Universal Pension Scheme: Private sector employers to contribute 50pc

Private sector employers have to contribute 50 percent of their employees' monthly instalments under the universal pension scheme, said a gazette from the finance ministry yesterday.

The package, called Progoti, is one of the four offered under the much-talked-about pension scheme for common people, which will be unveiled by Prime Minister Sheikh Hasina on Thursday virtually from Gono Bhaban.

A select group of beneficiaries from 10 districts and under two foreign missions will join the launch ceremony virtually, said a finance ministry official.

The instalment options under Progoti are Tk 2,000, Tk 3,000 and Tk 5,000, as per the gazette yesterday that laid out the specifics of the four packages available. The other three packages: Probash, Shurokkha and Samata.

Even if the private company does not want to participate in the pension schemes, the employees can take part on their own.

On the other hand, the Shurokkha package is designed for the self-employed and the informal sector workers like farmers, rickshaw pullers and day labourers. They can put in Tk 1,000, Tk 2,000, Tk 3,000 or Tk 5,000 a month.

The Samata package is designed for the ultra-poor, with the monthly instalment being Tk 1,000. The government will pay Tk 500 and the other Tk 500 will be paid by the beneficiary.

The Probash scheme is for expatriate Bangladeshis, with the monthly instalment options being Tk 5,000, Tk 7,500 and Tk 10,000. They will have to furnish the instalment in foreign currency.

Upon their return home, they can continue the scheme by paying in taka or switch to another package. But they will get their pension in taka.

The universal pension scheme is available to those between the ages of 18 and 50 years; they will have to pay the instalment up to the age of 60.

However, those over 50 years of age will be able to participate in the scheme under special consideration. Such beneficiaries will have to pay monthly instalments for at least 10 years.

After that, they will start to get a pension every month.

The beneficiaries of the government's social safety net programmes will be able to participate in the universal pension scheme. But if they sign up, they will not be considered for benefits under the social safety nets.

For registration under the universal pension scheme, an individual will have to apply online and submit a mobile number.

After that, they will get a unique identification (ID) number, monthly instalment options and the deadline for payment.

For expatriate Bangladeshis who do not have a national identity (NID) card, they can register with their passports.

The beneficiaries will be able to pay instalments at a bank branch or through mobile financial service, online bank transfer or a bank card.

If a beneficiary fails to pay the instalment on time, they will have 30 days to clear it without a fine. However, after that, they will have to pay 1 percent of the instalment as the late fee per day.

If a beneficiary fails to pay instalments for three consecutive months, the account will be suspended. The account will be reactivated upon payment of all dues.

If an individual is unable to pay the instalment because of a physical or mental ailment or unemployment, they have to notify the authority through an application.

In case of an ailment, a medical board will decide and may allow the beneficiary to continue the account for up to 12 months without paying the monthly instalment.

The pension authority will be able to announce banks, government offices and post offices as its 'front office' to provide various services to the beneficiaries.

Beneficiaries can find out the status of their accounts from the authority's website, help desk and front office.

As per the gazette, the pension authority will announce a dividend each year and such dividend will be credited to the beneficiary's account.

The authority will determine how much money a beneficiary will get as a monthly pension based on the accumulated deposit.

If necessary, a beneficiary will be able to switch from one scheme to another by showing reasons. Besides, they will be able to take loans from the authority based on their schemes.

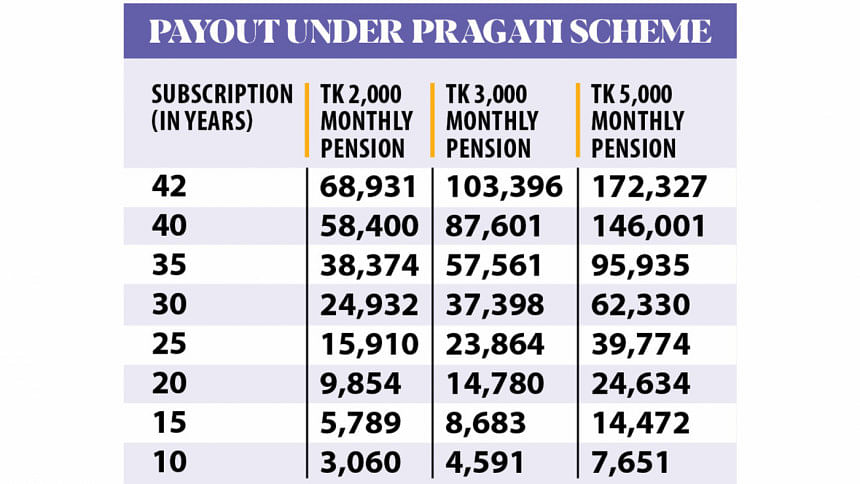

The gazette gives an outline of how much money a beneficiary can get as a monthly pension from the four schemes.

For the Shurokkha package, the monthly pension ranges from n Tk 1,530 to Tk 172,327.

If a beneficiary under the scheme pays Tk 1,000 in monthly instalments at the age of 50, then they will have to continue the payment for the next 10 years. In return, they will get Tk 1,530 in monthly pension after the age of 60.

However, if a pensioner starts to pay the same amount in instalment from the age of 18 and continue it for the next 42 years, they will get Tk 34,465 a month.

Under the scheme, if a beneficiary pays the highest Tk 5,000 in monthly instalments for 10 years, they will get Tk 7,651 in monthly pension.

Such beneficiaries will get Tk 172,327 in monthly pension if they continue to put in Tk 5,000 a month for 42 years.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments