New fiscal year, old challenges

When a year passes, those who had a good time look forward to continuing the momentum while those who had struggled to keep their head above water might breathe a sigh of relief.

But the latter's respite does not prolong if they see that the challenges they experienced throughout the bygone year are set to persist in the coming months.

Most Bangladeshis will fall into the second group since the high cost of living shows no sign of falling.

So, taming inflation would be the top most challenge for the government in the new fiscal year of 2023-24 as the external and internal determinants behind it, such as the Russia-Ukraine War as well as market imperfections and the erosion of the foreign currency reserve at home are still in place.

Taming inflation would be the top most challenge for the government in the new fiscal year, as the external and internal determinants behind the higher consumer prices are broadly still in place

"Inflationary pressure may soften to some extent in 2023-24, but there may not be a significant respite for consumers. The ride in FY24 is going to be bumpy," said Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue.

Bangladesh, where inflation averaged nearly 9 per cent in recent months, is not the only nation that is struggling to contain higher consumer prices.

According to the World Bank, high prices prevail in most low- and middle-income countries, with inflation higher than 5 per cent in 66.7 per cent of low-income countries, 81.4 per cent of lower-middle-income countries, and 77 per cent of upper-middle-income countries, with many experiencing double-digit inflation.

"The key policy challenge today remains fully taming inflation, and the last mile is typically the hardest," said Agustín Carstens, general manager of the Bank for International Settlements (BIS), the world's central bank umbrella body, last week.

"The burden is falling on many shoulders, but the risks from not acting promptly will be greater in the long term."

According to the BIS, governments should tighten their budgets, while targeting support on the most vulnerable, and embarking on a long-term consolidation of their spending.

Although macroeconomic challenges stemming from the crisis in the balance of payments, the volatility in the exchange rate, and the interest rate cap will be there, it is the higher inflation that is hurting people day in, day out, said Selim Raihan, executive director of the South Asian Network on Economic Modeling (Sanem).

"Their struggle is expected to continue in the coming months as well."

The latest monetary policy statement unveiled by the central bank has promised to make a departure from an administered exchange rate and interest rate. But worries remain over whether the plans would translate into reality and both rates would actually become market-driven in a true sense.

This is because the formula that would set the lending rate would still be influenced by the central bank, said Raihan.

Similarly, a uniform exchange rate might not be possible as long as the incentives for exporters and remitters are there.

Exporters receive as low as 4 per cent to as high as 15 per cent incentives on their export receipts, so importers will always be in a disadvantaged position when they buy US dollars.

Raihan thinks if the exchange rate is left to the market, the 2.5 per cent incentive on remittance would not be required.

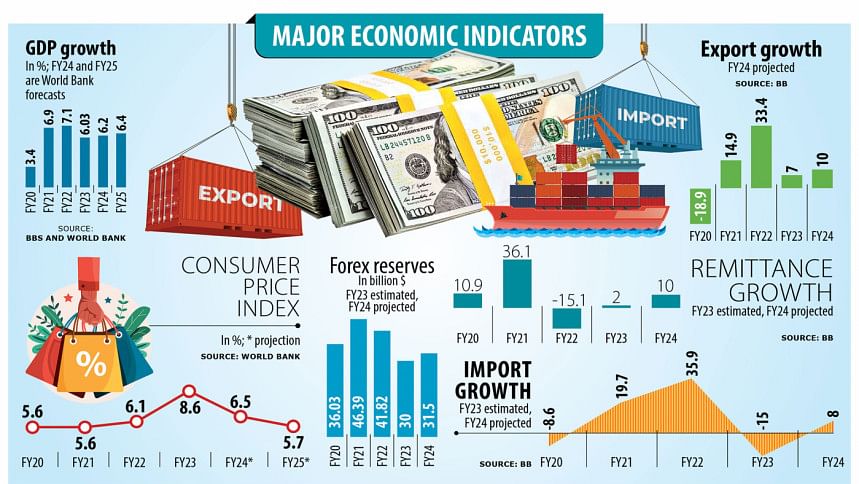

Bangladesh has targeted a 6.5 per cent GDP growth in FY24, which, if achieved, would be one of the highest in the world and the highest in South Asia.

One of the major challenges for the government would be to raise its tax-to-GDP ratio, which is one of the lowest in the world. What is even more worrying is that the National Board of Revenue (NBR) has not been able to attain the tax collection target set by the government in the past 11 years.

The export growth is likely to moderate, the World Bank said in April.

Last year, higher inflation in the US and the European Union dealt blows to exports, the biggest source of foreign currencies for Bangladesh, as consumers in the two biggest markets tightened their belts. But prices have declined from their peaks, which may bode well for exporters.

In the US, the inflation index showed that prices rose 3.8 per cent in May from 12 months earlier, while the eurozone's annual inflation rate fell by more than expected in June to 5.5 per cent amid sharp falls in the cost of energy.

Shipments from Bangladesh grew 7.11 per cent in July-May of FY23, down from 34.09 per cent year-on-year. The export might increase by 10 per cent in FY24, the Bangladesh Bank forecasts.

Imports, which have been at the heart of the crisis in Bangladesh as the country has had to pay more to buy goods and services from external sources owing to their elevated prices and the taka's 25 per cent fall against the US dollar, dropped 14.44 per cent in July-April of FY23 against a staggering 41.40 per cent growth during the same period of FY22.

The central bank has projected an 8 per cent import growth in FY24.

MM Akash, a professor at the economics department at the University of Dhaka, called for stepping up the government's intervention in the market to rein in the prices of essentials.

"We have not seen any significant measures in the FY24 budget to contain higher prices. But the price level will not come down unless such a step is taken."

He said adequate foreign currencies should be made available to import essential goods and those goods have to be sold at subsidised rates among the poor and low-income groups.

CPD's Rahman does not expect the geopolitical tension and the war situation to improve in FY24. "This means our export might continue to face a slowdown."

He said the improvement in the tax-to-GDP ratio and a lower budget deficit would be possible if the government gets down to work in a determined way.

"A lot of efforts will be needed to overcome macroeconomic challenges, bring down default loans, and restore discipline in the banking sector."

Default loans increased by Tk 10,964 crore in the first three months of 2023 to Tk 131,621 crore. The non-performing loans increased by 9 per cent from three months ago and 16 per cent from a year earlier.

Rahman pointed out that the government has targeted to lift private sector investment by five percentage points to 27 per cent in a single year.

"This will require a radical effort since private investment has remained stuck for many years."

Prof Rahman said there has to be good governance at all levels, institutional efficiency has to be enhanced, and public service delivery has to be ensured.

"I also would like to see what steps the government takes in FY2024 in order to raise the tax-to-GDP ratio, discipline the banking sector and ensure efficiency in the public expenditure management," said Prof Raihan of the Sanem.

An uninterrupted energy supply and affordable pricing are necessary to maximise productivity and avoid exacerbating inflationary difficulties, said Md Sameer Sattar, president of the Dhaka Chamber of Commerce and Industry.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments