Remittance in ten months surpasses FY24 total

Remittance inflows in the first ten months of the current fiscal year have already exceeded the total receipts of FY 2023-24, providing a much-needed breather to the economy and easing a severe foreign currency crisis.

The surge in money sent home by Bangladeshi expatriates is being credited to a cocktail of factors, such as a narrowing gap between official and informal exchange rates, a clampdown on money laundering, and renewed confidence of the people living abroad in the interim government.

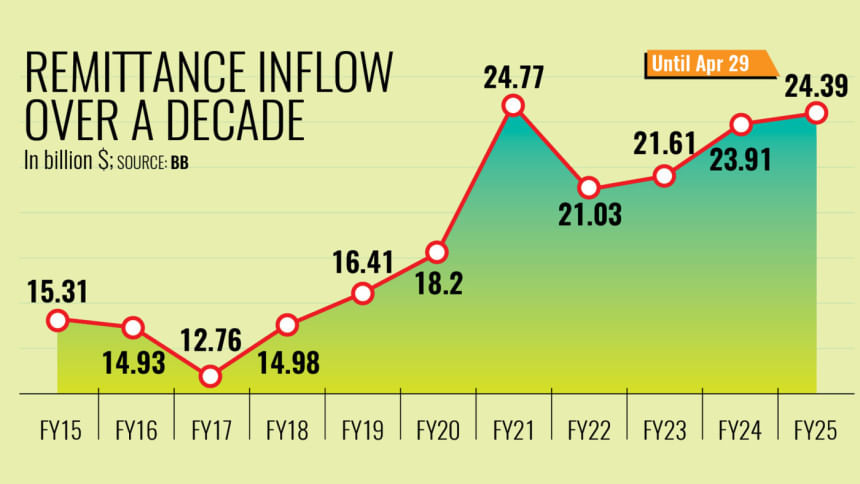

From July to April 29 of FY 2024-25, Bangladesh received $24.39 billion in remittances, up 2 percent from the $23.91 billion received in the previous fiscal year, according to Bangladesh Bank (BB) data.

A senior BB official estimated that total receipts could reach $27 billion to $28 billion by the end of June.

Economists, however, said that the surge is a tonic for the stressed macro-outlook, but not a cure for all economic ills.

The country previously crossed the $24 billion mark in FY 2020-21, when remittances totalled $24.77 billion.

Now, the latest spike in remittance inflow is playing a key role in helping the interim government stop the depletion of foreign currency reserves.

A senior central bank official said the narrowing of the gap between official and unofficial exchange rates has driven this uptick.

Currently, the official exchange rate for the US dollar ranges from Tk 121 to Tk 122.50, while rates in the informal market hover between Tk 123 and Tk 124.50, according to industry insiders.

The central bank official also said that they have informed commercial banks that the Bangladesh Bank will no longer provide direct dollar support, pushing them to source foreign currency on their own.

"This has also contributed to the remittance collection through formal channels," commented the official.

Previously, a large portion of remittances flowed through informal routes such as "hundi" and "hawala" -- illegal yet widely popular money transfer channels.

"But after the political changeover in August last year, much of that flow has shifted to formal banking channels, as many individuals involved in illicit money transfers have fled the country," said Sohail R K Hussain, managing director of Bank Asia PLC.

"After the political changeover, the demand for hundi came down, which pushed the remittance inflow through the formal channel," he said.

According to Hussain, this change helped increase monthly remittance receipts from $2 billion to $3 billion, a trend he believes will continue.

Remittance flows have risen steadily each month since the August changeover. In March, the country registered its highest-ever monthly inflow of $3.29 billion.

Foreign exchange reserves, which had been on a declining trend since August 2021, have now stabilised thanks to these higher inflows. As per the International Monetary Fund (IMF) calculations, the country's reserves have been hovering over $20 billion since December last year.

On 30 April, reserves stood at $22.04 billion, up from $21.41 billion a week earlier, according to the latest figures of the central bank.

Despite the positive signs, the current account balance remained in negative territory during July to February, standing at negative $1.26 billion, BB data showed.

The current account balance is part of a country's financial inflow and outflow record. It is part of the balance of payments, the statement of all transactions made between one country and another, as per Investopedia.

So, does the remittance boom signal easing pressure on the country's external balance?

Not quite, said Mohammad Abdur Razzaque, economist and chairman of local think-tank Research and Policy Integration for Development (RAPID).

He said that the external balance remains under pressure and is likely to remain so in the coming months.

"The central bank now wants to control inflation while also trying to prevent further depreciation of the taka," he said.

"I am observing that the inflow of remittance will be good in the upcoming days because money laundering has already come down. As a result, remittance through formal channels has improved."

Razzaque added that export growth will be important to improving the external balance. On inflation, he noted that import restrictions, though unofficial, are weighing on prices, and increasing imports could help ease the pressure.

He also played down concerns about possible IMF loan delays, saying the central bank could still manage without external support.

However, he said that failing to secure IMF funds might raise questions about the government's policy credibility. "Questions may arise about policy credibility if we do not get the IMF loans."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments