MFS booming but largely confined to fund transfer

More than a decade has passed since the rollout of mobile financial service (MFS) in Bangladesh, but its use has largely been limited to fund transfers though it can become a major vehicle to turn the country into a cashless economy eliminating its over-dependence on fiat currencies.

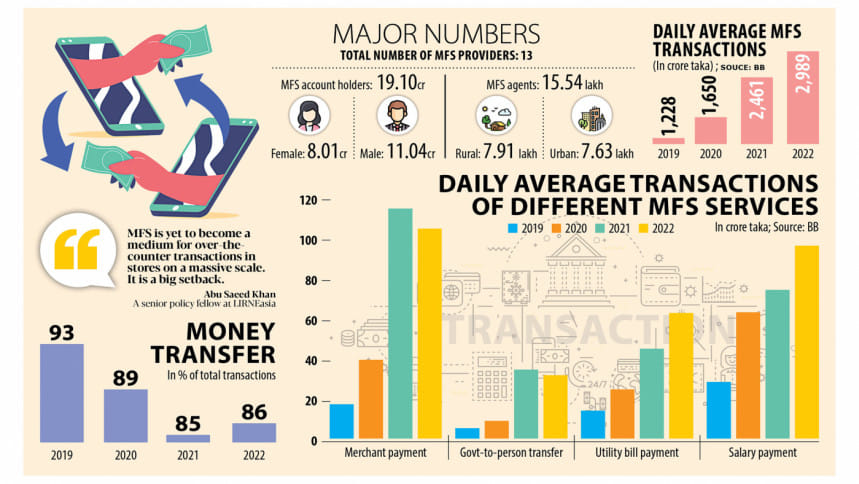

Bangladesh Bank data showed that the ratio of money transfers – cash-in, cash-out and person-to-person transfers – using the MFS system, which was introduced in 2011, is declining albeit at a slower pace.

The share of money transfers stood at 86 per cent out of all transactions recorded at Tk 10,75,990 crore last year. Four years ago, it was 93 per cent of all transactions involving Tk 442,090 crore.

Industry operators describe the drop as a positive development as the volume of transactions has more than doubled during the period, pointing to the expansion of the overall MFS market.

But, according to industry stakeholders, a number of issues -- lack of digital literacy, high cost of transactions, the reluctance of businesses to carry out transactions digitally, low penetration of smartphones, and a lack of push from the policy-makers – are deterring the faster growth of digital transactions through MFS platforms.

In 2022, the use of MFS for merchant payments, salary disbursements, government cash transfers to persons, utility bill payments, talk-time purchases and other usages accounted for more than 10 per cent of all transactions.

"Despite exponential growth, there are a few challenges that are hindering wider adoption of digital payments," said Mahfuz Sadique, chief communications officer at bKash, the largest MFS provider in Bangladesh in terms of transactions.

According to him, the barriers include a lack of digital literacy and costlier internet and smartphones.

"We are encouraged that the state and relevant stakeholders are actively working to address these challenges and promote digital payments."

Still, the success of the MFS industry can't be overlooked.

In less than 12 years, MFS providers have brought millions under the formal financial channel, accelerating financial inclusion. Bangladesh's achievement is cited as an example in the world of fintech.

"Today, it is not impossible for anyone to lead a cashless or less-cash life," Sadique said.

Central bank figures showed that the use of MFS in terms of all types of transactions is growing thanks to an increase in the number of MFS providers and their rising popularity.

About 19.10 crore users were registered with 13 MFS providers in 2022 in a country of 17 crore people, with many using multiple accounts.

Currently, transactions involving about Tk 3,000 crore are made through the MFS system every day, tripling from Tk 1,200 crore four years ago.

Various government and private organisations such as readymade garments, corporates, NGOs, and distribution networks are already using MFS to disburse salaries.

"It is necessary to maximise the use of MFS to become a cashless society," said Sadique.

Salary payments through MFS platforms increased 3.4 times to Tk 2,886 crore in 2022 from four years ago. Merchant payments that were Tk 518 crore in 2019 grew six times to Tk 3,183 crore last year.

The rate of growth of cash transfers by the government to people under safety net schemes rocketed nearly six times since then. And people paid utility bills such as electricity by four and half times the amount they paid in 2019, according to BB data.

Sadique said in order to make people habituated in diversified digital payments, it is essential for relevant stakeholders to make combined efforts to build and enhance the digital financial ecosystem.

Bkash has put in place innovative technologies and services and formed partnerships with various financial institutions.

"All these efforts will hopefully boost digital transactions and empower customers in their daily financial activities," Sadique said.

Muhammad Zahidul Islam, head of public communications of Nagad Ltd, said the MFS provider is working on upgrading the country's overall position when it comes to going cashless and paperless.

"We have removed the paper-based know your customer process and introduced charge-free bill payments alongside easing merchant payments. The strategy has facilitated the expansion of financial inclusion and given a push to popularise cashless payments."

Nagad, a majority of which is owned by the government's postal department, is now placing emphasis on resolving merchant and other payment issues. It is offering cashback and discounts.

"We are going to introduce some new services within a short time. We are very hopeful that cashless payments will be popular in the country and day-to-day transactions using mobile phones will be at the top," Islam said.

Abu Saeed Khan, a senior policy fellow of LIRNEasia, a think-tank based in Colombo, said transactions through MFS providers are rising, which shows that the overall pie has become larger.

"This is a very positive sign."

He said the market is still in a growing mode and there is room for further growth.

Khan, however, laments that MFS is yet to become a medium for over-the-counter transactions in stores on a massive scale.

"It is a big setback. Policymakers and industry should see how this sort of transaction can be increased."

Khan also sees cost as a major issue. "The cost of transaction needs to be contained."

Selim Raihan, executive director of the South Asian Network on Economic Modeling, said the slow growth in the shares of digital transactions does not go with the aspiration for a digital Bangladesh.

Problems exist on both the demand and supply sides.

Products and services of MFS such as salary payments have not been publicised and promoted from the supply side. And firms that can avail the benefits have not shown interest, the economist said.

One reason, Raihan said, is the high prevalence of informal transactions.

"It may be that many firms don't want to use digital platforms to avoid recording transactions. There are firms that maintain more than one book of accounts to avoid taxes."

There is also an absence of push for digital transactions from regulators and policymakers, said the economist, calling for the formalisation of digital payments.

"India has nicely implemented digital payments and Bangladesh can learn from the neighbouring country."

Raihan, also a professor of economics at the University of Dhaka, said increased digital transactions would ensure transparency of businesses, which will eventually bring more taxes for the state.

He cited the International Monetary Fund's condition of raising the tax-to-gross domestic product ratio.

"This is high time to promote digital payments."

Last month, the central bank launched an interoperable payment method, Bangla QR, to help customers pay bills through mobile banking applications, MFS providers and payment service providers.

The central bank has also asked banks and financial institutions to replace their proprietary QR codes within June with the Bangla QR.

"There will be a boom in the cashless transactions when payments become interoperable," said Syed Mohammad Kamal, country manager of Mastercard.

"We are on the right track to becoming a cashless economy."

Md Mezbaul Haque, executive director of the BB, said the central bank monitors cash-out.

"The ratio of cash-out is falling. It will reduce further once the Bangla QR code transaction gains traction. But it is a big challenge to change people's habits. It takes time."

The BB plans to launch cashless transactions in three districts before Eid-ul-Azha, the biggest religious festival in Bangladesh.

"We are very optimistic. There are some challenges but we are working to give a boost to digital transactions," Haque said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments