Non-traditional products that are driving exports alongside RMG

Apart from garment items, some non-traditional products played a vital role in gaining export earnings for Bangladesh even amid the global economic slowdown in the previous fiscal year.

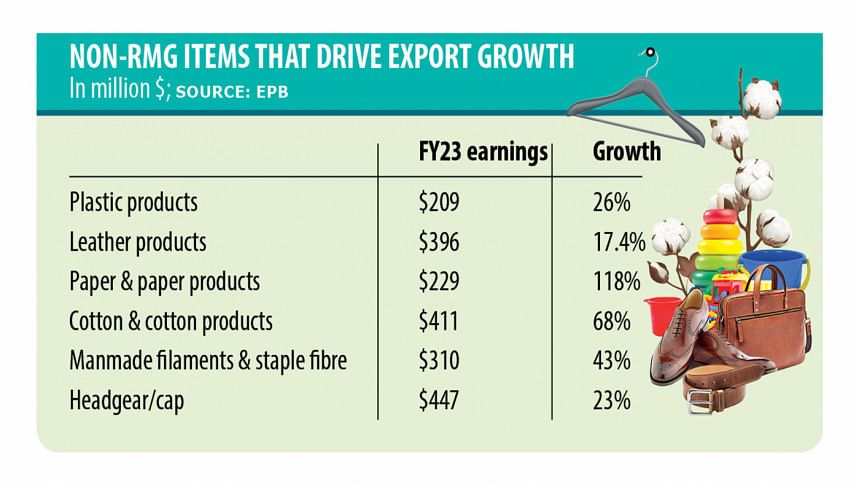

In fiscal 2022-23, Bangladesh earned $55.55 billion from merchandise shipments, registering year-on-year growth of 6.67 per cent, according to data from the Export Promotion Bureau (EPB).

And like previous years, the garment sector made the highest contribution by bringing in some $46.99 billion of that amount.

However, some non-traditional items displayed strong performances as well.

For instance, exports of cotton and cotton products, such as discarded yarn and fabrics, performed well in fiscal 2022-23 due to the high demand for garment items made from recycled materials.

As such, exports of such goods witnessed phenomenal growth of 67.86 per cent year-on-year to reach $411.12 million from $244.92 million in fiscal 2021-22.

The demand for yarn and fabric waste has been growing worldwide as western clothing retailers and brands have started selling garment items made from recycled textiles.

Recently, Swedish retail giant H&M said it aims to ensure that 24 per cent of its apparels from global sources, including Bangladesh, are made from recycled or sustainable materials by 2025.

H&M plans to fully shift to recycled or sustainable products by 2030 as the company will abide by a due diligence law of the European Union for protecting the environment and human rights.

Recycled or sustainable clothing is made from yarn and fabrics that were discarded during the garment manufacturing processes. The material is widely known as "jhoot" in Bangladesh.

This means that no virgin cotton is used in the apparels, with the only exception being cotton grown using sustainable cultivation practices.

Shipments of manmade filament yarn and staple fibre also increased by more than 42.98 per cent to $310.03 million in fiscal 2022-23 compared to $216.83 million the year prior, EPB data shows.

Sources in the primary textile sector said local spinners recently started producing yarn and fabrics from manmade fibre considering the high demand.

Besides, some of them are also exporting yarn made from manmade fibre alongside traditional garment items in order to meet the demand of international buyers.

Similarly, shipments of the non-leather footwear increased to $478.86 million, up by 6.61 per cent year-on-year from $449.15 million in fiscal 2021-22.

One of the most non-traditional export items is headgear, such as caps, shipments of which grew significantly by 22.71 per cent to $447.43 million, as per EPB data.

Also, exports of paper and paper products grew by 118.33 per cent year-on-year to $229.47 million.

Likewise, shipments of plastic products and cement, salt and stones registered positive growth.

AHM Ahsan, vice-chairman of the EPB, said that as usual, the garment sector accounted for more than 84 per cent of the country's exports last fiscal year.

Some non-traditional sectors contributed a lot as well whereas a few promising sectors like leather and leather goods, jute and jute goods, and frozen food could not perform well.

On the other hand, shipments of manmade yarn and fabrics, cotton waste, non-leather footwear, prayer caps, paper and paper goods performed well.

This symbolises that diversification of exportable products is taking place, Ahsan added.

Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association, said increasing exports of cotton waste as well as yarn made from manmade fibre is a very positive sign for the country's export earnings.

This is because the growth in exports of these items indicates that local entrepreneurs are investing in these sectors.

"But we want more investment in those areas so we can be more competitive and efficient, and thereby ensure quality," Hassan added.

MA Razzaque, research director of the Policy Research Institute, said exports of manmade fibre and cotton waste may grow as many have invested in these sectors.

However, exports of some very non-traditional items are mainly casual, and the survival rate of those products as regular export items is rare, Razzaque said, citing a finding in his own research.

These extremely non-traditional export items are sometimes shipped on a test basis, he added.

Razzaque also said that while the export market survivability of new non-traditional items is a challenge, the export opportunities of those products will expand as China is retreating from manufacturing them.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments