RMG export orders fall up to 40%

The inflow of work orders from international clothing retailers and brands to Bangladesh has slowed because of the persistently higher cost of living in the western world and a pile-up of apparel stocks at stores.

The ominous development could deal a blow to the country's biggest foreign currency earning sector, which will ultimately deepen the foreign exchange crisis.

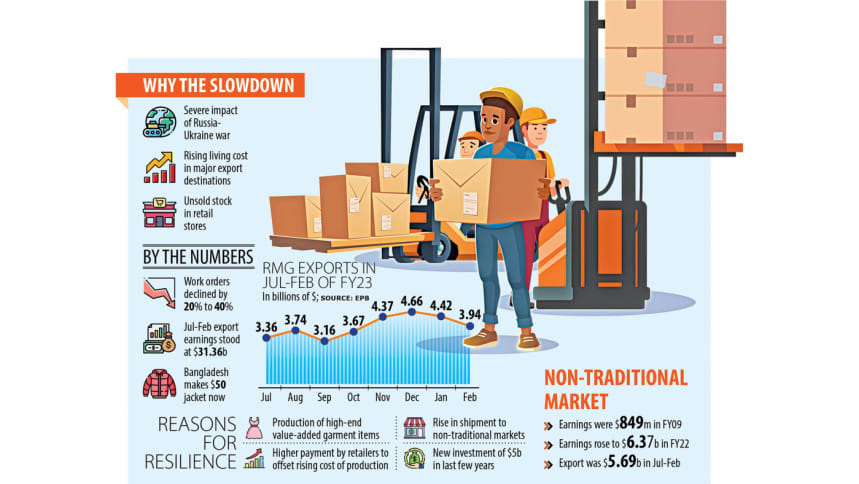

Now exporters say the orders for the April-June season declined by 20 per cent to 40 per cent because of higher inflation in the western economies stemming from the ongoing Russia-Ukraine war.

A K Azad, a top garment exporter, said orders have declined by 20 per cent for the next season at his factory because of the volatile economic situation in the destinations such as Europe and the US.

"The downward trend in the garment shipment started in November and it has still continued."

The war has an impact on garment shipment and it is now becoming visible as there has been a slowdown in orders, said MA Jabbar, managing director of the DBL Group.

Siddiqur Rahman, chairman of Sterling Group, another major apparel exporter, said the slowdown has been going on for the last one year.

Suppliers who make high-end garment items are faring well while the producers of low-end and basic products are performing poorly, said a major value-added garment exporter asking not to be named.

"In general, orders for garment items are falling."

Headline inflation in the eurozone fell to 8.5 per cent in February, down from 8.6 per cent the previous month. This was above the 8.2 per cent forecast by economists, according to CNBC.

Inflation in France and Spain accelerated unexpectedly in February, and a German flash estimate put the inflation rate harmonised with the rest of the EU at 9.3 per cent in February, which would be an increase from 9.2 per cent in January.

In the US, the consumer price index increased 0.4 per cent last month, putting the annual inflation rate at 6 per cent.

The EU and the US account for more than 80 per cent of Bangladesh's apparel exports. So, a higher consumer price in the continents means greater pressure on their consumers, which will translate into lower demand for garment items from Bangladesh.

Although local exporters say the order is falling, garment shipment has been resilient so far in the current financial year of 2022-23.

Exports fetched $4.63 billion in February, up 7.81 per cent year-on-year, according to the Export Promotion Bureau. The receipts stood at $37.08 billion in the first eight months of 2022-23, an increase of 9.56 per cent from the identical period a year earlier.

Last week, Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), cited three factors for the positive export earnings from garment shipment despite a slowdown in orders.

The unit price of a garment item has increased as international retailers and brands have started paying more as they have taken into the higher energy prices, freight costs and raw material prices.

The earnings are growing on the back of a spike in shipments for high-end value-added garment items. For instance, many of the local exporters are supplying winter jackets worth $50 apiece, a massive development for the apparel sector. This was almost unthinkable even five years ago.

The shipment is growing to new destinations as the demand for locally made garment items has increased in Asian nations, according to the BGMEA chief.

The shipment to emerging markets was $849 million in 2008-09 and their share in the total apparel exports was 6.87 per cent. The amount jumped to $6.37 billion in 2021-22 and the share surged to 14.96 per cent, BGMEA data showed.

In July-February of FY23, the shipment to the non-traditional market was $5.69 billion and the share was 18.13 per cent.

The export to Asian markets rose to $1.08 billion in July-February, up 47.65 per cent year-on-year.

Jabbar said Bangladesh has been performing strongly despite the war largely because of the shipment of value-added garment items. "As a result, the impacts of the war on the overall earnings have not been noticeable."

Moreover, local entrepreneurs have invested $5 billion to $6 billion in the garment industry in recent years, he said.

"Most of the fund has been used in modernising factories. The investment has started to pay off."

Currently, the investment in the garment sector stands at $25 billion and a similar amount has been pumped into the primary textile sector, which includes the spinning, weaving and dyeing industries.

Another $25 billion in new investments may come in the textile and garment in the next five years as the sector looks to raise apparel shipments to $100 billion.

Siddiqur Rahman said exports are growing as suppliers are receiving back payments that were due during the peak of Covid-19. "

Buyers are paying higher prices following the price hike of raw materials, freight charges and utilities."

Exporters hope that the orders will rebound from July as stores are expected to finish selling the old stocks while the shipping for the next winter season will kick in.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments