Relaxed rules can’t tame default loans

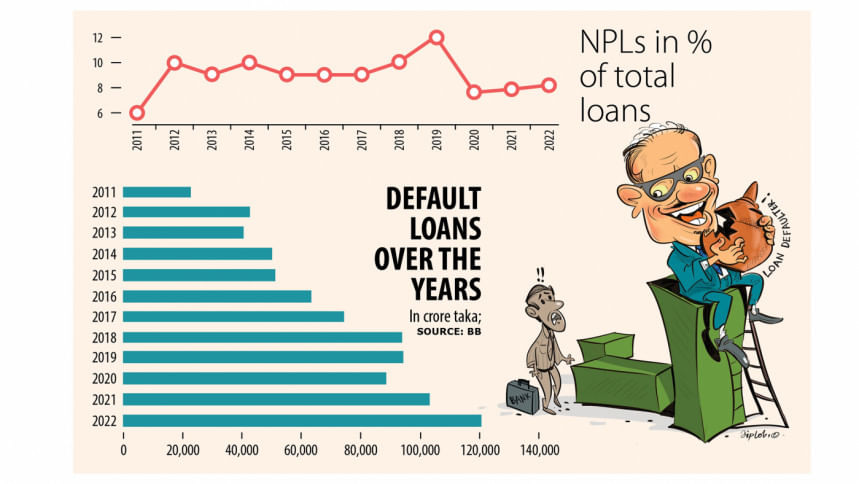

Default loans in Bangladesh's banking sector jumped 17 per cent year-on-year to Tk 120,656 crore last year owing to a lack of corporate governance and the ongoing business slowdown.

As a result, the ratio of bad loans rose to 8.16 per cent of the outstanding loans in December compared to 7.93 per cent in the same month in 2021, data from the Bangladesh Bank showed.

Analysts say that the forbearance for loan repayments and the relaxed loan rescheduling policy offered by the central bank have failed to rein in the upward trend of non-performing loans (NPLs).

NPLs, however, decreased 10.2 per cent in the final quarter of 2022 from Tk 134,396 crore reported in the July-September period.

"The trend of the last quarter can't be considered as a major progress as many banks might have reported a lower-than-actual volume of bad debts through window dressing," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

Window dressing refers to the manipulation of accounts so as to present financial statements in a way that portrays a better position than the actual scenario.

Mansur, also a former official of the International Monetary Fund, said banks normally recover a nominal amount of loans compared to hefty unpaid installments just before the end of a year in a bid to paint a rosy picture of their balance sheets.

The central bank has recently relaxed the rules on rescheduling to bring down the rate of default loans.

In July, the BB allowed defaulters to reschedule term loans, whose repayment tenure is more than a year, by giving only 2.5-6.5 per cent down payment of their total NPLs instead of the previous 10-30 per cent.

Similarly, the down payment for the NPLs related to working capital or demand loans was made 2.5-5 per cent from 5-15 per cent previously.

"Such a relaxation has apparently painted a better picture of the banking sector. But it will erode the strength of the sector in the long run," said Mansur, also the chairman of Brac Bank.

"A lower amount of default loans usually helps shareholders enjoy a better profit."

Mansur suggests the central bank align its loan classification and rescheduling policies in line with global standards in order to strengthen the banking sector.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, welcomed the reduction in default loans.

"This is definitely a positive development for the banking sector."

He thinks that the relaxation on loan repayment helped lenders decrease their default loans in the October-December quarter.

"Although cash recovery from default loans has increased to some extent in recent months, the trend is still lower compared to the pre-pandemic level. So, we should gear up our loan recovery programme for the betterment of the banking sector," he said.

In December, borrowers were allowed to avoid being classified as a defaulter subject to the clearing of 50 per cent of installments payable in the final quarter instead of 75 per cent previously.

Trade bodies and chambers, including the Federation of Bangladesh Chambers of Commerce and Industry, have frequently pressed for a relaxed loan classification policy in recent times.

In fact, the central bank followed a relaxed loan repayment policy from the early day of the coronavirus pandemic in 2020 to 2022.

Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, said there was no genuine reason for the default loan to go down in the fourth quarter.

He urged the central bank to move away from relaxing its policies on loan classification and rescheduling. "At the same time, banks should identify habitual defaulters to improve their financial health."

Prof Rahman said the economy was going through stresses.

"So, if we fail to address the issue of default loans appropriately, the ongoing volatility will deepen," he warned.

BB data showed that NPLs in the state-run banks rose 25 per cent year-on-year to Tk 61,169 crore last year.

Forty-one private commercial banks held defaulted loans of Tk 56,439 crore, up 9 per cent from a year ago. The NPLs in nine foreign banks increased to Tk 3,048 crore in contrast to Tk 2,785 crore.

Recently, the IMF said elevated NPLs could dampen growth prospects.

A holistic and time-bound NPL resolution strategy would help address bank balance sheet weaknesses, it said.

According to an IMF document, the BB has committed to developing bank-specific NPL resolution and capital restoration strategies and establishing effective monitoring and enforcement framework, underpinned by memorandums of understanding (MoUs), to oversee concrete actions adopted by banks.

These MoUs will target a reduction of the average NPL ratios to

below 10 per cent for state-owned commercial banks and below 5 per cent for private commercial banks by 2026, said the document.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments