MFS transactions hit record Tk 1.25 lakh crore in April

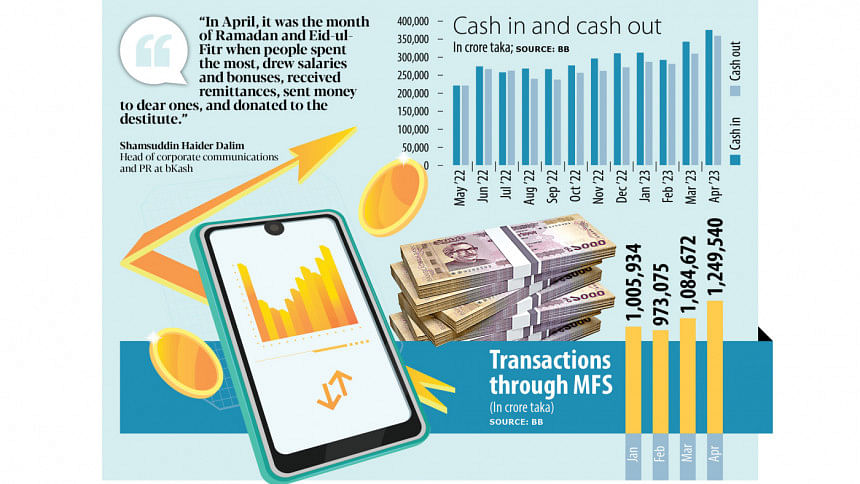

Mobile financial service (MFS) providers recorded Tk 1.25 lakh crore-worth transactions in April, the highest ever so far, buoyed by an increase in spending, payments and money transfers ahead of the Eid-ul-Fitr festival.

The transactions in April rose 15 per cent from the previous month's Tk 1.08 lakh crore, and April was the second consecutive month that registered a growth momentum in the use of the MFS, according to data released by Bangladesh Bank.

Year-on-year, transactions through MFS platforms grew 16 per cent from Tk 1.07 lakh crore in April 2022.

"Last April 2023, it was the month of Ramadan and Eid-ul-Fitr when people spent the most," said Shamsuddin Haider Dalim, head of corporate communications and public relations at bKash, the largest MFS provider in Bangladesh.

"(People) drew salaries and bonuses, received remittances, sent money to dear ones, donated to the destitute, etc," he said.

"And that spending spree was clearly reflected in the latest MFS transaction trend unveiled by Bangladesh Bank," he said.

Dalim said compared to the previous month, transactions through the MFS platform saw a sharp rise in almost all segments.

These include merchant payment, person to person, government's cash transfer to people under social protection scheme, salary disbursement, mobile recharge and utility bill payment, he said.

The MFS system, which was introduced in 2011, gained popularity within a couple of years because of convenience. Today, the number of MFS accounts is 20 crore and more than half of the accounts are owned by men.

April's data showed that average daily transaction crossed Tk 4,000 crore, which was Tk 1,200 crore four years ago, according to the BB data.

"Due to convenience in digital transactions, the MFS industry has been experiencing a behavioural shift of customers in the last couple of years, resulting in ever-increasing MFS transactions," said Dalim.

"In general, people spend more during festival season, special days, and holidays," he said.

Of the total transaction, cash in and cash out accounted for 59 per cent in April followed by person-to-person fund transfer, payment to merchant for purchases by consumers and salary disbursement.

The float amount of money kept by users in their MFS wallets also hit a new high, Tk 11,084 crore, in April.

"The transaction figures look smarter, but this is not a surprise to us. Actually, we already assumed such a massive jump with more and more people now availing mobile money services," Muhammad Zahidul Islam, head of public communication at Nagad.

"The MFS provider received a tremendous response soon after we launched the mega BMW campaign," he said.

"We have witnessed more than 10 times higher payment growth in April compared with March, eventually helping to boost the overall transactions of Nagad," he said.

He cited a central bank target to make 75 per cent of the country's total transactions cashless by 2027 and said Nagad continued to come up with diversified products and services to encourage people to go for digital payments.

"We are now working on bringing all financial services on a single platform, which will be possible once we establish a digital bank. In this way, we want to help the country move to a cashless society," he said.

Md Shamsuzzoha, deputy director for corporate affairs of upay, another MFS provider, said his company found increased flow of inward remittance, higher salary disbursement, person to person payment and govt payments in April.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments