Motorcycle sales hit six-year low

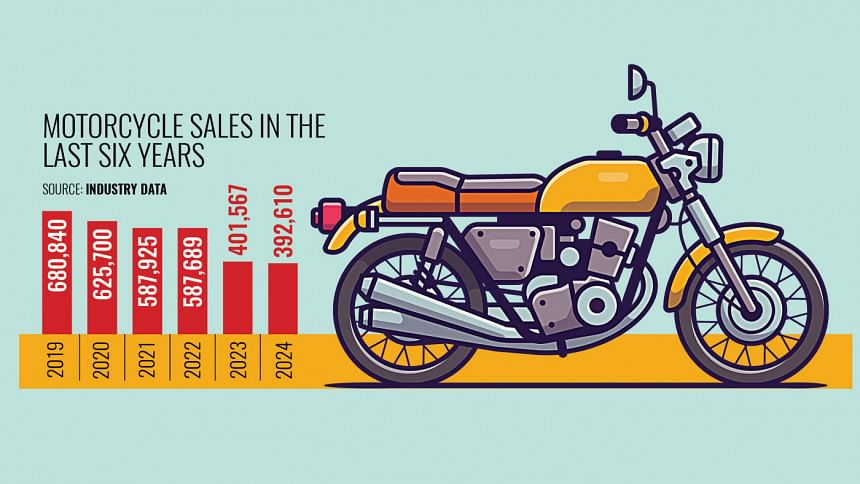

Motorcycle sales in Bangladesh hit a six-year low in 2024, in continuation of a downward trend emanating from economic instability, inflation and political transitions, according to industry experts.

An overall market assessment by ACI Motors states a 2 percent year-on-year decline from the 392,610 motorcycles sold in 2023. The fall exceeded the downturn experienced during the Covid-19 pandemic.

Subrata Ranjan Das, deputy managing director of ACI Motors, attributed the slump to economic challenges.

"Motorcycle prices also increased significantly due to the ongoing US dollar crunch and rising inflation," he explained.

Interestingly, the premium motorcycle segment bucked the trend, showing significant growth in 2024.

Das noted that affluent buyers remained unaffected by economic pressures, driving demand for high-end models.

However, Das warned that the broader market faces limited opportunities for growth.

"With the economy under strain, manufacturers and retailers have little scope to expand until conditions improve," he added.

According to the latest sales data, the motorcycle market in 2024 has seen a mix of surprises and setbacks.

While some brands experienced noteworthy growth, others faced a decline, reflecting shifts in consumer preferences and market dynamics.

Among the brands, Hero Motorcycles emerged as a strong contender, recording the highest growth rate of 19 percent in 2024, according to the ACI report.

Hero's sales soared to 58,189 units, boosting its market share to 14.8 percent, it added.

This surge apparently reflects the brand's strategic focus on affordable models and fuel efficient designs, which resonated well with budget-conscious consumers.

Meanwhile, Suzuki and Yamaha also posted positive growth rates of 8 percent and 11 percent respectively, according to the ACI report.

Both brands now hold an equal market share of 19.3 percent, closely competing in the mid-range segment, it added.

Yamaha's aggressive marketing campaigns and innovative features have played a pivotal role in driving demand while Suzuki's consistent reliability continues to win over buyers.

In stark contrast, Bajaj, once a leader in the motorcycle market, experienced a significant 10 percent decline in sales, the report said.

The company sold 85,696 units in 2024, causing its market share to fall to 21.8 percent, though it remains the dominant player, it added.

Industry insiders suggest that rising competition and limited new launches may have contributed to this slump.

Another notable trend is a slight dip in sales for Honda, which recorded a 1 percent decline year-on-year. Honda's market share now stands at 15.2 percent, a minor decrease, however, an official of Bangladesh Honda claimed a three percent sales growth in the last year.

Analysts believe the brand needs to revamp its lineup to cater to evolving customer expectations.

Overall, the motorcycle market reflects a dynamic landscape where brands are vying for a larger share through innovation, pricing strategies and targeted promotions.

The total market sales figures reveal that consumers are increasingly prioritising value-for-money options without compromising on style and performance.

Biplob Kumar Roy, chief executive officer of TVS Auto Bangladesh Limited, the local distributor and manufacturer for India's TVS Motor Company, said their sales fell by around 35 percent to 29,932 units last year.

He said inflation, political transitions, and a vulnerable economy impacted the market.

Roy said that after last year's political transition, customers who used to take advantage of their political affiliations saw their benefits decline to zero, which affected the market.

Additionally, he noted that retailers were unable to open outlets for over a month last year due to political unrest.

Shah Muhammad Ashequr Rahman, chief marketing officer at Bangladesh Honda Private Limited (BHL), stated that Honda's satisfactory sales performance in 2024, despite a declining market, highlights the brand's commitment to innovation and customer-centric designs.

"Our models, inspired by Honda's racing DNA, deliver thrill, precision, and reliability while continuously improving to meet customer needs," Rahman said.

He emphasised that BHL's strategy focuses on high-performance motorcycles, which resonate with a growing segment of discerning buyers.

BHL operates as a joint venture between Japan's Honda Motor Co and the state-owned Bangladesh Steel Engineering Corporation.

Rahman expressed optimism about maintaining steady growth in the challenging market by leveraging Honda's legacy of innovation and reliability.

The brand's resilience in navigating economic challenges reflects its strong position and ability to adapt to evolving market demands in Bangladesh, he stated.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments