Setbacks linger for businesses even after they’re set up

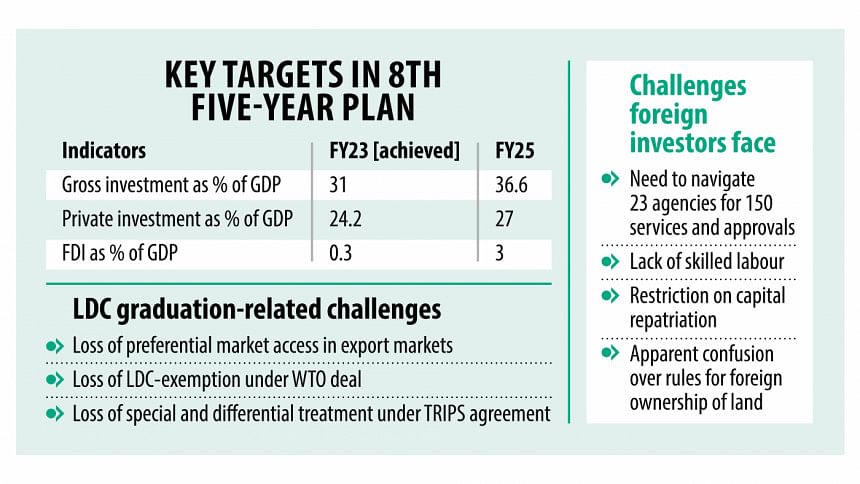

In spite of making progress in various sectors, Bangladesh still faces challenges in attracting foreign direct investment (FDI) due to problems faced once businesses are formed, according to Asian Development Bank Country Director Edimon Ginting.

Most of the FDI is concentrated to a few traditional industries and barriers at the entry level are limited, he said.

However, the challenges prevail at the post-establishment stage for entities which hinder the country's goal of strengthening economic diversification and integrating with global value chains, he said.

An investor needs to navigate 23 government agencies to secure up to 150 regulatory services and necessary approvals, he said.

Ginting made the remarks while presenting a keynote speech at an event titled "Enhancing Investment Policy Framework to Catalyse Private Investment" organised by the Foreign Investors' Chamber of Commerce & Industry (FICCI) at The Westin Dhaka yesterday.

With its over-reliance on road transport and low Indus Water Treaty use, Bangladesh now ranks 88 out of 138 countries in a Logistics Performance Index of the World Bank, he said.

Some industries including logistics, telecom, banking, legal services and fisheries remain partly off limits to foreign investors, holding back potential economy-wide productivity gains, he said.

"Service restrictions not only affect FDI but also manufacturing activities downstream," said Ginting.

He also blamed the fact that Bangladesh has a large pool of unskilled workers as well as a lack of training infrastructure to meet demand.

"There is a need for significant liberalisation of different verticals to attract investments while simplifying acquisition of lands, protection of intellectual property rights and simplifying and making the tax regime competitive," he said.

M Masrur Reaz, chairman and founder of Policy Exchange Bangladesh, reiterated the need for moving towards increasing skills of the workforce while engaging on strategic levers for FDI promotion and improving investment policy framework.

Speaking as the chief guest, Lokman Hossain Miah, executive chairman of Bangladesh Investment Development Authority, said the government was committed to ensuring a conducive business climate for foreign as well as domestic investors.

"But we have some limitations as a developing country. We need some time for preparations," he said.

He said the government was thinking about increasing facilities for sectors alongside that of garments.

Private investment and revenue collection need to be boosted for vital resource allocation to crucial sectors to achieve Vision 2041, said FICCI President Zaved Akhtar.

Bangladesh needs to simplify and transform the tax and regulatory regime to build overall credibility and predictability while building capability of human capital by leveraging digitalisation and facilitating better care for investors, he said.

"Only then FDI can play a pivotal role in this regard," he added.

Among others, Myung-Ho Lee, president of Japan Bangladesh Chamber of Commerce and Industry, TIM Nurul Kabir, executive director of the FICCI, and Mahbub Ur Rahman, CEO of the Hongkong and Shanghai Banking Corporation, also spoke.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments