Non-bank deposits on the wane

Non-bank financial institutions (NBFIs) have been witnessing a persistent fall in deposits for the past one year as many clients withdrew their savings to manage expenses amid the soaring cost of living and lower returns.

Banks, the main pillar of the financial sector, also registered a slowing growth in deposits for the higher inflation and shifting of investments by a section of savers to alternative areas, namely property, because of the very low interest rate offered by lenders.

Also, savers' appetite for buying government-sponsored savings certificates reduced and many are liquidating their investments owing to the squeeze in purchasing power.

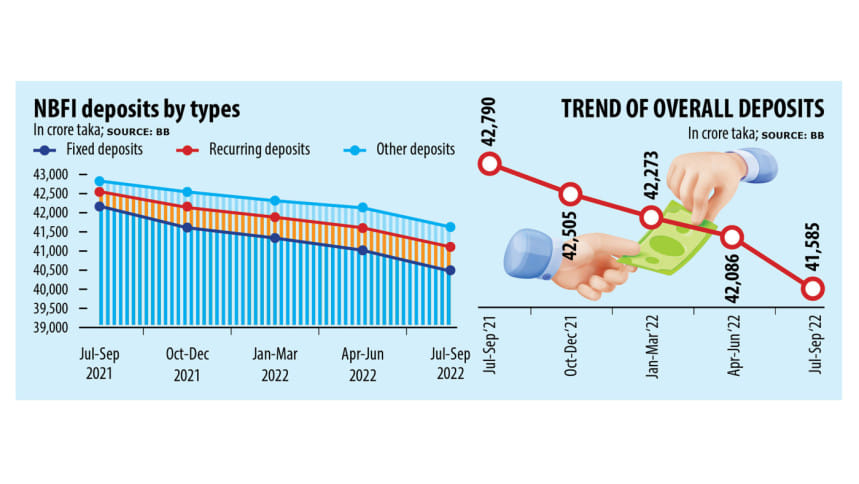

Deposits at the NBFIs declined 3 per cent year-on-year to Tk 41,585 crore in July-September. It was Tk 42,790 crore in the identical three-month quarter a year ago.

On a quarterly basis, overall deposits slipped 1.19 per cent from Tk 42,086 crore at the end of June, according to data from the Bangladesh Bank released last week.

The deposit with the NBFIs at the end of September was the lowest since December 2020, a trend that raises concerns about the lending capacity of the firms and the increase in risks in their overall asset quality.

Kanti Kumar Saha, chief executive officer of Lankan Alliance Finance, said the deposit growth in the NBFIs had been impacted significantly due to the interest rate cap at 7 per cent from July 2022.

The ceiling came at a time when inflation in Bangladesh rocketed due to a surge in the prices of commodities in the global market and the fast depletion of foreign currency reserves.

Consumer prices, after touching a 10-year high at 9.52 per cent in August, eased in the last three months. In November, inflation was 8.85 per cent, official data showed.

"While banks can offer inflation-adjusted interest rates to attract deposits, NBFIs can't do the same. So, we are facing tremendous competition from banks when it comes to attracting funds. This has negatively impacted the ability of NBFIs to disburse fresh loans," Saha said.

"Unless the interest cap for banks and NBFIs is withdrawn, the problem of the financial sector to attract deposits will persist."

Saha said the growth in revenue collection by the government and its borrowing through savings certificates are not encouraging.

Under this circumstance, the government will not have other alternatives but to depend on the financial sector to borrow a huge amount of money in the coming months, especially in the last few months of the fiscal year.

"The single action of the government will be more than enough to soak up the excess liquidity in the financial sector," he said.

Saha warned that the current challenges in the overall business environment are likely to further increase the non-performing loans (NPLs) in the financial sector.

The ratio of NPLs was 24.6 per cent of the total loans of around Tk 70,000 crore given by the NBFIs as of September.

BB data showed that the flow of private sector deposits, which made up 93 per cent of the total funds, declined 3 per cent year-on-year in the July-September period and 1 per cent from the previous quarter.

This was largely because of a decline in fixed deposits, which represented 97.3 per cent of the total amount in September, down from 97.47 per cent a year ago.

Shah Md Ahsan Habib, a professor at the Bangladesh Institute of Bank Management, does not think that the decline in deposits at the NBFIs is unusual since people's savings power has shrunk for the escalated prices of goods and services.

"The overall trend is that deposits in the financial sector are falling and NBFIs also operate in the same segment. Money circulation has dropped in the economy as a whole."

The investment flow to NBFIs will be affected unless deposits grow, he said, urging policymakers to take note of the development and take steps accordingly.

People's confidence in NBFIs has received a serious blow owing to several loan scams affecting the flow of funds from savers to financial institutions.

M Jamal Uddin, CEO of IDLC Finance Ltd, however, said his company had not seen any dip in deposit flow even after the central bank imposed the interest rate cap.

"NBFIs that ensure good governance and have goodwill don't see any shortage of deposits."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments