Major targets of current budget still unmet

The government is far away from achieving the major targets set for the current fiscal year when the national budget was unveiled in June last year, owing to its failures to assess the global scenario before fixing the goals, experts said.

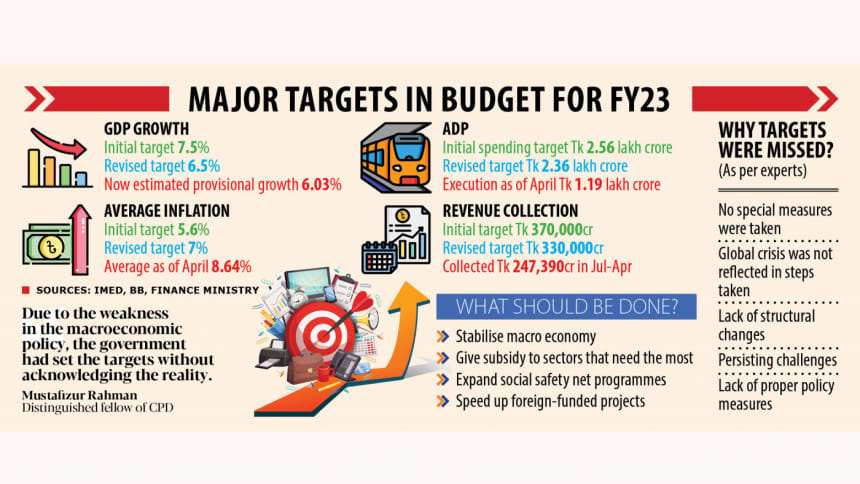

The major targets that the government might miss at the end of 2022-23 include gross domestic product (GDP) growth, inflation, revenue and annual development programme (ADP).

Initially, the government set a 7.5 per cent GDP growth target. Later, the target was revised downwards twice, cutting it to 6.5 per cent owing to the continuing stress in the economy stemming from the dragging fallout of the coronavirus pandemic and the Russia-Ukraine war.

The GDP is estimated to have grown by 6.03 per cent in FY23, said the Bangladesh Bureau of Statistics (BBS), which arrived at the figure on the basis of the data of the first half of FY23.

The estimate is, however, higher than the projection made by the World Bank, the International Monetary Fund and the Asian Development Bank.

The government has also not been able to rein in the rising trend of inflation in the last 10 months.

It had targeted to keep the average inflation within 5.6 per cent in FY23 and it was revised upwards to 7 per cent as consumer prices surged owing to the war-induced disruption in the international commodity market and the global energy crisis.

The Consumer Price Index averaged 8.64 per cent as of April, BBS data showed.

The government's revenue collection target is also set to be missed.

The National Board of Revenue was given a task to raise Tk 370,000 crore in FY23. It collected Tk 247,390 crore in the 10 months to April, which was 67 per cent of the target.

This means taxmen will have to collect Tk 122,600 crore in the remaining two months of the year, which is ending in June.

If the NBR misses the target, it would be the 11th consecutive year that the revenue goal will remain unachieved.

The situation is the same regarding the implementation of the development budget: Tk 119,064 crore was spent in July-April against the revised target of Tk 236,560 crore, which accounted for half of the target.

MA Razzaque, research director of the Policy Research Institute of Bangladesh, described the targets on GDP growth, inflation, revenue collection and ADP spending as the "heart" of the national budget.

"But so far, we have been in the slow lane when it comes to attaining the goals," he said.

He said 2022-23 has been a very difficult year for Bangladesh and the budget was formulated at a time when the impacts of the pandemic were still significant and the war in Ukraine was raging.

"Under such circumstances, setting a 7.5 per cent growth target was unrealistic."

Razzaque, however, said although the average inflation is still high, the government should have managed it through proper policy measures.

Prof Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, said the targets were set without considering the fallout of the Russia-Ukraine war.

"The government did not anticipate that the war would have a serious impact on the overall budget. As a result, the budget was business as usual."

He explained the government could not assess the impact the conflict would have on the foreign exchange and the exchange rate.

The reserve has fallen by about 28 per cent in the past one year while the taka lost its value by about 25 per cent against the US dollar.

"Due to the weakness in the macroeconomic policy, the government had set the targets without acknowledging the reality," said Prof Rahman.

The economist went on to say that the CPD had urged the government to revisit the budget two or three months after it was unveiled considering the global scenario.

"Now we can see where the budget stands when it comes to achieving its major targets."

CPD's Rahman said the government ignored the reality while setting the targets and there are structural weaknesses behind the slower ADP execution and lower tax collection.

About the budget deficit, he said the current deficit might go past 5 per cent of GDP and it may shoot up to 6 per cent in 2023-24.

"The higher deficit will bring about challenges as the government would have to rely on the banking sector to finance the shortfall. Then, it will have adverse effects on the private sector. And if the government borrows from the central bank, it will stoke inflationary pressure."

The government borrowed Tk 78,560 crore from the banking sector as of May 10, against the full fiscal-year target of Tk 106,334 crore.

The noted economist suggested the government focus on stabilising the economy and containing inflation, revisit subsidy allocation and give subsidies to the sectors that need the most.

In order to tackle inflationary pressures, he called for expanding social safety net programmes.

The government will have to adjust the interest rate of national savings certificates as people are not very keen about them owing to the lower return, he said, calling for fast-tracking the implementation of foreign-funded projects.

Prof Razzaque suggested the government undertake effective policy measures in the next budget for 2023-24 to restore macroeconomic stability.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments