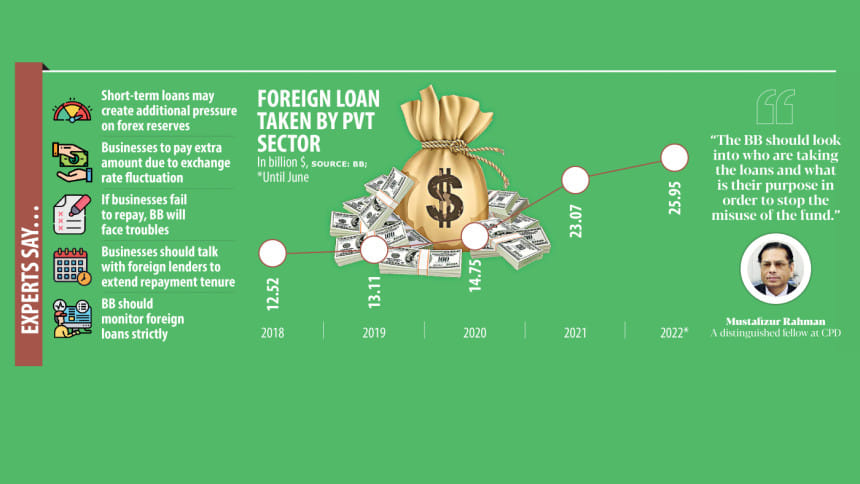

New headache: Private firms’ foreign loans jump to $26b

The amount of foreign loans availed by the private sector in Bangladesh has been swelling fast since 2020, creating a major headache for the country's economy at a time when its foreign exchange reserves are plummeting.

Various private companies in the country took foreign loans to the tune of $25.95 billion collectively as of June this year, up 39 per cent year-on-year, shows data from Bangladesh Bank.

Besides, short-term external debt accounted for 68.4 per cent of all foreign loans taken by the private sector till June. The repayment tenure for a majority of these short-term loans is a maximum of three years.

Experts say repaying the short-term foreign loans will place additional pressure on the foreign exchange reserves, which have been under stress due to blistering import payments since the last quarter of fiscal 2021-22.

The reserves now stand at less than $38 billion in contrast to more than $46 billion a year ago.

Businesses chiefly took a hefty amount of foreign loans during the pandemic, when the LIBOR and other benchmark rates nosedived to below 1 per cent in the global market. Local businesses were allowed to take foreign loans at the benchmark rate plus 3.5 per cent as set by Bangladesh Bank.

But things are completely different now as the benchmark rates have ballooned to more than 3 per cent in the foreign market in keeping with the recovery of the global economy from the business slowdown caused by Covid-19.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, says if businesses fail to repay the loans on time, the central bank will have to provide foreign exchange support to them.

Under such a situation, the foreign exchange reserves will face a deep crisis.

"So, businesses should try to negotiate with foreign lenders such that they can repay the loans at a convenient time, when the ongoing volatility comes to an end," he said.

The ongoing fluctuation of the foreign exchange rate has emerged as a big challenge for businesses as well, creating an uneasiness in the private sector, Mansur added.

The taka shed 25 per cent of its value in the inter-bank platform over the past year. As such, the exchange rate of taka stood at Tk 106.75 for each US dollar yesterday in contrast to Tk 85.25 a year ago.

Mansur, also a former official of the International Monetary Fund, went on to say that the rise in global interest rates along with the depreciation of the local currency against the US dollar has brought lots of drawbacks for borrowers.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, says the businesses that are able to mobilise funds from different multinational sources will not face major problems despite the ongoing stress.

"But if businesses manage greenbacks from the local market in exchange of the taka, they will have to face a setback to resolve the pressure," he said.

The country's power, gas and petroleum sectors took foreign loans amounting to $4.33 billion as of June, which is the highest among all sections of the private sector.

This indicates that the power sector will have to repay their debts by mobilising funds from local sources as they usually do not export anything, Rahman added.

Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, said the central bank should beef up its monitoring on foreign loans to protect the country's reserves from further depletion.

"If any borrower turns into a defaulter, the image of the entire country will get tainted," he added.

Businesses had previously taken loans without thinking about any risks they might face in the foreseeable future, but the situation has changed, he said.

"So, the central bank should look into who are taking the loans and for what purpose in order to avoid any misuse of such funds," Rahman said.

The global supply chain disruption resulting from the ongoing Russia-Ukraine war mainly created an excessive pressure on the country's external sector.

The disruption had hiked commodity prices in the global market and that subsequently shot up Bangladesh's import payments.

The country paid a record of $82.49 billion for imports while it earned $49.2 billion by shipping goods abroad in the last fiscal year, causing the trade gap to rise to $33.2 billion.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments