Non-tax revenue collection grows marginally

The government's overall non-tax revenue collection grew marginally in the first nine months of fiscal year 2022-23, with dividends and profits earned by state-owned enterprises slumping to one-third of that in the preceding year.

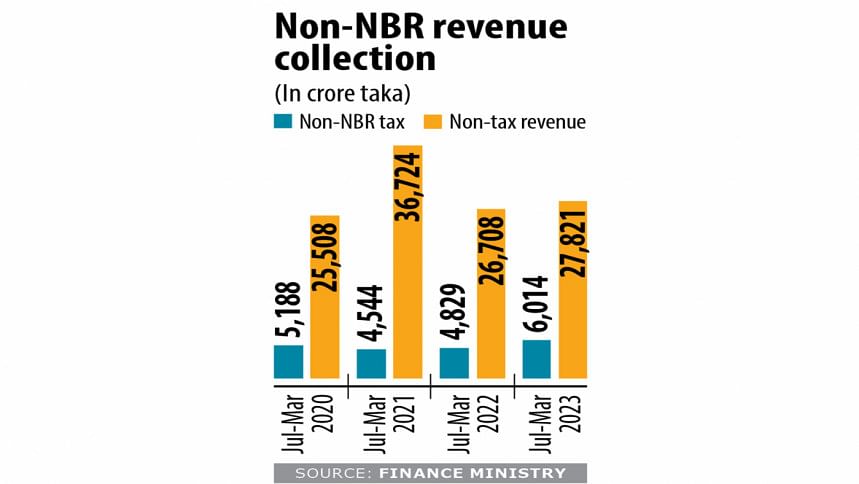

Collection of non-tax revenue, which includes dividends, profits and interest income from lending, increased 4 per cent year-on-year to Tk 27,821 crore in the July-March period.

This is 62 per cent of the target, according to the finance ministry data.

Dividends and profits fell to Tk 1,425 crore from Tk 4,293 crore a year ago, according to finance ministry data.

However, the government agencies collected 25 per cent more non-National Board of Revenue (NBR) tax, which includes revenue from narcotics and liquor, stamp duty and vehicles, during the period.

Collection of the non-NBR tax stood at Tk 6,000 crore. This is just 33 per cent of the year's target.

Revenue collection usually rises in the last quarter of every fiscal year, said a finance ministry official. "We expect a good amount of revenue from the final quarter," he said.

This was echoed by Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

A good amount of non-tax revenue comes from Bangladesh Bank, which earns interest by lending to the government and makes gains from foreign currencies sold to the commercial banks, he added.

The government has borrowed a lot of money from the central bank, which will ultimately deposit the interest to the government coffer. So, the government may achieve the non-tax revenue target, said.

The issue of revenue collection in Bangladesh is often limited to the NBR, said Towfiqul Islam Khan, senior research fellow of the Centre for Policy Dialogue.

"But there is further scope for improving revenue receipt from non-tax sources. One of the key areas is to focus on good governing of state-owned enterprises," he said.

"The reform agenda for state-owned enterprises appears to be in deep freezer now. While we discuss several aspects of public finance management reform in the current economic context, the reform should be revitalised," added Khan.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments