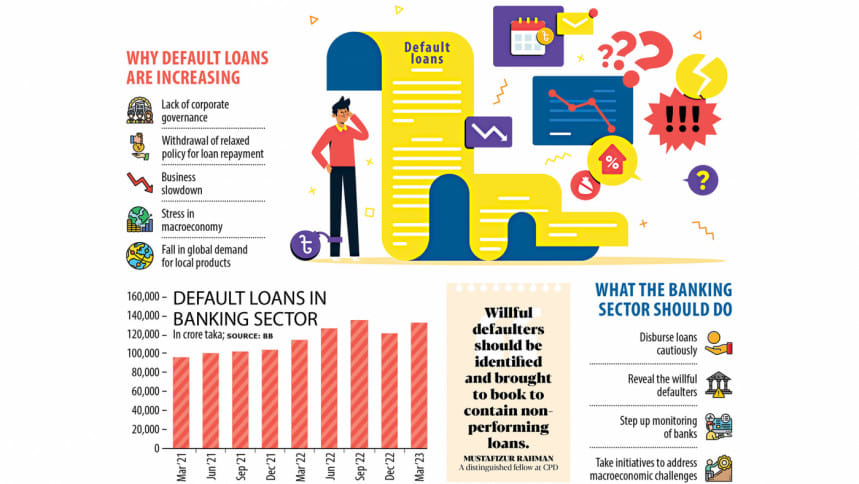

Tk 10,964cr loans turn sour in 3 months

Banks in Bangladesh witnessed an accumulation of default loans by Tk 10,964 crore in the first three months of 2023, highlighting the worsening financial health of the banking sector, official figures showed.

Non-performing loans stood at Tk 131,621 crore as of March 31, up 9 per cent from three months ago and 16 per cent from a year earlier, data from the Bangladesh Bank showed.

The latest NPL figure is the second-highest in the banking sector's history and was just behind the Tk 134,396 crore reported in the July-September quarter of 2022.

A persisting lack of corporate governance, the withdrawal of the relaxed loan repayment policy, the current business slowdown, and the fall in global demand for Bangladeshi goods are among the major factors that drove up the NPLs.

In March, the NPL ratio accounted for 8.8 per cent of the outstanding loans of Tk 14,96,346 crore in the banking system. It was 8.16 per cent in December and 8.53 per cent in March last year.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, says many industries are facing power outages and gas shortages, so they can't operate at the optimum level. This means they would not be able to pay back loans.

The central bank stopped the regulatory forbearance, which allowed borrowers to enjoy a relaxed loan repayment facility from 2020 to 2022, a development that has played a role in the rise in the NPLs, he said.

Some banks are still facing a shortage of US dollars, meaning borrowers have been unable to open letters of credit needed to buy goods, inputs and machinery from the international markets. This has put an adverse impact on businesses and industries.

Persisting higher inflation in many developed nations has also eroded the purchasing power of their citizens. Under the circumstances, international buyers have either cancelled orders or postponed the shipment of goods.

Thus, export earnings declined 16.52 per cent year-on-year to $3.95 billion in April as the shipment of garments, the key export item, dipped. The overall sales, however, increased 5.38 per cent to $45.67 billion in the July-April period of the current fiscal year.

"The negative developments at both local and global markets have dealt a blow to local businesses. And some of them have become defaulters," Rahman said.

He urged banks to disburse loans with the utmost caution in a bid to avoid a higher ratio of NPLs.

Elevated NPLs impair bank balance sheets, depress credit growth, and delay output recovery, according to international researchers.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, says some banks gave out loans at the height of the coronavirus pandemic without following rules and regulations.

"The credits might have become default loans."

A lack of corporate governance in the banking sector is another major factor for the continued upward trend of defaulted loans, he said.

"The economy is in deep trouble. This has pushed up defaulted loans as well."

The former official of the International Monetary Fund urged both the government and the central bank to take initiatives to resolve the issue.

Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, says that willful defaulters should be marked and brought to book to contain NPLs.

"The higher NPL ratio has created a liquidity crunch in the banking sector, so lenders can't use the funds to make new loans. Besides, banks have to set aside a hefty amount of funds in the form of provisioning against default loans."

He called for setting up a banking commission to unearth the real factors for the upward trend of NPLs.

In a report in April, the World Bank said the extent of troubled assets is obscured by lax regulatory definitions and reporting standards, extended forbearance, as well as weak supervisory enforcement.

BB data showed that 47.6 per cent of the defaulted loans were with nine state-run banks, which held Tk 62,690 crore in bad loans as of March, up 19 per cent year-on-year.

Forty-one private commercial banks held defaulted loans of Tk 65,881 crore, an increase of 14 per cent, while the NPLs at nine foreign banks increased to Tk 3,042 crore from Tk 2,885 crore a year ago.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments