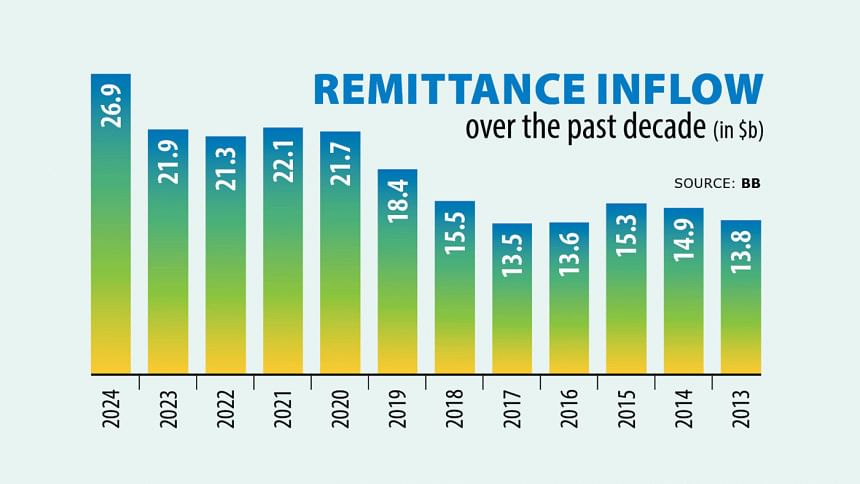

Remittance hit all-time high in 2024

Expatriate Bangladeshis sent home a record $26.9 billion, up 23 percent year-on-year, in a development that will bring a huge sigh of relief to policymakers as they endeavour to shore up strained dollar stockpile.

The inflows saw a spike after the fall of the Awami League government on August 5, with more than $2 billion coming in every month since, as per the latest statistics published by the Bangladesh Bank.

In December, a record $2.63 billion came in, up 33 percent from a year earlier.

"A large portion of migrant workers had declared emotionally that they would not send remittance through formal channels amid the tenure of the previous government -- they have been sending remittance after the political changeover," said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

Previously, there was a growing demand for hundi, an illegal cross-border transaction mechanism. Typically, the demand for hundi rises when a large volume of money is siphoned out from the country.

This stopped after the interim government took charge, said Rahman, also a former chairman of the Association of Bankers, Bangladesh, a forum of banks' MDs.

"The business people and politically influential individuals who siphoned off money from the country are now in jail, some are fugitives and some are in hiding," said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

The flexible exchange rate or the narrow difference of exchange rate between the formal and informal markets accounts for the spike in remittance uptick, he said, adding that the repatriation of export earnings has increased.

In 2023, the exchange rate gap between the formal and informal channels was Tk 7 to Tk 10 per dollar. Last year, the gap came down to Tk 3 to Tk 5 per US dollar, industry insiders said.

Rahman hopes that the external sector will not face huge pressure in the coming days due to the rising trend of remittance and export, the two main sources of foreign currency.

"The signs are already there that the external sector is making a turnaround," said Hussain, who was part of the 12-member committee that prepared a white paper on the Bangladesh economy.

The repatriation of export earnings has become more frequent now, he added.

The growing trend of dollar inflows will give a breathing space to reserves, which crossed the $21 billion-mark after several months despite making regular payments for imports.

When Ahsan H Mansur took charge of the central bank, the overdue payment for letters of credit was at more than $2 billion. This has now come down to only $400 million, according to BB officials.

In December, Islami Bank received the highest amount of remittance ($366 million), followed by Agrani ($264 million), Janata ($147 million), BRAC Bank ($193 million), and Trust Bank ($184 million), central bank data showed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments