deputy manager for marketing and communication of Anwar Group of Industries, says the demand for SUVs has been increasing in Bangladesh for the last one decade as income of people has increased significantly.

"This prompted many of the people to shift to SUVs from sedan cars."

Toledo Motors has brought three models: Wrangler Rubicon, Wrangler Rubicon Unlimited, and Wrangler Sahara Unlimited. All three models have the capacity of 2000cc.

Wrangler Rubicon will cost Tk 1.30 crore, Wrangler Rubicon Unlimited Tk 1.52 crore, and Wrangler Sahara Unlimited Tk 1.54 crore.

The government considers vehicles with more than 2000cc engine capacity to be luxury cars, although some brands are producing luxury vehicles with smaller engine capacity as well.

The price of a luxury car ranges from a minimum of Tk 70 lakh to a maximum of Tk 3.20 crore, dealers and retailers say.

Executive Motors, the sole distributor of BMW in Bangladesh, and the price of a BMW car starts at Tk 75 lakh and goes up to Tk 3.25 crore.

Businessmen, top executives, and senior officials of multinational companies and international organisations as the main customers.

Rezwan Nawsher, divisional head of marketing of Rancon, the sole distributor of Mercedes-Benz in Bangladesh, says earlier people of Bangladesh used to consider European cars like Mercedes-Benz and BMW as luxury, but the mindset has changed along with the increased incomes, steady economic growth and frequent foreign trips.

"People prefer branded new luxury cars as prices have gone down after the government cut taxes," he said.

Besides, the reduction in the maximum depreciation facility on five-year-old reconditioned cars to 35 per cent from a previous 45 per cent has led to narrowing of the price gap between reconditioned and brand new vehicles. This has contributed to increasing the affordability of consumers to switch to brand new cars, said LightCastle Partners.

Saad N Khan, managing director of Audi Bangladesh-Progress Motors Imports Ltd, says as people have become richer, they shifted to luxury brands from sedan cars.

The reconditioned car market in Bangladesh is typically considered as new cars in the local market which covers 50 per cent of the total market. While 5 per cent of the cars are brand new, the rest 45 per cent are used cars referring to the presence of a healthy second-hand car market, according to LightCastle Partners.

Despite growing car use, per capita car use in Bangladesh is very low compared to comparator countries.

Bangladesh has three cars per 1,000 people, compared with 897 per 1,000 in Malaysia, showed a research paper of the Policy Research Institute of Bangladesh, a think-tank. It is 34 in Vietnam, 22 in India, and 16 in Pakistan.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments