March revenue growth nears 10%, but no cause for cheer

The sluggish pace of tax collection by the National Board of Revenue (NBR) has heightened concerns over meeting the targets set by the International Monetary Fund (IMF), casting a shadow over the government's fiscal performance.

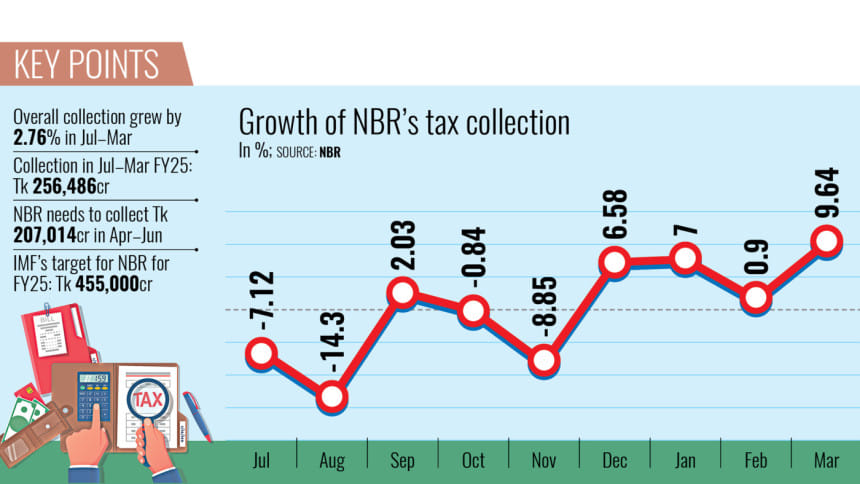

Although the monthly growth in March was nearly 10 percent year-on-year, the NBR now faces a herculean task in meeting its annual tax target set by the government as well as the benchmarks prescribed by the multilateral lender amid ongoing economic headwinds.

According to internal data of the NBR, revenue collection grew by only 2.76 percent in the nine months since the beginning of fiscal year (FY) 2024-25.

Until March, the NBR -- which mobilises 86 percent of the state's total revenue -- collected Tk 256,486 crore, less than half of the government's revised target of Tk 463,500 crore.

The figure is also significantly lower than the Tk 455,000 crore target set by the IMF for its ongoing $4.7 billion loan programme for Bangladesh.

To meet the IMF's target, the NBR must collect nearly Tk 200,000 crore in the final three months of the fiscal year -- or about Tk 65,000 crore per month.

During its latest visit, an IMF mission asked the NBR to raise the tax-GDP ratio, which currently stands at 7.4 percent, to 7.9 percent by June, according to NBR sources.

The IMF has also called for an additional Tk 57,000 crore in revenue collection for the next fiscal year by eliminating tax exemptions offered to different sectors.

"Only 2.76 percent revenue growth is alarming," said Ashikur Rahman, principal economist at the Policy Research Institute of Bangladesh. "If we can't revive the historic 15 percent growth momentum, there's no way we can meet the IMF-set revenue targets.

"At this rate, there's absolutely no way we can reach 15 percent. In fact, we're not even sure if we'll hit 10 percent in the current fiscal year," he added.

Based on the current growth trajectory, the government may not even have the capacity to increase spending due to the revenue shortfall, even if it wants to, he noted.

"In that light, both the revenue target and the overall projection appear aspirational," Rahman said.

Referring to revenue collection in the first half of FY25, the Centre for Policy Dialogue (CPD) projected earlier last month that total collection would need to increase by a staggering 55.5 percent in the second half of FY25 for the target to be met.

"This is indeed a highly unlikely prospect," the CPD noted, adding that if the current trend of revenue mobilisation continues, the shortfall could reach Tk 105,000 crore by the end of FY25.

On top of that, the government has set a revenue collection target of Tk 499,000 crore for the tax administration in the upcoming fiscal year, a 7.6 percent increase from the revised target for this year.

Preliminary NBR data shows that customs revenue grew slightly, by 0.38 percent, during the July–March period of this year as Bangladesh's imports still remain low despite recovering from a downturn.

Overall imports grew 3.32 percent year-on-year to $38.11 billion in the July–January period of this fiscal year.

Value-Added Tax (VAT) -- the largest source of tax revenue, accounting for 38 percent of total NBR tax -- also witnessed 2.09 percent year-on-year growth to Tk 114,749 crore in the nine months until March.

Income and travel tax grew 5.67 percent to Tk 116,676 crore in the same period, up from Tk 82,253 crore the year prior.

This weak performance has raised concerns that the government will be more reliant on domestic borrowing to finance the national budget as foreign funding declines and debt repayment obligations rise.

"Without major fiscal reforms, macroeconomic stability cannot be achieved," Rahman said.

"If you look at this budget, 85 percent of interest payments are going towards domestic interest expenses. The operating budget is increasingly being eaten up by interest payments."

Without boosting revenue growth, there is no way out of this fiscal quagmire, he stressed.

"But it's not just about setting targets; real reforms are needed."

He referred to the government's decision to separate the tax administration from the policy division. "But it should not be limited to paper. These need to be staffed immediately with people who understand tax policy -- whether brought in from abroad or found locally."

He also said that the Tax Policy Department must be restructured immediately, and this entire process needs to be expedited.

Additionally, Rahman sought to lessen the burden of tax exemptions.

"We've done little to address tax exemptions. It's time to act, not just promise."

According to a top NBR official, the revenue board is planning to reduce existing tax exemptions for export-oriented sectors in the upcoming national budget in a bid to rationalise tax benefits and meet revenue targets set by the IMF.

The corporate tax rate will not be reduced in the upcoming fiscal year, NBR Chairman Md Abdur Rahman Khan said recently.

He also underscored the need to establish a non-discriminatory tax regime for all sectors and reduce exemptions.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments