Time running out to devalue taka sharply

The inter-bank exchange rate set by the central bank has not been effective as the foreign exchange regime is facing volatility of a high degree

Bangladesh has so far resisted calls for a major devaluation of its currency despite runaway imports amid higher food, energy and raw materials prices globally.

But the stance might not be continued for too long as minor depreciation, which was brought in gradually, has already created indiscipline in the foreign exchange market.

Now, the country, like most other import-dependent nations, is facing difficult choices: immediately devalue the taka at a faster rate or face consequences that nobody could predict as the volatility in the global market is intensifying since the Russia-Ukraine war shows no sign of abating, China is under huge pressure for rising coronavirus cases, and inflationary pressures are deepening globally.

This is the suggestion from a number of economists and senior bankers, as they urge the Bangladesh Bank to immediately depreciate the local currency to a large degree against US dollars.

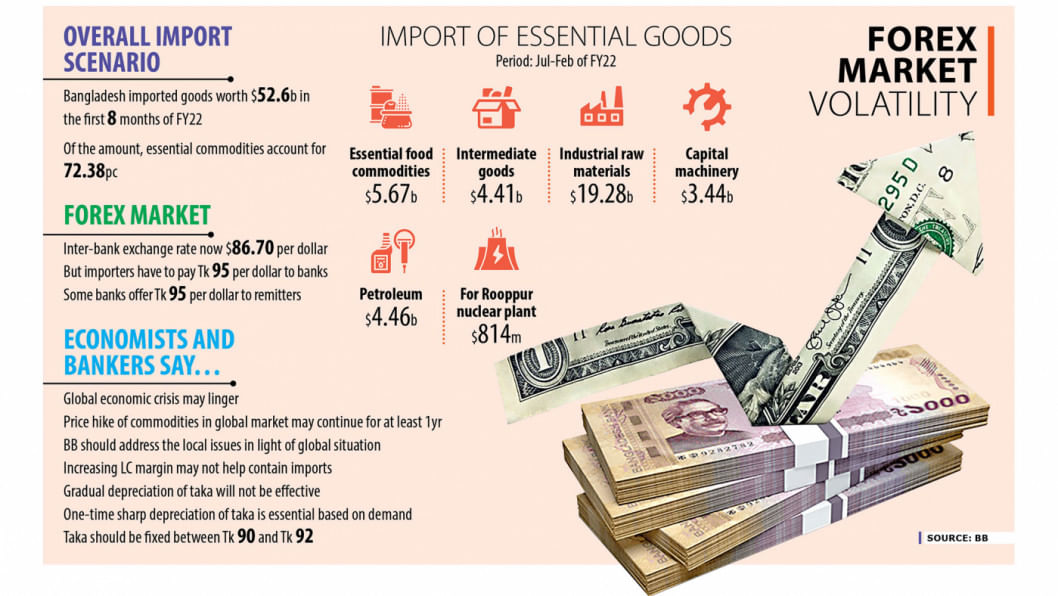

The gradual depreciation followed by the BB since the global economy rebounded from the pandemic late last year may not be effective as banks have already started charging more than Tk 95 per dollar for businesses to settle imports. This means that the interbank exchange rate set by the central bank has become inoperative.

The exchange rate now stands at 86.70 a dollar after the BB devalued the local currency by Tk 0.25 on May 9.

Banks usually sell US dollars to importers, under the arrangement known as BC (bills for collection) selling rate, by adding Tk 0.05 with the inter-bank exchange rate. But importers now have to pay Tk 94-95 to purchase a dollar from banks.

Similarly, some banks are offering between Tk 92 and Tk 95 per dollar to remitters to encourage them to send their money through their channel.

Banks usually deduct Tk 1 from the BC selling rate when they pay remitters.

Migrant workers don't send money through banks if a higher rate is not provided, said managing directors of three banks, requesting anonymity.

The interbank rate set by the central bank has not been effective as the foreign exchange regime is facing volatility of a high degree, they said.

So, the central bank should address the issue promptly or else the instability will spread further. Against the backdrop, the interbank exchange rate should be set on the basis of the demand and supply of the greenback, they said.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, called for raising the inter-bank rate to at least Tk 92 per dollar immediately.

He argued: "We earlier urged the central bank to depreciate the local currency by Tk 3 to Tk 89 per US dollar. But the central bank had not done so. As a result, the situation has worsened."

In December last year, he urged the BB to depreciate the taka more against US dollars in order to discourage imports and to maintain macro-economy stability.

If the local currency is not depreciated, remittances will be hit hard by the ongoing instability, he said yesterday.

Expatriate Bangladeshis will send their hard-earned money through the hundi channel, an illegal cross-border money transaction system, more if they do not get the desired rate from banks, said Mansur.

Yesterday, a trader of the kerb market, an illegal trading platform of foreign currencies, said clients had to count Tk 94.30 to purchase a dollar.

So, providing a 2.5 per cent cash incentive to remitters will not bring any output due to the higher rate prevailing in the kerb market, said Mansur, also a former official of the International Monetary Fund.

Between July and April, migrant workers sent home $17.30 billion, down 16.2 per cent year-on-year, data from the BB showed.

Mansur added that the attempts to keep the depreciation of the local currency subdued will put an adverse impact on exporters as well.

"The ongoing global economic crisis stemming from the coronavirus pandemic and Russia's invasion of Ukraine may not be over immediately. The twin issues will linger. So, the central bank will have to address the foreign exchange issue keeping them in mind."

He described more than $7 billion in expenses to settle import payments for a single month as illogical and urged the central bank to insulate the foreign exchange reserves from the ongoing global volatility.

The reserves fell to $41.9 billion on May 11 from $46.15 billion on December 31, driven by surging imports needed to feed the economy rebounding from the coronavirus pandemic.

Between July and February, import payments shot to $52.60 billion, of which at least 72.38 per cent was spent on essential commodities.

In the face of depleting reserves, the BB last week instructed banks to take up to 75 per cent of import payments in advance from businesses to open letters of credit for luxury and non-essential goods.

But Mansur said that the decision may not yield any major outcome on a long-term basis since the dollar would gain further.

Earlier this month, the Federal Reserve, the central bank of the US, raised the benchmark interest rate by 0.5 percentage points to a target rate range of between 0.75 per cent and 1 per cent in order to tamp down soaring inflation.

More rate increases are expected.

The Economist Intelligence Unit, the research and analysis division of The Economist Group, expects the Fed to raise rates seven times in 2022, reaching 2.9 per cent in early 2023, according to a Guardian report.

This means the currencies of almost all countries will face devaluation pressure this year.

Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, said that the central bank should depreciate the local currency quickly.

"Raising margin on the opening of LCs alone can't offset the volatility in the foreign exchange market. A sharp one-time depreciation of the local currency is essential."

Mohammad Shams-Ul Islam, managing director of Agrani Bank, says many banks have become involved in an unholy competition to chase US dollars in the form of remittances in the wake of shortages of foreign exchanges.

"The central bank should explore more ways to ease the ongoing foreign exchange pressure."

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, thinks the current situation warrants more depreciation.

Zahid Hussain, a former lead economist of the World Bank's Dhaka office, says monetary policy must protect reserves by increasing the flexibility of the exchange rate.

"This is now almost fait accompli. Better do it from a position of strength than from a position of weakness. This means allowing the interbank to adjust to market conditions."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments