Revenue collection falls in Nov though business climate improves

Bangladesh's revenue collection fell in November this year even though the country saw improvement in its business climate that month thanks to the alleviation of political uncertainties stemming from the nationwide mass uprising in July-August.

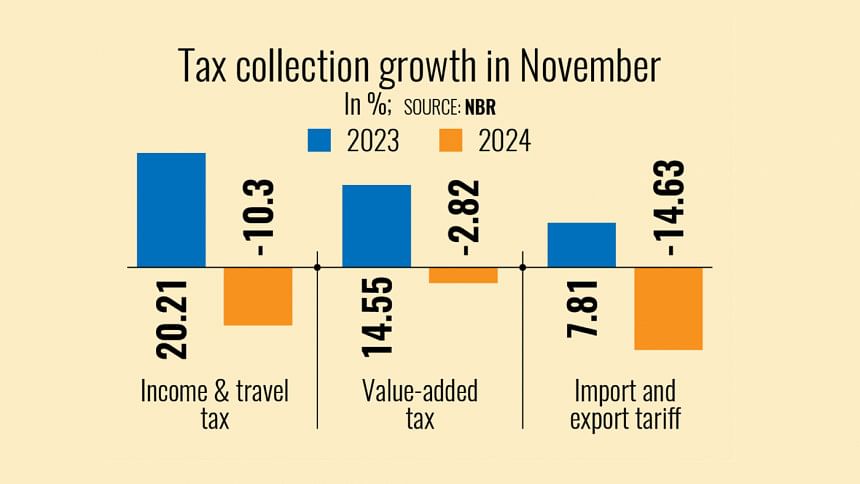

Revenue collection amounted to Tk 25,360 crore in November, down 8.95 percent compared to the same month the year prior, shows provisional data of the National Board of Revenue (NBR).

On top of that, overall revenue collection declined 2.62 percent year-on-year to Tk 130,185 crore in the July-November period of the current fiscal year (FY).

Besides, the tax administrator was Tk 38,830 crore behind its collection target of Tk 169,015 crore for the first five months of FY25, with its end goal set at Tk 480,000 crore for the year.

Bangladesh underwent political upheaval in the July-August period as a student movement culminated in an uprising that ended the 15-year reign of the Awami League government led by Sheikh Hasina.

In the lead up and even long after the political changeover in early August, businesses in the country were seriously hampered by internet outages, lack of law-and-order and labour unrest, resulting in lower revenue collection.

And although the situation started stabilising from September, government revenue collection has remained below what was registered during the same period of the previous year.

Regarding the lower revenue collection, some NBR officials and financial analysts are blaming the ongoing economic slowdown, including reduced imports, increased subsidies for various sectors and persistent higher inflationary pressure.

"The deceleration in revenue collection is closely linked to the current economic slowdown," said MA Razzaque, research director of the Policy Research Institute of Bangladesh.

Reduced imports, higher exemptions and inflationary pressure also contributed to the overall shortfall, he added.

The World Bank slashed its forecast for Bangladesh's economic growth by 1.7 percentage points to 4 percent for FY25 due to "significant uncertainties following recent political turmoil" and "data unavailability".

However, Razzaque said the country's actual GDP growth this year could be lower than that forecasted by the World Bank.

Bangladesh's imports stagnated over the past three or four years, with its total imports decreasing to $70 billion in 2023 from $90 billion in 2021

"So, the NBR is not going to get enough tariffs from imports alone," he added.

Citing recent moves by the interim government to reduce inflationary pressures by providing higher subsidies for various essential commodities, he said this could be another reason for lower revenue collection.

"Still though, I firmly believe that imports should not be considered as a key source of revenue collection," Razzaque added.

NBR data shows that receipts from international trade declined 0.94 percent to Tk 41,155 crore.

Meanwhile, income tax receipts reduced by 0.94 percent to Tk 40,293 crore and the collection of value-added tax (VAT), the largest revenue source, fell 5.45 percent to Tk 48,082 crore.

Razzaque also said most businesses are registering lower sales as inflation has reduced the peoples' purchasing power, and this translated to less revenue from VAT.

In this situation, lower revenue mobilisation has resulted in a tighter fiscal space that may force the interim government to curtail its development spending to avert a further economic downturn.

"Lower development spending also contributed to the decreased revenue collection."

The implementation rate of the annual development programme (ADP) stood at 12 percent in the first five of FY25, as per data of the Implementation Monitoring and Evaluation Division (IMED).

Seeking anonymity, an NBR official acknowledged the reason for slow economic growth.

"We are currently facing hurdles in collecting revenue amid the government's lower public spending, higher inflation and slow private sector credit growth," the official said.

Meanwhile, the interim government has not slashed the revenue collection target set by its predecessor, the official added.

Finance Adviser Salehuddin Ahmed said in September that the FY25 revenue target would remain unchanged.

"The existing target is unrealistic. It is unlikely to be achievable this year," Razzaque said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments