Market-driven exchange rate not before national polls

The exchange rate volatility and its strain on the foreign currency reserves would not disappear anytime soon after Bangladesh Bank Governor Abdur Rouf Talukder yesterday said a floating US dollar rate would not be materalised before the upcoming national election.

The delay in introducing a market-based exchange rate is aimed at bringing down consumer prices as the central bank thinks a free-floating regime might stoke inflationary pressures further.

So, the BB governor asked banks to step up their efforts to bring export proceeds to the country in order to give a much-needed fillip to the flow of the American greenback.

The instruction came at a meeting between the BB and a delegation of the Association of Bankers, Bangladesh (ABB) at the central bank headquarters. Talukder presided over the meeting where chief executives of 13 lenders were present.

The meeting discussed the state of the financial sector, the forex market, the new interest rate-setting formula, the exchange rate, inflation, policy measures that have already been initiated by the central bank, the balance of payments, remittance flow, and non-performing loans (NPLs).

Bankers urged the governor not to take action against them if they attract remittance at a rate that is higher than the fixed rate because it will help boost remittance earnings, a key pillar of the economy.

The CEOs also informed the governor that they were facing liquidity shortages both in the local and foreign currencies, requesting him to float the exchange rate.

Against their request, the central bank chief said the regulator would not take any initiatives to float the exchange rate before the election, due in January, because it might fuel inflation.

Average inflation rose 9.63 percent in September, way above the government's target of 6 percent for the current fiscal year. It has been at an elevated level since June last year as the volatility in the global market driven by the Russia-Ukraine war sent commodity prices higher, hitting the reserve level of import-dependent countries such as Bangladesh.

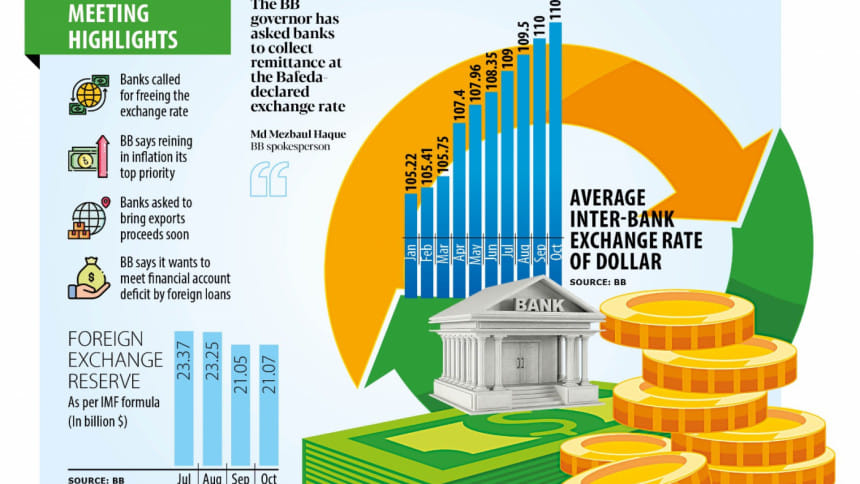

Bangladesh had forex reserves of about $40.7 billion in August 2021 and $33.4 billion at the end of 2021-22, according to a document of the International Monetary Fund (IMF). It plummeted to $21.07 billion on October 11, central bank figures showed.

Owing to the fast-depletion of the reserves, the taka has lost its value by about 28 percent against the US dollar in the past 18 months.

The ABB and the Bangladesh Foreign Exchange Dealers Association (BAFEDA) have been fixing the exchange rate since last year as per the informal directive of the central bank. The two platforms implemented a uniform exchange in September.

However, the visiting IMF delegation has recently told central bankers that the exchange rate is yet to be market-driven and is still controlled.

The banking regulator is now focused on reining inflation and meeting the deficit in the financial account by securing foreign loans from countries such as India and Saudi Arabia.

After the meeting, Selim RF Hussain, chairman of the ABB, told reporters that the governor asked banks to bring the export proceeds as early as possible.

"We also discussed the policy issues that the central bank has already introduced to rein in inflation."

There is a pressure on the liquidity in the banking sector but the CEO of Brac Bank calls it normal.

BB Executive Director and Spokesperson Md Mezbaul Haque said the governor asked banks to bring in remittance at the BAFEDA-fixed rate.

The bankers also said the payments against exports are being deferred by foreign buyers. As a result, a portion of earnings are not being transferred to the country, he said.

"Banks are clearing the import bills immediately whereas export proceeds are being delayed, which has resulted in the forex crisis."

According to Haque, there has been higher export growth this year but proceed realisation has fallen in proportion to the shipment.

"There is a gap between the export figures of the Export Promotion Bureau and the real proceeds."

A section of exporters doesn't want to cash in their forex incomes immediately in order to benefit from the downward trend of the taka rate, according to experts.

In 2022-23, products worth more than $55 billion were shipped from Bangladesh, but around $46 billion came to the country, Haque pointed out.

"We instructed banks to reduce the gap."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments