Stocks keep bleeding

The stock market in Bangladesh yesterday extended its losing streak as fears of the capital gains tax being reinstated in the coming fiscal year and rising yields of government treasury bills and bonds continued to weigh on investors' minds.

The market opened on an upbeat note but that did not last long as institutional and foreign buyers mostly remained on the sidelines.

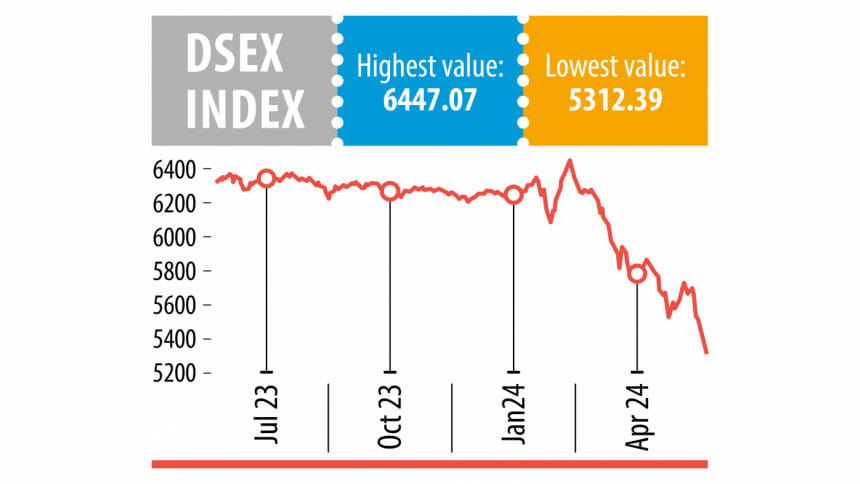

The DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), shed 58.7 points, or 1.09 percent, to close at about 5,312 points, its lowest in 39 months.

All other indices suffered losses too.

"The market drop can be attributed to numerous factors, like the increased policy rate and treasury security yields as well as rumours about the capital gains tax," said Asif Khan, chairman of Edge Asset Management.

He added that many stocks are currently trading at a very low price multiple, but most investors are not trading as they want to time their investments for better returns.

Of the large-cap sectors, non-bank financial institution (NBFI) experienced the highest loss of 2.51 percent followed by food and allied, engineering, pharmaceuticals, fuel and power, bank, and telecommunication, according to the daily market update of BRAC EPL Stock Brokerage.

As per the daily market update of UCB Stock Brokerage, all the sectors closed in negative territory with decreased turnover. Life insurance, NBFI, and information technology were the top three sectors to close in the negative.

Daily turnover, which indicates the volume of shares traded, stood at Tk 50.8 crore, down 14.13 percent compared to the previous session, the market update showed.

The pharmaceuticals sector dominated the turnover chart, covering 15.52 percent of the day's total.

Orion Pharma Ltd was the most traded stock, with turnover of Tk 25.8 crore. Meanwhile, Lovello contributed 14.08 crore, Orion Infusion 10.19 crore and Alif Industries Limited 9.30 crore.

In its market update, Shanta Securities said market movement was driven by negative changes in the market cap of travel and leisure, fuel and power, and paper and printing scrips.

On the other hand, turnover in the block market stood at Tk 19.19 crore, representing 37.8 percent of the overall turnover.

A block trade is a high-volume transaction in a security that is privately negotiated and executed outside the open market.

Of the 379 issues that changed hands, 319 saw their prices fall while 42 managed to nudge higher. Meanwhile, 56 did not see any fluctuation.

New Line Clothings topped the gainers' list with 9.48 percent followed by Active Fine Chemicals with 9.35 percent.

Simtex Industries, Yeakin Polymer, Pubali Bank, AFC Agro Biotech, Apex Spinning and Knitting Mills and Rahima Food Corporation placed on the gainers' chart as well.

Unilever Consumer Care shed the most, losing 2.99 percent.

Apex Foods, Eastern Cables, Bangladesh Submarine Cables, Sonali Aansh Industries, Kohinoor Chemicals Company, Apex Footwear, Agni Systems, Beach Hatchery, and Gemini Sea Food lost more than 2 percent each.

BAT Bangladesh, Renata, BRAC Bank, Beximco Pharmaceuticals, Beacon Pharmaceuticals, LafargeHolcim Bangladesh, Khan Brothers PP Woven Bag Industries and Best Holdings also placed on the losers' list.

The Chittagong Stock Exchange witnessed a similar trend.

The Caspi, the main index of the port city bourse, edged down by 154.94 points, or 0.99 percent, to close at about 15,403 points.

Rajesh Saha, chief executive officer of CAL Securities, said he did not expect such a situation in the country's stock market.

"I think policy decisions taken at different times have affected investors," he said.

"Actually, when you come into the stock market, you expect fundamental shares will move. But there is no such environment here to move them," he added, also citing the lack of participation from institutional and foreign investors.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments