Rising headgear, cap export gives diversification a leg-up

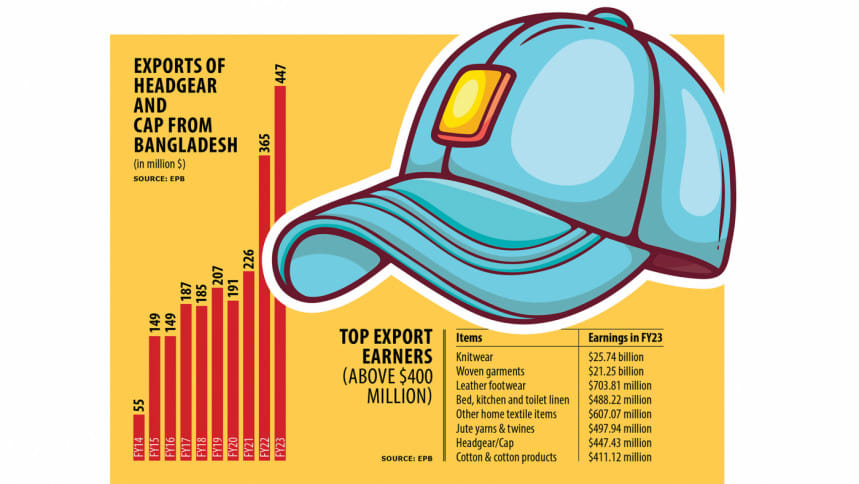

Bangladesh bagged $447.43 million by exporting headgear products such as hats and caps in the last financial year, a positive development for a country that relies heavily on a handful of products to earn foreign currencies.

Data from the Export Promotion Bureau (EPB) showed that the receipts were up 22.71 per cent in 2022-23 from a year earlier as Bangladesh has emerged as one of the key suppliers of headgear items in the growing segment of the global market.

Headwear items include headbands, hats, beanies, and caps, and in Bangladesh, their manufacturing began nearly two decades ago and is completely export-oriented.

The shipment, however, accelerated in recent years rising from just $55 million in 2013-14 to nearly $450 million in 2022-23.

"It is amazing to see how much the headgear export from Bangladesh has advanced," said Nazmus Shakib, a former senior official of a cap manufacturer.

According to the Bangladesh Exports Processing Zones Authority (Bepza), there are five headgear-making factories in EPZs. Of them, Actor Sporting Ltd and Dhakarea Ltd are located in the Dhaka EPZ and Young An Hat (BD) Ltd, Young An International (BD) Ltd, and Wink Company Ltd are based in the Chittagong EPZ.

Shafiul Azam, general manager of Actor Sporting, said there are a few headgear manufacturers in Bangladesh and they are largely based in the export processing zones. All manufacturers are from Hong Kong and South Korea.

He said the demand is seasonal and orders for headgear items are placed towards the end of summer in the western economies as retailers and brands target the winter season to boost sales.

"The headgear segment is a significant addition to Bangladesh's export basket."

Nearly 85 per cent of Bangladesh's export earnings come from shipping apparel items. Other notable export-earning sectors include leather and jute.

And less than 10 items brought home earnings of more than $400 million in FY23, EPB data showed.

Bangladesh ships headgear products largely to the United States and Europe, the two largest markets for the country.

Industry people say manufacturers can produce world-class headgear products at competitive prices thanks to cheap labour and the availability of a skilled workforce.

Nazma Binte Alamgir, executive director for public relations at the Bepza, said investors from many countries, including China (Hong Kong) and South Korea are producing headgear items at the EPZs.

The factories based in the EPZs exported products such as caps worth $126 million in 2022-23, she said.

Nazma said the Bepza is giving the highest priority to product diversification and now 70 per cent of active industries at the EPZs produce diversified products rather than readymade garments.

Nazmus Shakib said local garment manufacturers have no idea about this segment although headgear is part of the broader readymade apparel sector. As a result, foreign investors are taking the advantage.

He said although investors in the headgear segment are currently external, they have employed thousands of people, bringing indirect benefits to the economy.

The global headwear market is projected to register significant growth in the coming decade, exhibiting an annual growth of 6.6 per cent from 2023 to 2033, according to research firm Future Market Insights.

The global market is predicted to stand at $28.24 billion in 2023 and is expected to be worth $53.51 billion by 2033.

The growing adoption of headwear as a style statement among the millennial and Gen Z demographics is expected to foster the market growth in coming years, said the firm in a report in April.

"Younger generations are increasingly wearing headgear like headbands, beanies and caps as a fashion statement. Prominent brands are launching headbands in modern patterns to grab the attention of consumers," it said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments