MFS cash-out limit raised to Tk 30,000

The Bangladesh Bank has raised transaction limits for mobile financial service (MFS) providers such as bKash, Rocket, and Nagad ahead of Eid-ul-Fitr, a time when money flow in the economy typically increases.

The central bank issued a notice in this regard yesterday.

Under the revised policy, MFS account holders can now deposit up to Tk 50,000 daily through an agent, up from Tk 30,000.

The monthly cash-in limit via agents has also been raised to Tk 3 lakh from Tk 2 lakh.

For cash-outs through agents, the daily transaction limit has been increased to Tk 30,000 from Tk 25,000 while the monthly limit has been raised to Tk 2 lakh from Tk 1.5 lakh.

However, transaction caps via bank accounts and cards remain unchanged.

The maximum cash-in limit stands at Tk 50,000 per day and Tk 3 lakh per month while the cash-out limit remains Tk 50,000 daily and Tk 3 lakh monthly.

For person-to-person (P2P) transactions, MFS users can now transfer up to Tk 50,000 per day, double the previous limit of Tk 25,000. The monthly transfer cap has been raised to Tk 3 lakh from Tk 2 lakh.

Additionally, the maximum balance an MFS account can hold has been increased to Tk 5 lakh from Tk 3 lakh.

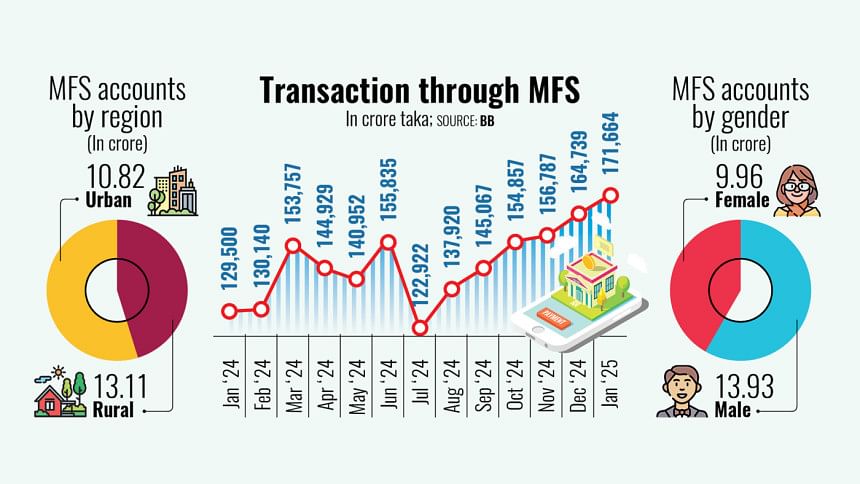

The decision comes as MFS transactions continue to surge.

In January 2025, total MFS transactions rose 33 percent year-on-year to Tk 171,664 crore from Tk 129,500 crore in the same month last year. The amount was also 4 percent higher than in December.

In December 2024, the average daily transaction volume through MFS stood at Tk 5,314 crore, with total transactions for the month reaching Tk 164,739 crore, according to central bank data.

Six years ago, total transactions through MFS amounted to only Tk 34,676 crore, indicating that the sector has grown nearly fivefold.

Cash-outs account for the majority of transactions followed by cash-ins.

The number of MFS agents has also increased over time. As of January 2025, MFS providers had 18.41 lakh agents, up from 17.39 lakh a year earlier.

Bangladesh, which introduced MFS one-and-a-half decades ago, now has around 24 crore registered MFS accounts.

"Customers are increasingly relying on digital transactions for their daily financial needs," said Major General (retd) Sheikh Md Monirul Islam, chief external and corporate affairs officer of bKash.

"This decision to raise cash-in, cash-out, and P2P transaction limits will encourage more cashless transactions while boosting customer confidence. We welcome this timely move by Bangladesh Bank," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments