State banks' default loans rise 42% in a year

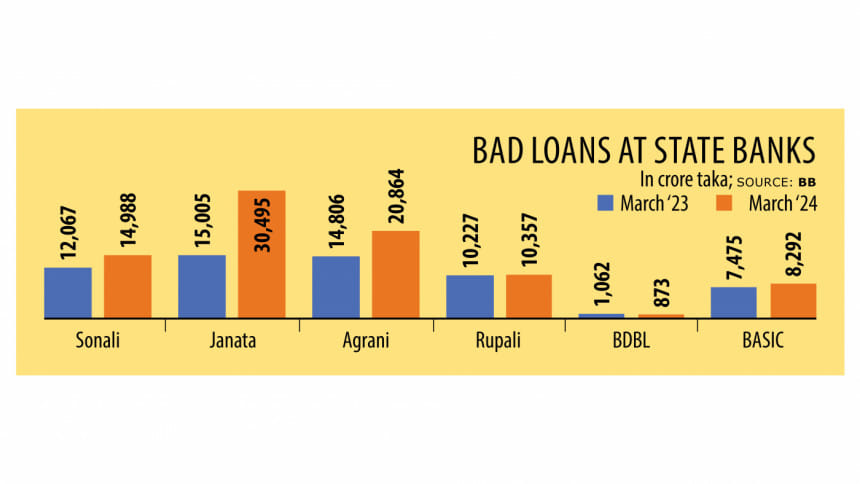

Default loans at six state-run banks rose by 42 percent to Tk 85,869 crore at the end of March this year, giving an indication of their fragile financial health resulting from a lack of good governance.

The lenders are Sonali Bank, Janata Bank, Agrani Bank, Rupali Bank, Bangladesh Development Bank and BASIC Bank.

At the end of March last year, the amount was Tk 60,642 crore, showed Bangladesh Bank data.

These banks had Tk 78,365 crore in bad loans at the end of December last year.

The default loans have increased at a time when the government and the central bank are seeking to reduce such loans.

In line with the prescriptions of the International Monetary Fund (IMF) for a $4.7 billion loan programme, the target is to reduce bad loans of state-run banks to 10 percent of their outstanding loans by 2026.

The target for private commercial banks is 5 percent.

Bankers said there was now a tendency among borrowers to refrain from repaying loans citing excuses of the present economic condition.

On the other hand, most of the bad loans of the state-run banks have been taken through irregularities and scams and that was why it was difficult to recover those loans.

Scam-hit Janata Bank has the highest amount of bad loans in the banking sector, of Tk 30,495 crore, which was 31 percent of loans it had disbursed.

Agrani Bank's bad loans amounted to Tk 20,864 crore or 28 percent of its disbursed loans, showed the BB data.

A senior official of the central bank said it was not only state-run banks but also private commercial banks which have seen an increase in bad loans.

At the end of December of last year, bad loans in the banking sector stood at Tk 145,633 crore, which accounted for 9 percent of the funds disbursed, BB data showed.

However, the distressed assets in the entire banking sector amounted to Tk 375,000 crore last year.

These include defaulted loans, rescheduled loans, written-off loans, and the credits that were regularised following court orders.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments