Synthetic footwear exports on a roll

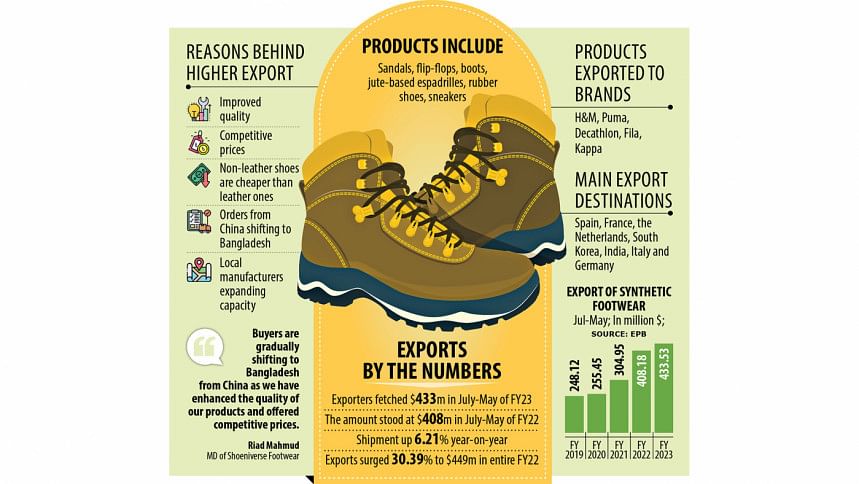

The shipment of synthetic footwear and sports shoes from Bangladesh grew 6.21 per cent year-on-year in July-May of the outgoing fiscal year thanks to shifting orders from China and the expanding capacity of manufacturers.

Non-leather footwear exporters bagged $433.53 million during the 11-month period of 2022-23, up from $408.18 million a year earlier, data from the Export Promotion Bureau showed.

The receipts built on a 30.39 per cent whopping shipment growth seen in the previous year when manufacturers brought home $449.15 million.

This came although leather footwear exports from Bangladesh posted a declining trend in recent months owing to slower demand.

Sales of leather footwear slipped 4.28 per cent in July-May owing to lower orders from Europe, the main market for Bangladesh

Sales of leather footwear slipped 4.28 per cent in July-May owing to lower orders from Europe, the main market for Bangladesh, as the cost-of-living crisis persists in the continent because of the lingering energy crisis fuelled by Russia's war in Ukraine.

In 2021-22, leather and non-leather footwear jointly generated $1.21 billion in export earnings, with the non-leather segment accounting for 37 per cent.

Bangladesh supplies synthetic shoes to international buyers and brands such as H&M, Puma, Decathlon, Fila, and Kappa. The main export destinations are Spain, France, the Netherlands, South Korea, India, Italy, and Germany.

The products being sourced from Bangladesh include sandals, flip-flops, boots, jute-based espadrilles, rubber shoes, and sneakers.

According to industry people, consumers across the world are switching to products made from jute, plastics, textile, and polyurethane leather on the back of their growing health consciousness.

"Buyers are gradually shifting to Bangladesh from China as we have enhanced the quality of our products and offered competitive prices. This has given a boost to exports," said Riad Mahmud, managing director of Shoeniverse Footwear Ltd.

"Besides, non-leather shoes are comparatively cheaper than leather ones. Non-leather shoes are also fashionable and comfortable."

He said the capacity of manufacturers in Bangladesh is improving day by day, retaining existing buyers and attracting new ones.

Shoeniverse is a Leed (Leadership in Energy and Environmental Design) certified factory, which points to its high compliance standards.

Currently, the factory produces 1.9 lakh pairs of shoes every day and expects to double the capacity by August. Its export earnings grew 35 per cent on average in the last four years.

Mahmud says apart from the young generation, people from all walks of life use synthetic shoes for jogging and exercises, both indoors and outdoors.

The synthetic shoe segment, he thinks, could be as big as the garment sector, the second largest in the world and the biggest export earner for Bangladesh.

Mahmud's company supplies products to seven global brands in Europe and India. Another eight buyers are currently negotiating with the manufacturer to source sports shoes.

Mohammad Shahadat Ullah, executive director of Maf Shoes, another synthetic footwear maker, says the sector is witnessing slower growth in the export market in the outgoing fiscal year compared to a year ago.

Maf Shoes, a concern of TK Group which is a pioneer in the manufacturing of synthetic shoes in Bangladesh, has the capacity to produce 50,000 pairs of shoes a day. It exports more than 1.5 crore pairs of synthetic shoes per year.

Bangladesh has improved the quality and design of synthetic footwear by investing in technologies and its products meet international standards, said Dilip Kajuri, chief financial officer of Apex Footwear Limited.

He, however, said the export scenario has changed from the second half of FY23 as orders have slowed amid persisting uncertainty in the western markets.

He said his company had been doing good business with a French sporting goods retailer by supplying non-leather footwear items.

The company has, however, stopped placing fresh orders as its distributors are not keen to take more products fearing inventories might pile up amid demand slowdown, he said.

"On the other hand, our costs have increased significantly. We can't cover the cost of production with the price we are being offered."

Exporters such as synthetic footwear manufacturers get a cash incentive of 4 per cent from the government on their export earnings.

Shoeniverse's Mahmud suggests large corporates invest in the sector as it does not require a huge amount of funds to set up an export-oriented factory.

"We also need to create skilled workers."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments