Swift action, long-term plans can offset US tariff shock

The US government's recent announcement to hike the tariff on Bangladeshi goods by an additional 37 percent has already begun affecting the country's readymade garment (RMG) industry, according to a leading denim exporter.

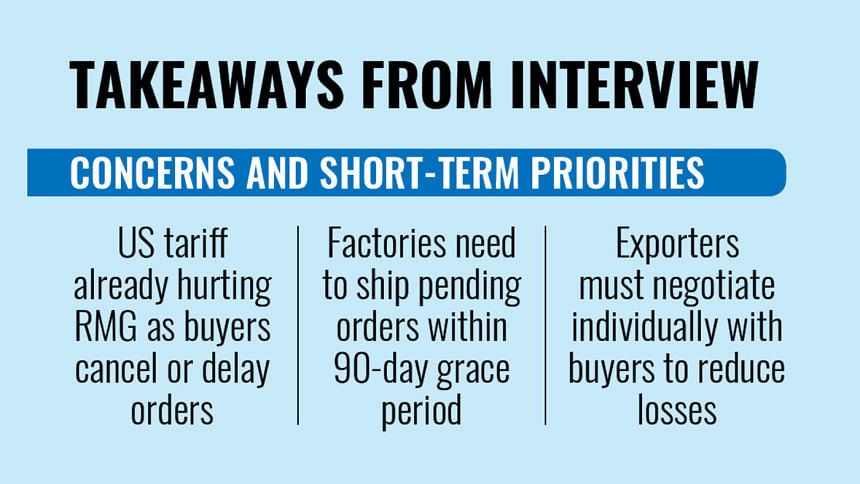

International buyers are cancelling or putting on hold some of the work orders and demanding price discounts, said Syed M Tanvir, managing director of Pacific Jeans.

In a recent interview with The Daily Star, Tanvir underscored the need for both the government and individual factory owners to take up immediate, mid-term and long-term strategies to weather the impacts.

Otherwise, the country's export competitiveness in the vital US market could suffer a setback, he apprehended.

Bangladesh's RMG sector accounts for over 80 percent of the country's total exports, with the US being one of its biggest markets.

The hike-induced abrupt demands of the international buyers are putting the factories under financial pressure, Tanvir said.

With a 90-day pause currently in place before the tariffs come into effect, he stressed the importance of manufacturing goods sought in the existing orders and shipping those at the earliest within this deadline.

The short-term strategy is to control damage, and every factory must act individually, negotiating with their customers to minimise losses as much as possible, he said.

"Within the pause period, the government also needs to put in the maximum effort to negotiate with the US government and get the best deal so that we are least impacted," said Tanvir.

For the medium term, he recommended exporters individually engage in intense dialogue with their US customers to negotiate the continuity of work orders and increase business to minimise the impacts of the tariff hike.

"Every factory should have its own strategy, have its own game plan in this regard," he said.

And, for the long-term strategy, the government has an important role to play, said Tanvir.

Referring to the chief adviser's letter to the US president expressing Bangladesh's intent to significantly increase imports of US farm products, including cotton, Tanvir said it was a very important issue.

US retailers also need to play a role, such as promoting the use of American cotton for their work orders, because it might help them avail tariff rebates, he said.

"There has to be dialogue not only between the two governments but also involving the brands, so that they endorse the use of US cotton while nominating spinning mills that would produce the yarn," he explained.

"To significantly increase the use of US cotton, the government needs to keep the Bangladesh Textile Mills Association (BTMA), Bangladesh Garment Manufacturers and Exporters Association (BGMEA), and other stakeholders like the buyers' forum on board when formulating a long-term strategy," he said.

For the long-term strategy, Tanvir also stressed the need for developing better infrastructure and backward integration for all categories of garment products.

To offset the impact of the US tariff hike, he also emphasised exploring scopes for increasing other imports from the US.

He proposed enhancing government spending for big-volume purchases like liquefied natural gas (LNG), aeroplanes, or military equipment from US companies to help balance the trade deficit.

And finally, there is no alternative to effective dialogue and trade negotiation or diplomacy to find a good solution so that the country's exports are protected and subsequently increase, he said.

If such strategies are adopted, Bangladesh's exports to the US will grow, he hoped.

He, however, predicts that the export of all categories of garment products may not witness growth if the US tariff hike is imposed.

Currently, the export of woven garments from Bangladesh to the US market is higher than that of knitwear products.

The exporter opined that woven garment exports could more or less decline once the hike comes into effect, while knitwear exports have good growth prospects.

This is because the US has alternative sources of woven garments, while work orders for knitwear will shift from China and Vietnam to Bangladesh, predicts Tanvir.

He also sees good prospects for synthetic items. China and Vietnam are now the main sources of man-made fibre products.

"China is out of the question now. If the announced US tariff for Vietnam prevails, then there are good prospects of an export increase of Bangladesh's man-made fibre products to the US," Tanvir opined.

He said Bangladesh's strength is in cotton-based products, but the country still does not have the huge infrastructure and backward integration required for synthetic items, which are mainly imported.

Diversification of the export market is also a crucial issue for the country's RMG sector, he added.

The RMG exporters have made good progress in the last 10 to 15 years to diversify the export market beyond the traditional markets in the US, Europe, and Canada, said Tanvir.

Still, there is a need to accelerate that effort to diversify the export market even further, he said.

Regarding which countries could benefit from the tariff hike, Tanvir said there could be a shift in work orders to Turkey, Jordan, Egypt, or Morocco, as their goods face lower tariffs than those from Bangladesh.

"But whether these countries have the capacity, skilled resources and manpower, and adequate infrastructure to actually cater to the business shift is also something we have to look at," he said.

Even though the tariffs are lower, the production costs are higher in those countries compared to Bangladesh, he said.

According to the exporter, the country's denim sector is in a good position with good backward integration, as a lot of denim mills are already working with US customers and aligned with US customers' quality requirements.

The country's major exports in the woven category are denims and shirts.

"We are very strong in denim, but at the same time, we also have our competitors who are in a more advantageous position due to the lower tariff," he said.

Tanvir believes Pakistan, Egypt, and one or two other countries could match or scale up their capabilities to cater to some of the shift in business.

He sees more opportunity in sectors other than RMG to actually grow exports.

This challenging situation also has a positive side in that it gives a chance to scale up capacity in other product categories like electronics, footwear, agro-processing, and pharmaceuticals, and in more value-added products, he opined.

He also urged the government to negotiate tariffs or duties which Bangladeshi goods face in other countries, such as the prospective market of South America where the duty is higher.

"And especially for LDC graduation, we have to focus on free trade agreements (FTAs) as much as possible," said Tanvir.

Terming FTAs as the only way forward, he urged the government to sign them with all prospective export markets so that the country does not lose what it already has.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments