Premier Bank to grow further on new trends

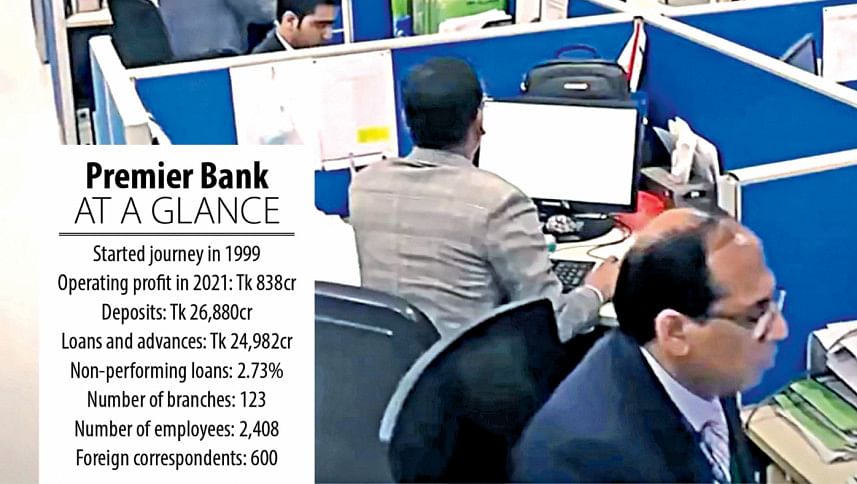

The Premier Bank Limited celebrates its 23rd anniversary today. Set up in 1999, it is one of the strongest banks in Bangladesh today with the lowest non-performing loan ratio. Its deposit base and loans have expanded in the last two decades. Recently, M Reazul Karim, managing director of Premier Bank, spoke about the bank's journey, digital banking and new challenges and opportunities for banks, during an interview with The Daily Star.

DS: Premier Bank is going to celebrate its 23rd anniversary today. Please tell us about the journey?

Karim: The Premier Bank has been on a roll since its inception. From the very beginning, the bank has been playing an active role in the country's economic development through financing to industrial, commercial and agricultural projects.

Over the last few years, we have achieved enviable success in all indicators. In the last five years, there has been more than 50 per cent growth in most of the indicators.

By creating hundreds of entrepreneurs, Premier Bank has paved the path for prosperity from generation to generation.

We have undergone major changes over the past four to five years. It has been possible thanks to the very active role of the board of directors headed by honourable chairman Dr HBM Iqbal.

The Premier Bank has received many national and international awards in recognition of its achievements. By gaining the trust of customers, Premier Bank has become one of the leading banks in Bangladesh.

DS: What is the key strength of your bank?

Karim: Our experienced workforce is the key strength of our bank.

We have targeted to expand our services in the rural areas to accelerate financial inclusion, alongside maintaining our focus in the urban areas.

We are continuously upgrading our service quality and bringing variety to our services. Customised services are frequently being provided to attract good clients.

DS: What is the situation of the bank?

Karim: When I took charge as the managing director and CEO of Premier Bank Limited on April 23, 2018, the bank's asset and deposit portfolios were Tk 18,892 crore and Tk 14,631 crore respectively. As of September 2022, it rose to Tk 38,280 crore and Tk 29,130 crore, respectively. It has been possible because of the wholehearted effort of all 2,408 employees of the Premier family.

DS: The non-performing loan (NPL) ratio is decreasing at your bank. What steps have you taken to bring down bad loans?

Karim: NPLs are always destructive for an economy. We continuously analyse the basic reasons for NPLs and then we adjust our strategies to control them.

A lack of monitoring is one of the major causes of loan defaults. Keeping this in mind, we are very much cautious regarding monitoring of every loan. Since prevention is better than cure, we emphasis following a rigorous process in loan disbursement.

If a loan is disbursed complying with the process of loan approval, there should be no difficulty in the collection.

DS: What have you added to modern remittance?

Karim: Our remittances are growing steadily. We currently have agreements with 30 exchange houses to bring remittances through the banking channel.

We have recently entered into strategic alliances with some of the top mobile financial services to deliver remittance services to distant villages. After the tie-up with MFS providers, we are now able to fetch remittances to the doorsteps at the village level.

DS: How much has your bank's asset quality improved?

Karim: We have always strived to improve and maintain the asset quality of our bank. At the time of loan originations, we check the quality of prospective borrowers, evaluate business risks and check the background of sponsors. We always try to follow the policies of the Bangladesh Bank in processing loans.

As a result, our asset quality is quite good and our classification rate was 2.49 per cent as of June this year, the lowest in the banking sector.

Question: Which sector is preferred in terms of financing? How are you contributing to green banking?

Karim: Premier Bank has adopted agent banking, which will play a major role in rural economic development. The service will turn into a profitable operation soon. In future, we have plans to provide loans through agents.

Simultaneously we are also focusing on retail banking.

In addition to providing banking services to school, college and other students, we have launched school banking programmes to extend necessary support to students going abroad for higher education.

We also practise green banking. We consider all social and environmental factors in our normal banking operations. We invest in projects that help prevent environmental degradation and are not harmful to the environment. Moreover, our core principle is the protection of resources for the future generations.

Question: What products and services have you brought to modern banking?

Karim: Our debit and credit cards are widely accepted in the market. In the next two to three years, we will enhance our position further from the current level.

Innovation has always been a central focus of Premier Bank's business, and we are well-positioned to take advantage of trends and opportunities we have identified in the market.

The pandemic has changed the behaviour of consumers and how businesses operate and, in many cases, it is accelerating the adoption of digital business models. We have adapted quickly to the changing environment and continued with our significant investment. This is helping us build fast-growing delivery and service channels.

Question: Do you have any plans for new technology-based services?

Karim: We have decided to focus on retail and alternative delivery channels in the next two to three years. Our digital banking will be our first segment of service. We have also expanded our alternate delivery channels.

Through our mobile app "pmoney", customers can easily perform various banking services such as money transfer, utility bill payments, credit card bill payment, mobile recharge, and mobile banking.

We have introduced Bangla QR code as the first bank to expand and refine our business. Our main objective is to increase the number of customers, so we want to enhance the retail deposit base. Hopefully, we will take this activity to a significant position in the next two to three years.

Question: What steps are you taking to improve the bank's performance?

Karim: In terms of liquidity, we always maintain the ratio well within the Bangladesh Bank standard. We have always maintained our NPL ratio at a very low level.

Our capital adequacy ratio is also better than the capital adequacy ratio given by the Bangladesh Bank. Our position in the indicators such as profitability and earnings per share is good. These indicators will improve further in the coming years.

In the next five years, we want to maintain very sustainable growth where the quality of assets would be the top target.

Question: How do you look at the government and the central bank's measures aimed at dealing with the ongoing dollar crisis?

Karim: Bangladesh Bank has imposed conditions on imports and I think import control was necessary as many unnecessary goods have been imported. At the same time, we have to keep in mind that our country is largely dependent on imports. Therefore, we should continue to import large quantities of industrial machinery and raw materials.

Although the price of imports increased, the volume did not. We must see whether the machine is being brought in for some work or money is being laundered by over-invoicing in the name of import.

The measures taken by the government to overcome the dollar crisis is a timely initiative. We expect the situation to improve gradually.

Question: What is your advice for the new generation looking to build their career in the banking industry?

Karim: Banking is a career which has always been recognised as prestigious. Those who want to take up banking as a career have to work tirelessly.

In the 21st century, various technological changes and developments are taking place. New challenges are coming every day. In order to deal with them, we must always be vigilant to follow principles and acquire knowledge.

To progress in your career, you must first develop yourself and adapt your skills to the changing demand through timely education.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments