Budget 2022-23: Time for austerity, time for generosity

Austerity and generosity may not go hand in hand, but Finance Minister AHM Mustafa Kamal faces a situation where he has to apply both when he unveils the budget for the next fiscal year today.

Austerity is the need of the hour because abnormally high imports, albeit needed to support the economy rebounding from the coronavirus pandemic, and higher commodity prices mean the septuagenarian politician will have to go all the way to save every penny he can amid depleting foreign reserves and lower revenue collection.

He has to be generous as never in recent memories, so many people of Bangladesh have looked to the government like they are doing now, in order just to protect themselves from the painful onslaught of higher inflation.

It seems that Bangladesh is now at an inflection point.

Bangladesh had recovered swiftly from the fallout of the coronavirus pandemic and was set to sail safely despite the threat of higher inflation three months ago. But everything has changed since the Russian invasion of Ukraine.

The war broke global supply chains and sent inflation to record levels in most countries.

In Bangladesh, the higher prices of essentials are mostly driven by elevated levels of global commodities prices and unprecedented freight charges. So, the government doesn't have full control over it.

What it can do to lessen the impacts of higher inflation is to take measures that are within its reach.

"The government will have to intervene in the market through increasing the supply of essentials, adopt direct cash transfer and provide rations to protect the poor and the lower-income groups from the impacts of inflation," said Prof MM Akash, chairman of the economics department at the University of Dhaka.

The current situation warrants all-out efforts from the government. But it can't rely on fiscal measures alone to reach the goal.

And the next move will have to be involved monetary instruments that the government has not used so far largely.

But if the monetary tools are applied appropriately, the liquidity supply will slow, the investment may fall and imports will come down. It may even go on to decelerate economic growth.

Even the country risks falling into stagflation -- a combination of high inflation and economic stagnation.

"In order to ensure stability and protect people from hardships, we may be needed to sacrifice economic growth to some level," said Monzur Hossain, research director of the Bangladesh Institute of Development Studies.

The government's performance when it comes to bringing meaningful reforms is low. What is even more worrying is it leaves reforms for the last minute until a disaster strikes or a situation emerges that gives no choice to the authorities but to do something.

But an important lesson could be gleaned about the cost of procrastination from the recent exchange rate volatility.

Experts have long demanded a gradual depreciation of the taka. But it was not done. Now, the government has been compelled to do so as the depletion of foreign reserves sounded out an alarm that Bangladesh might face a Sri Lanka like situation.

"It is better to introduce reforms from the position of comfort that gives the country an advantage, rather than doing it out of compulsion," said Selim Raihan executive director of the South Asian Network on Economic Modeling, a think-tank.

Governments, for years or maybe decades, have neglected the issue of raising the tax-GDP ratio.

The Value Added Tax and Supplementary Duty Act 2012 was enacted in December 2012, but it did not come into effect, albeit partially, until 2019 because of the strong opposition from the business community.

Likewise, the National Board of Revenue has not been able to popularise electronic fiscal devices that would allow it to generate more VAT, which accounts for about 40 per cent of the tax collected.

"Unfortunately, no significant tax reforms have happened. Without a strong political signal, this will not be possible," wrote Sadiq Ahmed, vice-chairman of the Policy Research Institute of Bangladesh, recently.

As a result, the current government does not have much fiscal space to support the people who need the most.

"The problem is the current elevated level of inflation is here to stay at least for another one and a half years," warned Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

Maintaining macro-economy stability is the main challenge for the government. And in order to restrain domestic demand, the budget deficit has to be very limited.

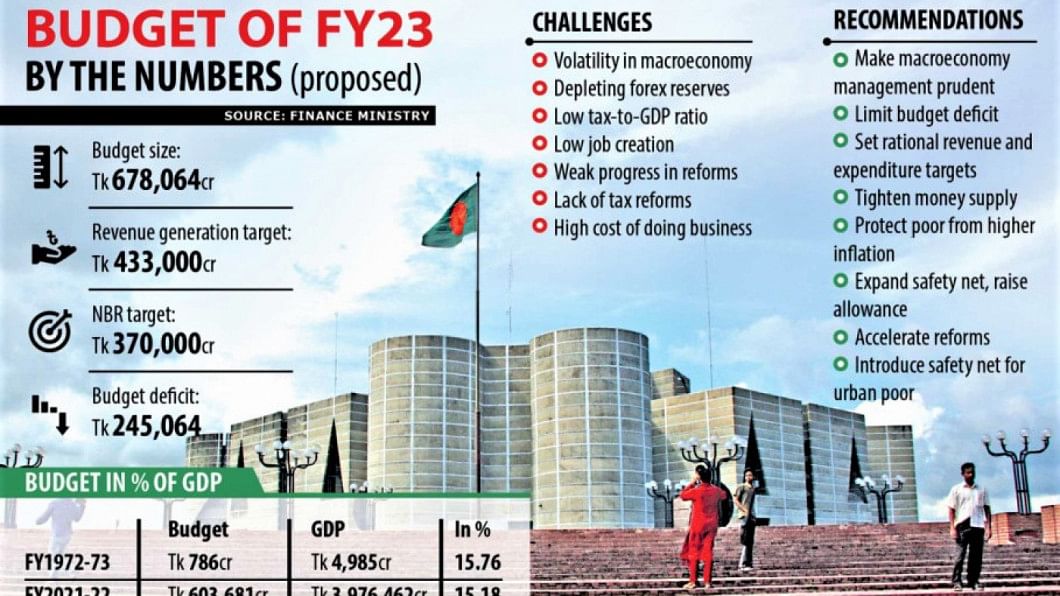

But the budget deficit in FY23 would be 62 per cent higher compared to the outgoing fiscal year, said Zahid Hussain.

"That is not consistent with the expectation of restraining of expenditures."

The local prices of petroleum oil and fertilizer don't reflect their increase in the international markets owing to the administered price mechanism. Gas price adjustment has taken place.

This poses an insurmountable challenge to the government because it would lead to trouble whichever path it chooses.

"If prices are not adjusted upwards, subsidy spending will almost double. If prices are adjusted, inflation will spread. The practical approach will be adjusting prices gradually," Zahid said.

Monzur said the government should defer the implementation of import-tensive development projects for the time being and quickly complete the more important projects that are more economically viable.

He calls for raising the upper slab of the personal income tax, which benefits the well-off, since the government will have to raise more taxes from the wealthy and the rich.

"The income tax-free threshold should be raised."

The BIDS research director is against the idea of withdrawing subsidies in the energy and agriculture sectors.

"We even may face a food crisis in the coming days. So, we will have to continue support for the sectors for six months to one year."

Prof Akash vehemently opposed the plan to offer a scope to bring back the money, which businesspeople transferred abroad through trade under-invoicing, by paying a 7 per cent tax as penalty.

Job creation is a long-standing issue in the macro-economy context. The problem has been persisting for nearly a decade.

"During this period, sometimes we have low job creation. Even, the growth has been termed jobless sometimes," said Prof Raihan.

"We need to see how we can facilitate private sector credit growth and investment."

The cost of doing business is also high in Bangladesh.

"Procedures have to be simplified and regulatory barriers have to be removed in order to make it easy for investors to invest," he said.

Prof Raihan points out that the safety allowance was fixed several years ago.

"An allowance of Tk 500 to Tk 700 per month does not help much since the cost of living has gone up significantly," he said, calling for doubling or trebling of the allowance from the current level and the expansion of the coverage of the safety net schemes.

Asif Ibrahim, vice-chairman of Newage Group of Industries, one of the top garment exporters, recommended rationalising corporate tax rates in line with the rates in the countries in the region.

"All the necessary reforms have to be brought in to attract both local and foreign investments."

Rizwan Rahman, president of the Dhaka Chamber of Commerce and Industry, says cottage, micro, small and medium enterprises need special attention. Large businesses also need lower corporate tax and source tax in business operation.

American Poet Edgar Albert Guest wrote in one of his poems that someday the world will need a man of courage in a time of doubt.

For Bangladesh, Kamal is perhaps that man at this hour of economic uncertainty.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments