Three out of four people still unbanked in Bangladesh

Despite the continuous push for financial inclusion, nearly three out of four people in Bangladesh still do not have an account with a bank or non-bank financial institution (NBFI), according to a new survey.

The data from the Bangladesh Bureau of Statistics (BBS) survey titled "Bangladesh Sample Vital Statistics" showed that nearly 72 percent of those aged over 15 did not avail of such services in 2023.

Only 28.3 percent had an account with a bank or NBFI last year, it showed, increasing from 26.2 percent the year prior.

Among men, 32 percent took financial services from banks and financial entities in 2023 while the number was 24.8 percent for women. The figure for men stood at 30.9 percent in 2022 while it was 21.6 percent for women.

Although the number of people availing banking services is increasing gradually, the pace is insufficient. As a result, nearly three-fourths of those aged over 15 are unbanked.

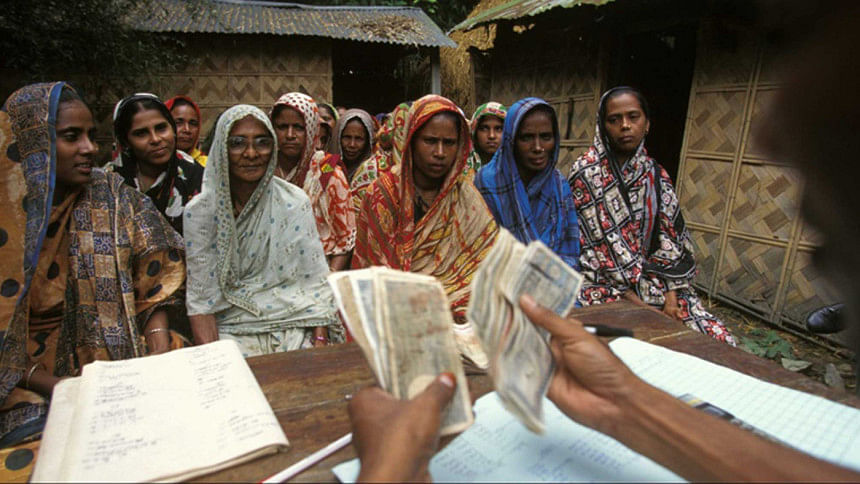

According to experts, this is because the services offered by banks and NBFIs are not oriented to the needs and requirements of the low-income population.

The BBS's findings are close to the results of the World Bank's Global Findex Database 2021, said MK Mujeri, a former chief economist of the central bank.

"This financial sector's major services are savings, payments, credit, and insurance. But the kind of services and products that our banks provide are not aligned with the needs of the larger population of the country whose income is low."

He said banks and financial institutions were unable to provide services in accordance with the needs of the people, especially those living in the rural parts of the country.

"Therefore, they are not interested in banking services."

He added that it is difficult and, in many cases, impossible for a less educated or illiterate person to provide all the documents and information required to open a bank account.

This prompts many of them to borrow from microfinance institutions (MFIs) because of their simple approval and disbursement procedures even though they charge higher interest rate.

"Above all, services in the banking sector should be customer-centric. Financial inclusion in this sector will not accelerate unless adequate services are provided to this large group of population."

According to the World Bank's Global Findex Database 2021, Bangladesh is among the top seven countries that have a sizeable unbanked population.

A total of 1.4 billion population across the world is unbanked. Of them, more than half come from seven countries, including China, India, Pakistan and Bangladesh, the report said.

In Bangladesh, about 30 million people do not have an account with a financial institution or mobile financial service, it said.

Atiur Rahman, a former governor of the Bangladesh Bank, said that other than banks and financial institutions, there are other popular choices for people such as mobile financial services, agent banking, and MFIs.

"If these are considered, the overall financial inclusion rate will increase a lot."

For example, there are now 22 crore mobile banking accounts, he said.

"I think the proportion of financial inclusion will rise to 70-80 percent if these accounts are considered."

Prof Rahman says digital finance will be the key in the future. "We have to go towards digital banking."

The BB has permitted Nagad Digital Bank and Kori Digital Bank to set up digital banks in Bangladesh.

"Banks should also do more digital banking," Rahman said.

The noted economist cited that cashless transactions are being done and cards are being used to a large extent.

"We are now gradually moving towards digital banking from conventional banking. Conventional banks will have to provide services digitally too."

He said that there are some regulatory challenges standing in the way of traditional banks shifting towards digital banking.

"We will have to make banking services inter-operable."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments